Global Telecom Drone Technology Market Size, Trends & Analysis - Forecasts to 2026 By Offering (Drone Inspection Software Solution, Drones Equipped for Telecom Inspection, and Telecom Inspection Services), By Application (Remote Engineering, Network Optimization, Tower Based Equipment Inspections, and Network Coverage Performance Measurement), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

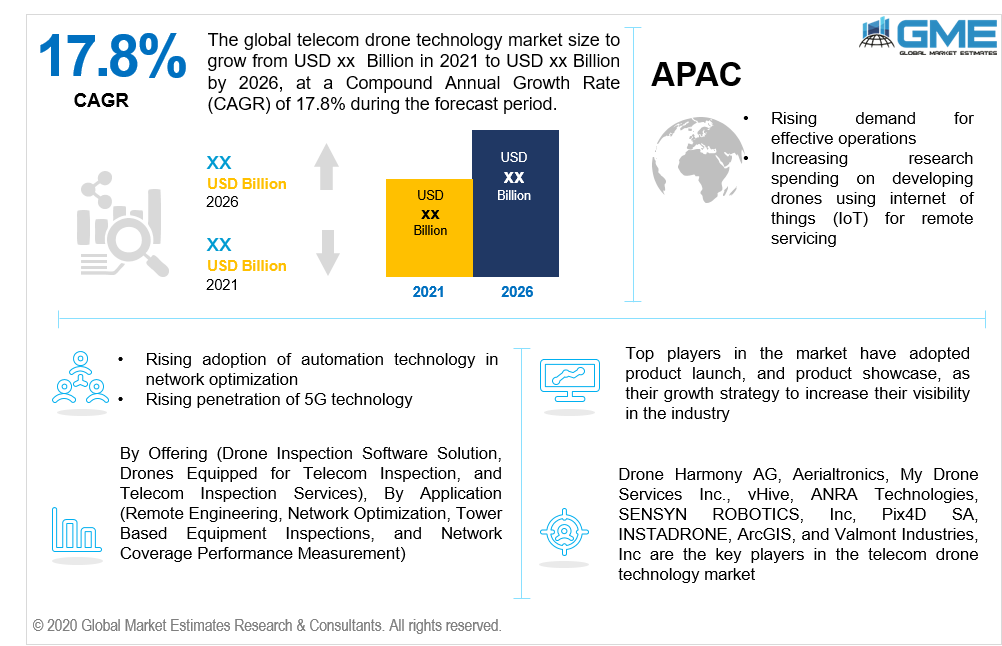

The global telecom drone technology market is projected to grow at a CAGR value of 17.8% from 2021 to 2026. The integration of drone technology with the telecom sector have opened many opportunities for the operators in terms of cost management, service management, network optimization among others. Many companies have been starting to adopt the drone technology in order to fulfil the rising demand for high speed network field setup. Telecom operators are well-positioned to develop these capabilities by building on their existing strengths in connectivity, cloud, big data, and analytics, as well as capitalizing on the partnerships they already have in place to augment these capabilities. With increasing penetration of automation in the telecom industry, drones are now capable of conducting autonomous services, and offering automatic data upload to the cloud, and eventually helping business accelerate revenue.

Drones make it possible to perform remote engineering and network planning tasks, automate tower inspections, and enhance the measurement of wireless coverage and performance. They will accelerate the rollout of 5G networks and enable new use cases leveraging 5G connectivity. The key prime application segments of drones in telecom sector are maintenance monitoring and maintaining good condition of infrastructure and installations. Earlier, technicians had to climb to the top of towers and complete a manual count on the different installed equipment. Manual inspections are usually conducted on a limited portion of the tower, meaning that many telecom companies don’t have a complete record of the equipment mounted on their towers or comprehensive data on whether towers have available space to host new equipment.

As per WHO, almost 2 million people die every year due to occupational hazardous or accidents. The risk of occupational accidents is even higher in developing and third world countries. Hence, the integration of drone in telecom sector has acted like a boom to address this issue.

The global telecom drone technology market is expected to grow rapidly during the forecast period mainly due to rapidly rising adoption of drones in small and medium sized telecom companies, increasing at-service accidents, rising demand for 5G network in developing countries, rising demand for safe & accurate inspection & monitoring in telecom industry, increasing cost-saving & human safety initiatives in developing countries, rising demand for drones as Remote Visual Inspection (RVI) tool for critical infrastructure applications.

The demand for telecom drones has been witnessed especially post COVID-19 pandemic hit, mainly due to shortage of workers who stayed off duty due to COVID-19-related detentions, lack of technically qualified skilled professionals, and increasing penetration of 5G technology. Hence, lately, manufacturers are resorting to drone based servicing of telecom towers, network optimization, and equipment inspection, coverage performance management, in order to reduce production costs and maintain a competitive cost edge and operate labor-free service process. These trends have changed the dynamic of the telecom drone technology market and are expected to continue during the forecast period.

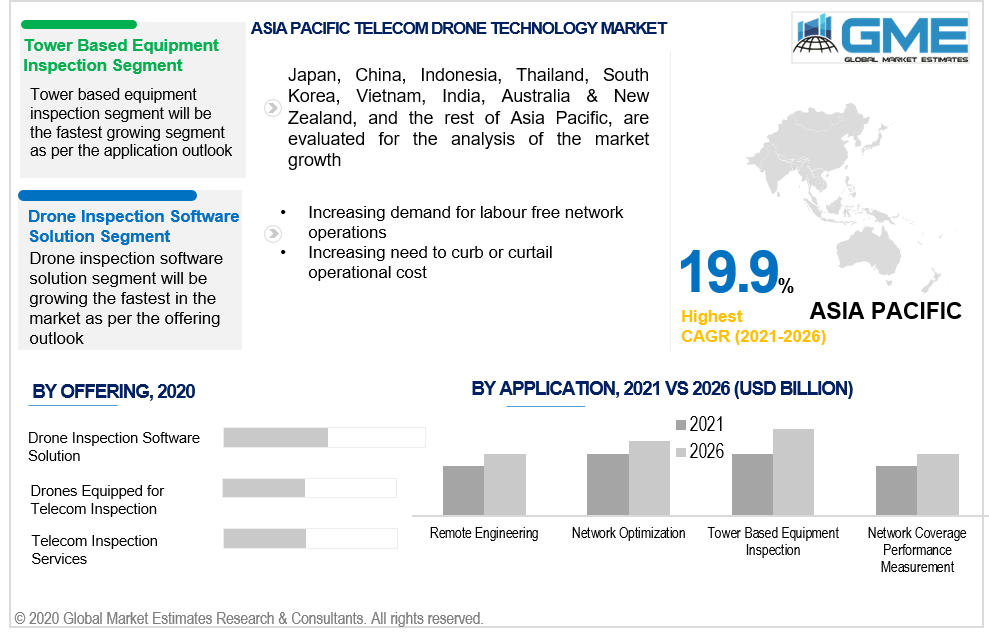

Based on the application, the market is segmented into remote engineering, network optimization, tower based equipment inspections, and network coverage performance measurement. Tower based equipment inspection segment is expected to grab the largest share in the market from 2021 to 2026. The key application areas for drones in telecoms are maintenance monitoring and keeping infrastructure and installations in good condition. Increasing demand for automatic servicing process, rising cases of accidents related to manual servicing, increasing demand for accurate servicing at a minimal cost are some of the factors supporting the growth of the segment in the market.

Based on the offering, the market is segmented into drone inspection software solution, drones equipped for telecom inspection, and telecom inspection services. The drone inspection software solution segment is expected to be the fastest growing and largest shareholder in the telecom drone technology market from 2021 to 2026. Rising organic strategies such as product launch activities related to software launch and software upgradation, increasing demand for touchless telecom tower repair process and increasing penetration of 5G technology in developing countries are some of the reasons for the segment’s growth.

As per the geographical analysis, the telecom drone technology market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the telecom drone technology market from 2021 to 2026. Rising awareness regarding drone based telecom tower services, increasing penetration of 5G technology, increasing demand for fail proof repair system, and presence of top players in the U.S. are some of the factors supporting the growth of the North American region.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest growing segment in the telecom drone technology market during the forecast period. Increasing adoption of industry 4.0 in countries like China and Japan, and flourishing telecom industry in India will propel the APAC market’s growth.

Drone Harmony AG, Aerialtronics, My Drone Services Inc., vHive, ANRA Technologies, SENSYN ROBOTICS, Inc, Pix4D SA, INSTADRONE, ArcGIS, and Valmont Industries, Inc are the key players in the telecom drone technology market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Telecom Drone Application Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Offering Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Telecom Drone Application Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Advancement in telecom drone application

3.3.2 Industry Challenges

3.3.2.1 Lack of capital investment in drone based tower inspection in developing countries

3.4 Prospective Growth Scenario

3.4.1 Offering Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Telecom Drone Application Market, By Offering

4.1 Offering Outlook

4.2 Drone Inspection Software Solution

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Drones Equipped for Telecom Inspection

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Telecom Inspection Services

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Telecom Drone Application Market, By Application

5.1 Application Outlook

5.2 Remote Engineering

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Network Optimization

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Tower Based Equipment Inspections

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Network Coverage Performance Measurement

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Telecom Drone Application Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Billion)

6.2.2 Market Size, By Offering, 2020-2026 (USD Billion)

6.2.3 Market Size, By Application, 2020-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Offering, 2020-2026 (USD Billion)

6.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Offering, 2020-2026 (USD Billion)

6.2.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Billion)

6.3.2 Market Size, By Offering, 2020-2026 (USD Billion)

6.3.3 Market Size, By Application, 2020-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Offering, 2020-2026 (USD Billion)

6.3.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Offering, 2020-2026 (USD Billion)

6.3.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Offering, 2020-2026 (USD Billion)

6.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Offering, 2020-2026 (USD Billion)

6.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Offering, 2020-2026 (USD Billion)

6.3.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Offering, 2020-2026 (USD Billion)

6.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Billion)

6.4.2 Market Size, By Offering, 2020-2026 (USD Billion)

6.4.3 Market Size, By Application, 2020-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Offering, 2020-2026 (USD Billion)

6.4.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Offering, 2020-2026 (USD Billion)

6.4.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Offering, 2020-2026 (USD Billion)

6.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Offering, 2020-2026 (USD Billion)

6.4.7.2 Market size, By Application, 2020-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Offering, 2020-2026 (USD Billion)

6.4.8.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Billion)

6.5.2 Market Size, By Offering, 2020-2026 (USD Billion)

6.5.3 Market Size, By Application, 2020-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Offering, 2020-2026 (USD Billion)

6.5.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Offering, 2020-2026 (USD Billion)

6.5.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Offering, 2020-2026 (USD Billion)

6.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Billion)

6.6.2 Market Size, By Offering, 2020-2026 (USD Billion)

6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Offering, 2020-2026 (USD Billion)

6.6.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Offering, 2020-2026 (USD Billion)

6.6.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Offering, 2020-2026 (USD Billion)

6.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Drone Harmony AG

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Aerialtronics

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 My Drone Services Inc.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 vHive

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 ANRA Technologies

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 SENSYN ROBOTICS, Inc

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Pix4D SA

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 ArcGIS

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Telecom Drone Technology Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Telecom Drone Technology Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS