Global Teleradiology Market Size, Trends & Analysis - Forecasts to 2027 By Teleradiology Services, Software [PACS, RIS] (Teleradiology Services, Software [PACS, RIS]), By Imaging Technique (CT, MRI, Ultrasound, X-ray, Mammography, Nuclear Imaging, Fluoroscopy), By End-use (Hospitals and Clinics, Diagnostic Imaging Center & Laboratories, Long Term Care Centers, Nursing Homes, Assisted Living Facilities, and Others), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

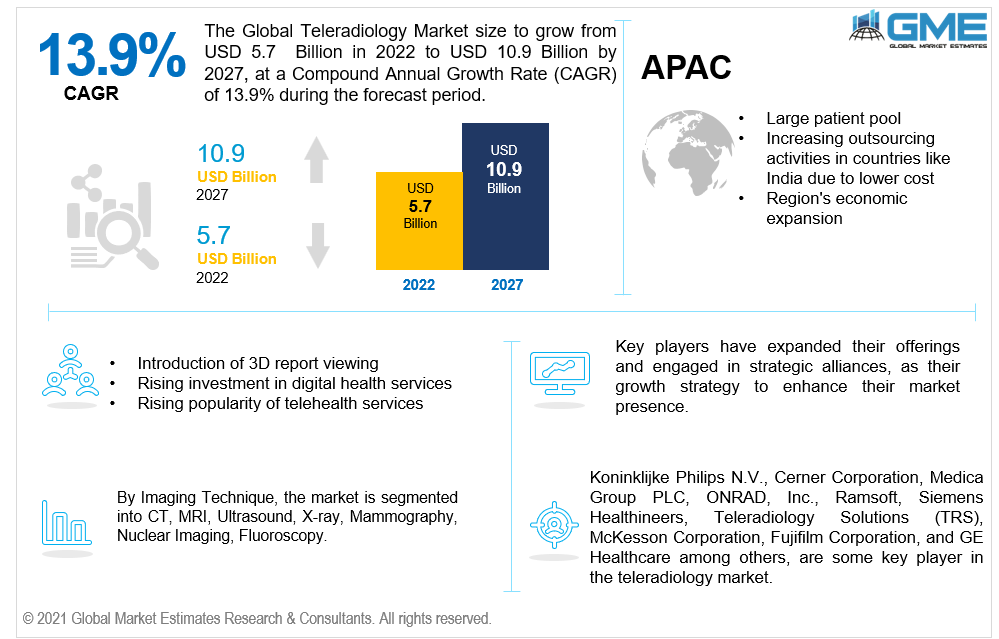

The global teleradiology market size was valued at USD 4.86 billion in 2021 and is projected to grow at a CAGR value of 13.9% from 2022 to 2027 to reach USD 10.87 billion by 2027. Rapid advancements in technology led to a paradigm shift in how patients' radiological data was viewed. Most challenges in moving radiological pictures from one location to another were resolved with the advent of teleradiology. It became a time-saving method that helped a lot of hospitals and diagnostic facilities. It significantly reduced the burden and facilitated the gathering of second opinions without requiring additional staff time.

Furthermore, medical imaging interpretation through teleradiology is a field that has grown in importance in recent years. Teleradiology enables diagnostic imaging facilities to use contemporary computer networking technology and medical software improvements to send patient medical pictures to radiologists operating from a remote location for image interpretation and consultations.

Moreover, teleradiology has advanced to the level of 3D report viewing. It makes it possible for medical professionals to read reports' material clearly without having to hold one in their hands. A significant advancement in the fields of teleradiology outsourcing and app development is the switch from 2D report viewing to 3D report viewing.

Also, transaction activity in the radiology sector has witnessed substantial growth for a few years due to demand in private organizations and large-scale hospitals. One of the major drivers is due to hospitals’ interest in acquisitions and mergers with diagnostic and imaging centers. Joint ventures have better sponsors and also tend to have a wide establishment in terms of skilled physicians and radiology practices. These factors are expected to positively impact revenue growth in the teleradiology market.

The quick reduction in worldwide elective diagnostic imaging operations owing to COVID-19 in 2020, followed by a second and third wave of escalating cases in numerous countries throughout 2020, resulted in a considerable drop in non-urgent imaging volumes. While teleradiology is used to provide after-hours reading services and has been somewhat shielded from this impact, increased hospital/imaging center capacity as a result of lower procedure volumes resulted in a considerable drop in the number of reading volumes for teleradiology reading service providers.

However, the teleradiology market and its vendors remain optimistic. Unprecedented issues experienced by healthcare providers (radiology groups, imaging centers, hospitals, etc.) in the last year have led to their need for improvement, notably in terms of radiologist utilization and operational efficiency. Furthermore, the December 2020 announcement by the Centres for Medicare and Medicaid Services (CMS) to drastically reduce diagnostic radiology reimbursement in 2021 will put additional pressure on U.S. healthcare providers to downsize their internal workforce and outsource outpatient imaging, with increased demand for teleradiology as a likely result.

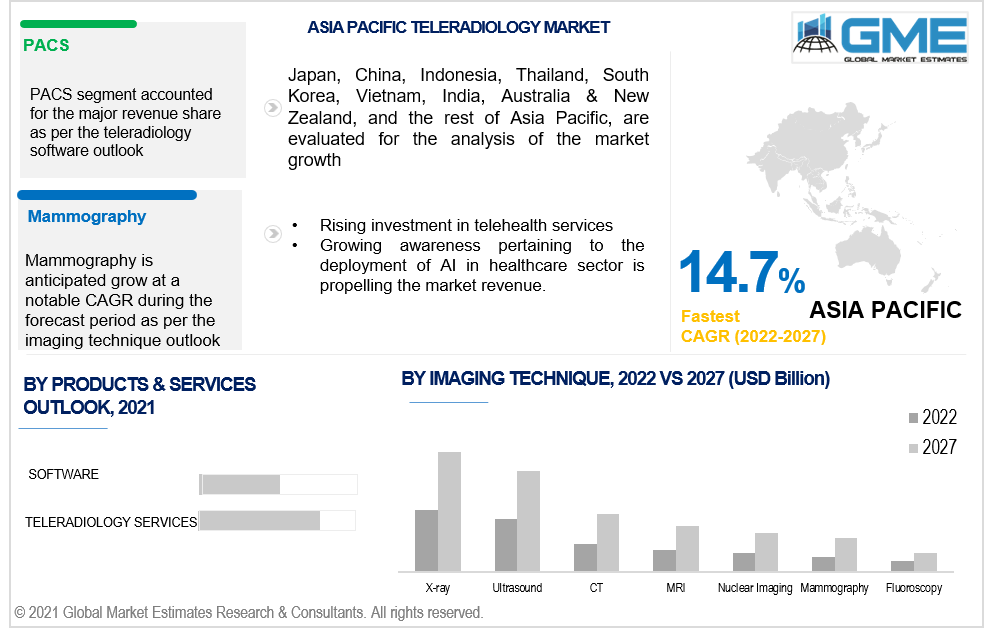

Teleradiology services accounted for the major revenue share in the 2021 market. In recent years, there has been an invasion of various teleradiology service providers and firms offering high-quality nighthawk and day radiology services, including weekend coverage, resulting in the dominance of this segment.

On the other hand, the software segment is expected to grow at the fastest CAGR during the forecast period. The launch of solutions with enhanced interoperability, high data transparency, and improved technical capabilities has driven demand for healthcare software. Furthermore, market players are undertaking strategic initiatives to boost their market presence in this segment. For example, TMC, a Unilabs business, has chosen Enlitic, a startup in the healthcare technology space, to supply medical intelligence software by November 17, 2021. This software will enhance operational effectiveness and patient outcomes for TMC's radiologists across the whole continuum of care.

Moreover, outsourcing PACS to a cloud-based infrastructure can have a significant impact on small centers as this would eliminate the need for additional expenditures on hardware, electricity, equipment, network, and maintenance, among other things. Also, in August 2021, GE Healthcare introduced Edison True PACS as a cloud-based corporate diagnostic imaging and workflow technology that aids radiologists in handling rising diagnostic complexity, dealing with increased workloads, and enhancing diagnostic precision. These factors are also expected to positively influence market growth.

The increasing volume of X-rays and ultrasound imaging across the globe has contributed to the dominance of these imaging techniques in the 2021 teleradiology market. With technological advancements, ultrasound has evolved from bulky, unwieldy equipment generating unsatisfactory pictures to a portable, user-friendly, and sophisticated device. This change has necessitated strategic collaborations between various healthcare settings as well as spurred revenue growth in this segment.

Companies with increasing capacity to process the large volume of mammography, CT scans, and MRI has resulted in the lucrative growth of these segments. Advancements in cancer management coupled with growing demand for CT scans over other imaging modalities as a viable strategy to avoid exploratory procedures are propelling growth in this segment.

Hospitals and clinics are the key end-users of this market in terms of revenue share. This growth can be attributed to the increase in imaging volume conducted within hospital settings coupled with the high standard of patient care in hospitals. Moreover, hospitals' growing propensity to automate and digitize patient data records further supports segment growth.

On the other hand, the increasing burden of patient care in hospitals creates lucrative opportunities for stand-alone diagnostic imaging centers and laboratories. Also, the launch of novel solutions which are easy to use and budget-friendly is anticipated to propel revenue growth of diagnostic imaging centers and laboratories during the forecast period.

North America (the United States, Canada, and Mexico) accounted for the major revenue share of the 2021 teleradiology market. The presence of a substantial number of software and technology suppliers in the U.S. has resulted in the dominance of North America in the 2021 global market. Furthermore, COVID-19 outbreak has led to significant changes in the U.S. radiology and diagnostic imaging field.

For instance, Texas Radiology Associates (TRA), which provides services to over 70 hospitals and healthcare facilities throughout Texas, has considerably increased the amount of remote work available to its 140 radiologists. The teleradiology service was created to offer emergency rooms across the UPMC health system overnight specialist radiology support. Such changes are anticipated to bolster the revenue growth of the North America teleradiology market.

On the other hand, Asia-Pacific is anticipated to register the fastest growth during the forecast period. Expansion of global market players in the Asian markets including China, India, and others is one of the key factors driving the market. Moreover, the global surge in healthcare consumption and medical tourism will drive medical imaging and teleradiology usage globally. In the United States, for example, rising demand for radiology services has resulted in an increase in radiology service outsourcing to India and Australia

Koninklijke Philips N.V., Cerner Corporation, Medica Group PLC, ONRAD, Inc., Ramsoft, Siemens Healthineers, Teleradiology Solutions (TRS), McKesson Corporation, Fujifilm Corporation, and GE Healthcare among others, are some key players operating in the teleradiology market.

Please note: This is not an exhaustive list of companies profiled in the report.

These key players are making focused attempts to enhance their market presence in the biopharmaceutical industry. New product development, merger, and acquisitions, and licensing deals are some of the key strategies undertaken by these companies to sustain the rising market competition.

In March 2022, Teleradiology Solutions announced a 5-year contract with Hamad Medical Corporation, a Qatar-based public healthcare provider. Under this contract, TRS would provide radiology interpretations in cooperation with its radiologists’ panel.

Similarly, in February 2020, NANO-X IMAGING LTD, a medical imaging technology company, collaborated with Siemens Healthineers-backed USARAD, a teleradiology and telemedicine company that offers radiology services to over 500 medical facilities across 50 U.S. states and 15 countries. As a result of this agreement, USARAD would be utilizing existing radiologists and recruiting additional expertise combined with Nanox.ARC and Nanox.CLOUD to become a service provider for imaging diagnostics.

1........... RESEARCH METHODOLOGY

1.1 Research Assumptions & Limitations

1.1.1 Research Assumptions

1.1.2 Research Limitations

1.2 Research Methodology

1.3 Information Procurement

1.3.1 Purchased Databases

1.3.2 GMEs Internal Report Repository for All Segments

1.3.3 Primary Research

1.3.4 Various Types of Respondents for Primary Interviews

1.3.5 Number of Interviews Conducted Throughout the Research Process

1.3.6 Primary Stakeholders

1.3.7 Discussion Guide: Primary Participants

1.3.8 Secondary Resources & Third-Party Perspectives

1.3.8.1 Secondary Resources/Desk Analysis

1.3.8.2 Company Information Sources

1.3.8.3 Secondary Data Sources

1.4 Analysis and Output

1.4.1 Regional/Country Analysis

1.4.2 Predictive Analytics’ Techniques

1.4.3 In-house AI Based Real Time Analytics Tool

1.5 Market Estimation

1.5.1 Top-Down Approach

1.5.2 Bottom-Up Approach

1.6 Data Triangulation

1.7 Final Output from Desk & Primary Research

1.8 Market Scope & Definition

2........... EXECUTIVE SUMMARY

2.1 Segment Outlook

3........... IMPACT OF COVID-19 AS A KEY MARKET CONTRIBUTOR ACROSS GEOGRAPHIES

3.1 North America

3.2 Europe

3.3 asia pacific

3.4 rest of the world

4........... TECHNOLOGICAL TRENDS

4.1 Intelligent Workflow Management

4.2 Consumerization Growth

4.3 Better Solutions for Mobile Devices

5........... Teleradiology Supplier Ecosystem

5.1 Full Stack (Self-Developed Commercial IT & Reading Services)-

5.2 Reading Service Provider (Self-Developed IT)-

5.3 Reading Service Provider (Third-Party IT)-

5.4 IT Only-

5.5 COVID-19 Impact on Teleradiology Vendors

5.6 Market Competition Analysis

5.7 FOUR QUADRANT COMPETITOR POSITIONING MATRIX

5.7.1 Leaders

5.7.2 Visionaries

5.7.3 Challengers

5.7.4 Niche Players

6........... Teleradiology Market- industry outlook

6.1 Market Lineage Outlook

6.1.1 Teleradiology Parent Outlook

6.1.1.1 M&A Transaction

6.1.2 Teleradiology Related/Ancillary Outlook

6.2 Market Dynamic Impact Analysis

6.3 Market Driver Impact Analysis

6.3.1 Global Teleradiology Market: Market Drivers

6.3.1.1 Advancements in Teleradiology Solutions

6.3.1.2 Adoption of Artificial Intelligence (AI) in Teleradiology

6.4 Market Restraint Impact Analysis

6.4.1 Global Teleradiology Market: Market Restraints.

6.4.1.1 Limited Access to High-Speed Internet in Rural Areas

6.5 Market Opportunities Analysis

6.5.1 Global Teleradiology Market: Opportunities

6.5.1.1 Use Of Blockchain in Teleradiology

6.6 Market Challenges Analysis

6.6.1 Global Teleradiology Market: Challenges

6.6.1.1 Data Breach and Cybersecurity Risks

6.7 Supply Side Analysis

6.7.1 Porter’s Five Forces Analysis

6.7.1.1 Intensity of Competitive Rivalry

6.7.1.2 Threat Of New Entrants

6.7.1.3 Threat Of Substitutes

6.7.1.4 Bargaining Power of Suppliers

6.7.1.5 Bargaining Power of Buyers

6.7.2 Global Teleradiology Market Overview

7........... GLOBAL Teleradiology Market, BY Imaging Technique

7.1 Introduction

7.2 Imaging Technique Business Analysis

7.3 Imaging Technique Revenue Progress Analysis, 2021 & 2027

7.4 X-ray

7.5 Ultrasound

7.6 CT

7.7 MRI

7.8 Nuclear Imaging

7.9 Mammography

7.10 Fluoroscopy

8........... GLOBAL Teleradiology Market, BY Product

8.1 Introduction

8.2 Product Business Analysis

8.3 Product Revenue Progress Analysis, 2021 & 2027

8.4 Teleradiology Services

8.5 Software

9........... GLOBAL Teleradiology Market, BY End-use

9.1 Introduction

9.2 End-use Business Analysis

9.3 End-use Revenue Progress Analysis, 2021 & 2027

9.4 Hospitals and Clinics

9.5 Diagnostic Imaging Centre and Laboratories

9.6 Long Term Care Centers, Nursing Homes, Assisted Living Facilities

9.7 Other End-users

10......... Global Teleradiology market, BY REGION

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 By Product

10.2.2 By Imaging Technique

10.2.3 By End-User

10.2.4 By Country

10.2.4.1 U.S.

10.2.4.1.1 By Product

10.2.4.1.2 By Imaging Technique

10.2.4.1.3 By End-User

10.2.4.2 CANADA

10.2.4.2.1 By Product

10.2.4.2.2 By Imaging Technique

10.2.4.2.3 By End-User

10.2.4.3 MEXICO

10.2.4.3.1 By Product

10.2.4.3.2 By Imaging Technique

10.2.4.3.3 By End-User

10.3 EUROPE

10.3.1 By Product

10.3.2 By Imaging Technique

10.3.3 By End-User

10.3.4 By Country

10.3.4.1 Germany

10.3.4.1.1 By Product

10.3.4.1.2 By Imaging Technique

10.3.4.1.3 By End-User

10.3.4.2 United Kingdom

10.3.4.2.1 By Product

10.3.4.2.2 By Imaging Technique

10.3.4.2.3 By End-User

10.3.4.3 France

10.3.4.3.1 By Product

10.3.4.3.2 By Imaging Technique

10.3.4.3.3 By End-User

10.3.4.4 ITaly

10.3.4.4.1 By Product

10.3.4.4.2 By Imaging Technique

10.3.4.4.3 By End-User

10.3.4.5 Spain

10.3.4.5.1 By Product

10.3.4.5.2 By Imaging Technique

10.3.4.5.3 By End-User

10.4 ASIA PACIFIC

10.4.1 By Product

10.4.2 By Imaging Technique

10.4.3 By End-User

10.4.4 By Country

10.4.4.1 China

10.4.4.1.1 By Product

10.4.4.1.2 By Imaging Technique

10.4.4.1.3 By End-User

10.4.4.2 Japan

10.4.4.2.1 By Product

10.4.4.2.2 By Imaging Technique

10.4.4.2.3 By End-User

10.4.4.3 India

10.4.4.3.1 By Product

10.4.4.3.2 By Imaging Technique

10.4.4.3.3 By End-User

10.4.4.4 South Korea

10.4.4.4.1 By Product

10.4.4.4.2 By Imaging Technique

10.4.4.4.3 By End-User

10.5 Central & South America

10.5.1 By Product

10.5.2 By Imaging Technique

10.5.3 By End-User

10.5.4 By Country

10.5.4.1 Brazil

10.5.4.1.1 By Product

10.5.4.1.2 By Imaging Technique

10.5.4.1.3 By End-User

10.6 MEA

10.6.1 By Product

10.6.2 By Imaging Technique

10.6.3 By End-User

10.6.4 By Country

10.6.4.1 Saudi Arabia

10.6.4.1.1 By Product

10.6.4.1.2 By Imaging Technique

10.6.4.1.3 By End-User

10.6.4.2 South Africa

10.6.4.2.1 By Product

10.6.4.2.2 By Imaging Technique

10.6.4.2.3 By End-User

11......... Company profile

11.1 KONINKLIJKE PHILIPS N.V.

11.1.1 Business Description

11.1.2 Swot Analysis

11.1.3 Products & Services Offered

11.1.4 Strategic Initiatives

11.2 CERNER CORPORATION (oracle corporation)

11.2.1 Business Description

11.2.2 Swot Analysis

11.2.3 Products & Services Offered

11.2.4 Strategic Initiatives

11.3 Medica Group PLC

11.3.1 Business Description

11.3.2 Swot Analysis

11.3.3 Products & Services Offered

11.3.4 Strategic Initiatives

11.4 Onrad, Inc

11.4.1 Business Description

11.4.2 Swot Analysis

11.4.3 Products & Services Offered

11.5 RamSoft

11.5.1 Business Description

11.5.2 Swot Analysis

11.5.3 Products & Services Offered

11.5.4 Strategic Initiatives

11.6 Siemens Healthineers

11.6.1 Business Description

11.6.2 Products & Services Offered

11.6.3 Strategic Initiatives

11.7 Teleradiology Solutions

11.7.1 Business Description

11.7.2 Swot Analysis

11.7.3 Products & Services Offered

11.7.4 Strategic Initiatives

11.8 McKesson Corporation

11.8.1 Business Description

11.8.2 Swot Analysis

11.8.3 Products & Services Offered

11.9 FUJIFILM Holdings America Corporation

11.9.1 Business Description

11.9.2 Swot Analysis

11.9.3 Products & Services Offered

11.9.4 Strategic Initiatives

11.10 GE HEALTHCARE

11.10.1 Business Description

11.10.2 Swot Analysis

11.10.3 Products & Services Offered

11.10.4 Strategic Initiatives

List of Tables

Table 1 Global Teleradiology Market, By Imaging Technique, 2019-2027 (USD Million)

Table 2 X-Ray Market, Regional Analysis (USD Million)

Table 3 Ultrasound Market, Regional Analysis (USD Million)

Table 4 CT Market, Regional Analysis (USD Million)

Table 5 MRI Market, Regional Analysis (USD Million)

Table 6 Nuclear Imaging Market, Regional Analysis (USD Million)

Table 7 Mammography Market, Regional Analysis (USD Million)

Table 8 Fluoroscopy Market, Regional Analysis (USD Million)

Table 9 Global Teleradiology Market, By Product, 2019-2027 (USD Million)

Table 10 Global Teleradiology Software Market, By Product, 2019-2027 (USD Million)

Table 11 Teleradiology Services Market, Regional Analysis (USD Million)

Table 12 Software Market, Regional Analysis (USD Million)

Table 13 Global Teleradiology Market, By End-Use, 2019-2027 (USD Million)

Table 14 Hospitals And Clinics Market, Regional Analysis (USD Million)

Table 15 Diagnostic Imaging Centre And Laboratories Market, Regional Analysis (USD Million)

Table 16 Long Term Care Centers, Nursing Homes, Assisted Living Facilities Market, Regional Analysis (USD Million)

Table 17 Other End-Users Market, Regional Analysis (USD Million)

Table 18 Global Teleradiology Market, By Region, 2019-2027 (USD Million)

Table 19 North America Teleradiology Market, By Product, 2019-2027 (USD Million)

Table 20 North America Teleradiology Software Market, By Product, 2019-2027 (USD Million)

Table 21 North America Teleradiology Market, By Imaging Technique, 2019-2027 (USD Million)

Table 22 North America Teleradiology Market, By End-User, 2019-2027 (USD Million)

Table 23 North America, Teleradiology Market, By Country, 2019-2027 (USD Million)

Table 24 U.S. Teleradiology Market, By Product, 2019-2027 (USD Million)

Table 25 U.S. Teleradiology Market, By Imaging Technique, 2019-2027 (USD Million)

Table 26 U.S. Teleradiology Market, By End-User, 2019-2027 (USD Million)

Table 27 Canada Teleradiology Market, By Product, 2019-2027 (USD Million)

Table 28 Canada Teleradiology Market, By Imaging Technique, 2019-2027 (USD Million)

Table 29 Canada Teleradiology Market, By End-User, 2019-2027 (USD Million)

Table 30 Mexico Teleradiology Market, By Product, 2019-2027 (USD Million)

Table 31 Mexico Teleradiology Market, By Imaging Technique, 2019-2027 (USD Million)

Table 32 Mexico Teleradiology Market, By End-User, 2019-2027 (USD Million)

Table 33 Europe Teleradiology Market, By Product, 2019-2027 (USD Million)

Table 34 Europe Teleradiology Software Market, By Product, 2019-2027 (USD Million)

Table 35 Europe Teleradiology Market, By Imaging Technique, 2019-2027 (USD Million)

Table 36 Europe Teleradiology Market, By End-User, 2019-2027 (USD Million)

Table 37 Europe Teleradiology Market, By Country, 2019-2027 (USD Million)

Table 38 Germany Teleradiology Market, By Product, 2019-2027 (USD Million)

Table 39 Germany Teleradiology Market, By Imaging Technique, 2019-2027 (USD Million)

Table 40 Germany Teleradiology Market, By End-User, 2019-2027 (USD Million)

Table 41 United Kingdom Teleradiology Market, By Product, 2019-2027 (USD Million)

Table 42 United Kingdom Teleradiology Market, By Imaging Technique, 2019-2027 (USD Million)

Table 43 United Kingdom Teleradiology Market, By End-User, 2019-2027 (USD Million)

Table 44 France Teleradiology Market, By Product, 2019-2027 (USD Million)

Table 45 France Teleradiology Market, By Imaging Technique, 2019-2027 (USD Million)

Table 46 France Teleradiology Market, By End-User, 2019-2027 (USD Million)

Table 47 ITaly Teleradiology Market, By Product, 2019-2027 (USD Million)

Table 48 ITaly Teleradiology Market, By Imaging Technique, 2019-2027 (USD Million)

Table 49 ITaly Teleradiology Market, By End-User, 2019-2027 (USD Million)

Table 50 Spain Teleradiology Market, By Product, 2019-2027 (USD Million)

Table 51 Spain Teleradiology Market, By Imaging Technique, 2019-2027 (USD Million)

Table 52 Spain Teleradiology Market, By End-User, 2019-2027 (USD Million)

Table 53 Asia Pacific Teleradiology Market, By Product, 2019-2027 (USD Million)

Table 54 Asia Pacific Teleradiology Software Market, By Product, 2019-2027 (USD Million)

Table 55 Asia Pacific Teleradiology Market, By Imaging Technique, 2019-2027 (USD Million)

Table 56 Asia Pacific Teleradiology Market, By End-User, 2019-2027 (USD Million)

Table 57 Asia Pacific, Teleradiology Market, By Country, 2019-2027 (USD Million)

Table 58 China Teleradiology Market, By Product, 2019-2027 (USD Million)

Table 59 China Teleradiology Market, By Imaging Technique, 2019-2027 (USD Million)

Table 60 China Teleradiology Market, By End-User, 2019-2027 (USD Million)

Table 61 Japan Teleradiology Market, By Product, 2019-2027 (USD Million)

Table 62 Japan Teleradiology Market, By Imaging Technique, 2019-2027 (USD Million)

Table 63 Japan Teleradiology Market, By End-User, 2019-2027 (USD Million)

Table 64 India Teleradiology Market, By Product, 2019-2027 (USD Million)

Table 65 India Teleradiology Market, By Imaging Technique, 2019-2027 (USD Million)

Table 66 India Teleradiology Market, By End-User, 2019-2027 (USD Million)

Table 67 South Korea Teleradiology Market, By Product, 2019-2027 (USD Million)

Table 68 South Korea Teleradiology Market, By Imaging Technique, 2019-2027 (USD Million)

Table 69 South Korea Teleradiology Market, By End-User, 2019-2027 (USD Million)

Table 70 Central & South America Teleradiology Market, By Product, 2019-2027 (USD Million)

Table 71 Central & South America Teleradiology Software Market, By Product, 2019-2027 (USD Million)

Table 72 Central & South America Teleradiology Market, By Imaging Technique, 2019-2027 (USD Million)

Table 73 Central & South America Teleradiology Market, By End-User, 2019-2027 (USD Million)

Table 74 Central & South America, Teleradiology Market, By Country, 2019-2027 (USD Million)

Table 75 Brazil Teleradiology Market, By Product, 2019-2027 (USD Million)

Table 76 Brazil Teleradiology Market, By Imaging Technique, 2019-2027 (USD Million)

Table 77 Brazil Teleradiology Market, By End-User, 2019-2027 (USD Million)

Table 78 MEA Teleradiology Market, By Product, 2019-2027 (USD Million)

Table 79 MEA Teleradiology Software Market, By Product, 2019-2027 (USD Million)

Table 80 MEA Teleradiology Market, By Imaging Technique, 2019-2027 (USD Million)

Table 81 MEA Teleradiology Market, By End-User, 2019-2027 (USD Million)

Table 82 MEA, Teleradiology Market, By Country, 2019-2027 (USD Million)

Table 83 Saudi Arabia Teleradiology Market, By Product, 2019-2027 (USD Million)

Table 84 Saudi Arabia Teleradiology Market, By Imaging Technique, 2019-2027 (USD Million)

Table 85 Saudi Arabia Teleradiology Market, By End-User, 2019-2027 (USD Million)

Table 86 South Africa Teleradiology Market, By Product, 2019-2027 (USD Million)

Table 87 South Africa Teleradiology Market, By Imaging Technique, 2019-2027 (USD Million)

Table 88 South Africa Teleradiology Market, By End-User, 2019-2027 (USD Million)

Table 89 Koninklijke Philips N.V.: Products/Services Offered

Table 90 Cerner Corporation: Products/Services Offered

Table 91 Medica Group PLC: Products/Services Offered

Table 92 Onrad, Inc: Products/Services Offered

Table 93 Ramsoft: Products/Services Offered

Table 94 Siemens Healthineers: Products/Services Offered

Table 95 Teleradiology Solutions.: Products/Services Offered

Table 96 Mckesson Corporation: Products/Services Offered

Table 97 Fujifilm Holdings America Corporation: Products/Services Offered

Table 98 GE Healthcare: Products/Services Offered

List of figures

Figure 1 Global Teleradiology Market Value From 2021-2027 (USD Billion)

Figure 2 Global Teleradiology Market Overview

Figure 3 Global Teleradiology Market Share, By Teleradiology Software (2021)

Figure 4 Global Teleradiology Market Share, By Imaging Technique (2021)

Figure 5 Global Teleradiology Market Share, By End-User (2021)

Figure 6 Global Teleradiology Market, By Region (Asia Pacific Market)

Figure 7 Fractors Driving Teleradiology Market

Figure 8 Top Funded Digital Health Categories Worldwide In 2020 (In Us Million Dollars)

Figure 9 Technological Trends In Global Teleradiology Market

Figure 10 Teleradiology Supplier Ecosystem

Figure 11 Teleradiology Supplier Ecosystem, By Vendor Examples

Figure 12 Teleradiology Suppliers

Figure 13 Example Of Strategic Alliance Between Teleradiology Reading Service Providers And IT Suppliers, And AI Developers

Figure 14 Europe’s Fastest Growing Company

Figure 15 Industry Trends – Healthcare IT Sector

Figure 16 Imaging M&A Transaction Volume

Figure 17 Factors Driving M&A Activity

Figure 18 Anticipated Benefits Of Strategic Acquisition

Figure 19 Impact Of Macro & Micro Indicators On The Market

Figure 20 Impact Of Key Drivers On The Global Teleradiology Market

Figure 21 Impact Of Restraint On The Global Teleradiology Market

Figure 22 Use Of Blockchain In Teleradiology

Figure 23 Porter’s Five Forces Analysis

Figure 24 Imaging Technique Business Analysis

Figure 25 Imaging Technique Segment: Revenue Progress Analysis

Figure 26 Global X-Ray-Based Teleradiology Market, 2019-2027 (USD Million)

Figure 27 Global Ultrasound-Based Teleradiology Market, 2019-2027 (USD Million)

Figure 28 Global CT-Based Teleradiology Market, 2019-2027 (USD Million)

Figure 29 Global MRI-Based Teleradiology Market, 2019-2027 (USD Million)

Figure 30 Global Nuclear Imaging-Based Teleradiology Market, 2019-2027 (USD Million)

Figure 31 Global Mammography-Based Teleradiology Market, 2019-2027 (USD Million)

Figure 32 Global Fluoroscopy-Based Teleradiology Market, 2019-2027 (USD Million)

Figure 33 Product Business Analysis

Figure 34 Product Segment: Revenue Progress Analysis

Figure 35 Global Teleradiology Services-Based Teleradiology Market, 2019-2027 (USD Million)

Figure 36 Global Software-Based Teleradiology Market, 2019-2027 (USD Million)

Figure 37 End-Use Business Analysis

Figure 38 End-Use Segment: Revenue Progress Analysis

Figure 39 Global Hospitals And Clinics-Based Teleradiology Market, 2019-2027 (USD Million)

Figure 40 Global Diagnostic Imaging Centre And Laboratories-Based Teleradiology Market, 2019-2027 (USD Million)

Figure 41 Global Long Term Care Centers, Nursing Homes, Assisted Living Facilities-Based Teleradiology Market, 2019-2027 (USD Million)

Figure 42 Global Other End-Users-Based Teleradiology Market, 2019-2027 (USD Million)

Figure 43 Teleradiology Market, By Region, 2021

Figure 44 North America Teleradiology Market, 2019-2027 (USD Million)

Figure 45 Europe Teleradiology Market, 2019-2027 (USD Million)

Figure 46 Asia Pacific Teleradiology Market, 2019-2027 (USD Million)

Figure 47 Central & South America Teleradiology Market, 2019-2027 (USD Million)

Figure 48 MEA Teleradiology Market, 2019-2027 (USD Million)

Figure 49 Koninklijke Philips N.V.: Company Snapshot

Figure 50 Koninklijke Philips N.V.: Financial Performance: Business & Geographical Revenue, 2021

Figure 51 Koninklijke Philips N.V.: Swot Analysis

Figure 52 Cerner Corporation: Company Snapshot

Figure 53 Cerner Corporation: Financial Performance: Business & Geographical Revenue, 2021

Figure 54 Cerner Corporation: Swot Analysis

Figure 55 Medica Group PLC: Company Snapshot

Figure 56 Medica Group PLC: Financial Performance: Business & Geographical Revenue, 2021

Figure 57 Medica Group PLC: Swot Analysis

Figure 58 Onrad, Inc: Company Snapshot

Figure 59 Onrad, Inc: Swot Analysis

Figure 60 Ramsoft: Company Snapshot

Figure 61 Ramsoft: Swot Analysis

Figure 62 Siemens Healthineers: Company Snapshot

Figure 63 Siemens Healthineers: Swot Analysis

Figure 64 Siemens Healthineers: Financial Performance: Business & Geographical Revenue, 2021

Figure 65 Teleradiology Solutions: Company Snapshot

Figure 66 Teleradiology Solutions: Swot Analysis

Figure 67 Mckesson Corporation: Company Snapshot

Figure 68 Mckesson Corporation: Swot Analysis

Figure 69 Mckesson Corporation: Financial Performance: Business & Geographical Revenue, 2021

Figure 70 Fujifilm Holdings America Corporation: Company Snapshot

Figure 71 Fujifilm Holdings America Corporation: Swot Analysis

Figure 72 Fujifilm Holdings America Corporation: Financial Performance: Business & Geographical Revenue, 2021

Figure 73 GE Healthcare: Company Snapshot

Figure 74 GE Healthcare: Swot Analysis

Figure 75 GE Healthcare: Financial Performance: Business & Geographical Revenue, 2021

The Global Teleradiology Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Teleradiology Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS