Global Trade Finance Market Size, Trends & Analysis - Forecasts to 2028 By Product Type (Commercial Letters of Credit (LCs), Standby Letters of Credit (LCs), Guarantees, and Others), By Provider (Banks, Trade Finance Houses, and Others), By Application (Domestic and International), By End User (Traders, Importers, and Exporters), and By Region (North America, Asia Pacific, Central & South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

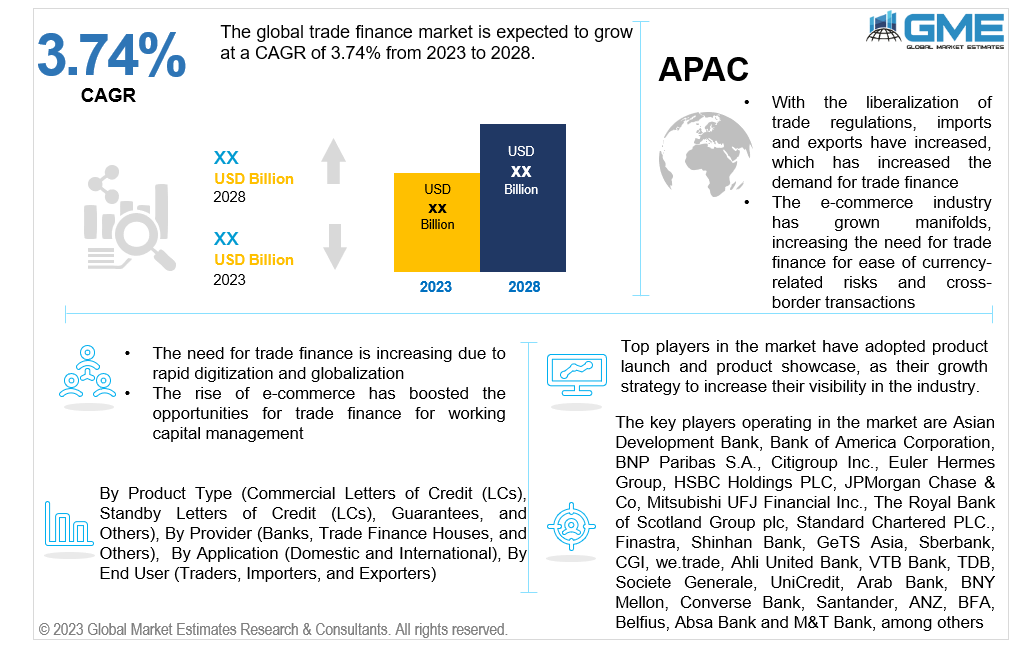

The global trade finance market is expected to grow at a CAGR of 3.74% from 2023 to 2028. Trade finance refers to the financial tools and products that facilitate international trade transactions. It enables cross-border trade by offering solutions for various financial risks and challenges. These tools also help mitigate risks associated with currency fluctuations, payment delays, and other trade-related uncertainties.

The trade finance market growth is driven by rapid digitization and globalization. Advancement in technology has enabled more efficient and secure trade finance solutions. The digital functioning of financial institutions allows for remote and easy access. It also reduces physical paperwork and removes the problem of storage. Globalization is also a significant driver. The increasing interconnectedness of the global economy has resulted in a rise in the volume of international trade, driving the demand for trade finance solutions. Moreover, the rise of e-commerce has boosted the opportunities for trade finance for working capital management.

The global trade finance market also has some restraints. The trade finance institutions can come across trade disputes and regulation complexities frequently. Trade finance is subject to ever-changing international regulations, making compliance a significant challenge for financial institutions.

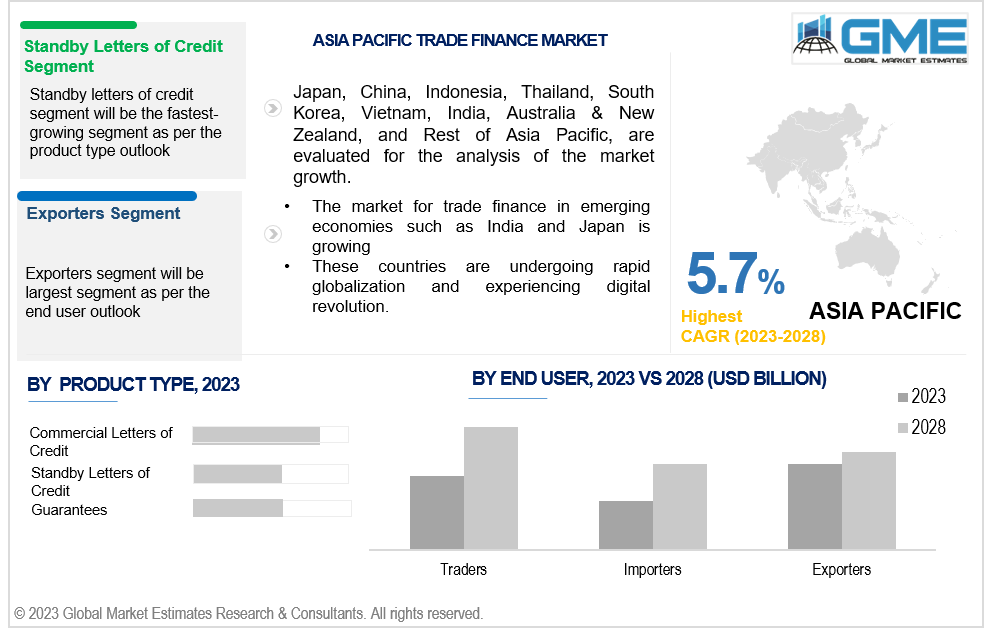

Based on product type, the market is segmented into commercial letters of credit (LCS), standby letters of credit (SBLC), guarantees, and others. Commercial letters of credit segment dominated the market in 2022 and is projected to retain its dominance over the forecast period. They are known to facilitate transactions and provide with security to both buyers and sellers in an international transaction.

Standby letter of credit segment is projected to exhibit the highest CAGR in the forecast period. It is very similar to bank guarantees though it is preferred mainly for international trade. SBLC is known to cover financial risks, demonstrates its financial credibility and commitment to the beneficiary, and is preferred for long-term contracts.

The market is segmented into banks, trade finance houses, and others based on provider. Banks segment is expected to be the dominant segment in the market over the forecast period. This is because banks are heavily regulated and reputable, and the cost of borrowing is lower than non-bank institutions.

The trade finance houses segment is projected to exhibit the highest growth rate in the forecast period. This can be attributed to the fact that they are not as heavily regulated as banks and can raise funding from several sources, such as banks, private investments, and crowdfunding. The lack of heavy regulations also ensures that the process is speedy.

Based on application, the market is segmented into domestic and international. International segment is anticipated to be the largest segment during the forecast period. Trade finance helps mitigate risks associated with international trade such as payment default, currency fluctuations by providing financial instruments like letters of credit. It also helps expand business by providing funds to engage in cross-border trade. Trade finance also helps companies adhere to compliance regulations that are associated with international trade.

Domestic segment is fast emerging and expected to exhibit highest CAGR in the forecast period. It is used to keep a tab on the movement of goods and services across the country and the cashflow. It also helps maintain the working capital and supply chain relationships.

Based on end user, the market is segmented into traders, importers, and exporters. Exporters segment is anticipated to be the largest segment in the market over the forecast period. The growth is attributed to the exporters who often use trade finance to secure payment for their goods or services while dealing with foreign buyers.

The traders segment is projected to exhibit the fastest rate of growth in the forecast period from 2023 to 2028. This can be attributed to the fact that traders include intermediaries who buy and sell without having it in their possession. They use trade finance to optimize the working capital, manage cash flow and reduce risks associated with international trade.

North America is analysed to be the largest region in the global trade finance market during the forecast period. Modern technology is taking over and enabling the growth of trade and financial technology across the region, mainly in the United States. Also, the overall international trade imports and exports are increasing in value, which is also responsible for the growth of the trade finance market.

Asia Pacific is projected to be the fastest-growing region across the global trade finance market. Asia Pacific region has several emerging economies, such as India, Philippines, Japan, Bangladesh, amongst others. These countries are undergoing rapid globalization and experiencing a digital revolution. With the liberalization of trade regulations, imports and exports have increased the demand for trade finance in the region. The e-commerce industry has also grown manifolds, and several small and medium-sized enterprises have registered as sellers, increasing the need for trade finance for ease of currency-related risks and cross-border transactions.

The key players operating in the market are Asian Development Bank, Bank of America Corporation, BNP Paribas S.A., Citigroup Inc., Euler Hermes Group, HSBC Holdings PLC, JPMorgan Chase & Co, Mitsubishi UFJ Financial Inc., The Royal Bank of Scotland Group plc, Standard Chartered PLC., Finastra, Shinhan Bank, GeTS Asia, Sberbank, CGI, we.trade, Ahli United Bank, VTB Bank, TDB, Societe Generale, UniCredit, Arab Bank, BNY Mellon, Converse Bank, Santander, ANZ, BFA, Belfius, Absa Bank, and M&T Bank, among others.

Please note: This is not an exhaustive list of companies profiled in the report.

In September 2023, the Asian Development Bank approved capital management reforms that unlock USD 100 billion in new funding capacity over the next decade to address Philippine’s overlapping, simultaneous crises. The expansion of available funds will be further leveraged through mobilizing private and domestic capital to move from the billions to trillions required to tackle the climate crisis.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL TRADE FINANCE MARKET, BY PRODUCT TYPE

4.1 Introduction

4.2 Trade Finance Market: Product Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Commercial Letters of Credit (LCs)

4.4.1 Commercial Letters of Credit (LCs) Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Standby Letters of Credit (LCs)

4.5.1 Standby Letters of Credit (LCs) Market Estimates and Forecast, 2020-2028 (USD Million)

4.6 Guarantees

4.6.1 Guarantees Market Estimates and Forecast, 2020-2028 (USD Million)

4.7 Others

4.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL TRADE FINANCE MARKET, BY PROVIDER

5.1 Introduction

5.2 Trade Finance Market: Provider Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Banks

5.4.1 Banks Market Estimates and Forecast, 2020-2028 (USD Million)

5.5 Trade Finance Houses

5.5.1 Trade Finance Houses Market Estimates and Forecast, 2020-2028 (USD Million)

5.6 Others

5.6.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL TRADE FINANCE MARKET, BY APPLICATION

6.1 Introduction

6.2 Trade Finance Market: Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4 Domestic

6.4.1 Domestic Market Estimates and Forecast, 2020-2028 (USD Million)

7 GLOBAL TRADE FINANCE MARKET, BY END USER

7.1 Introduction

7.2 Trade Finance Market: End User Scope Key Takeaways

7.3 Revenue Growth Analysis, 2022 & 2028

7.4 Traders

7.4.1 Traders Market Estimates and Forecast, 2020-2028 (USD Million)

7.5 Importers

7.5.1 Importers Market Estimates and Forecast, 2020-2028 (USD Million)

7.6 Exporters

7.6.1 Exporters Market Estimates and Forecast, 2020-2028 (USD Million)

8 GLOBAL TRADE FINANCE MARKET, BY REGION

8.1 Introduction

8.2 North America Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.1 By Product Type

8.2.2 By Provider

8.2.3 By Application

8.2.4 By end user

8.2.5 By Country

8.2.5.1 U.S. Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.1.1 By Product Type

8.2.5.1.2 By Provider

8.2.5.1.3 By Application

8.2.5.1.4 By end user

8.2.5.2 Canada Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.2.1 By Product Type

8.2.5.2.2 By Provider

8.2.5.2.3 By Application

8.2.5.2.4 By end user

8.2.5.3 Mexico Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.3.1 By Product Type

8.2.5.3.2 By Provider

8.2.5.3.3 By Application

8.2.5.3.4 By end user

8.3 Europe Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.1 By Product Type

8.3.2 By Provider

8.3.3 By Application

8.3.4 By end user

8.3.5 By Country

8.3.5.1 Germany Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.1.1 By Product Type

8.3.5.1.2 By Provider

8.3.5.1.3 By Application

8.3.5.1.4 By end user

8.3.5.2 U.K. Presered Flowers Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.2.1 By Product Type

8.3.5.2.2 By Provider

8.3.5.2.3 By Application

8.3.5.2.4 By end user

8.3.5.3 France Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.3.1 By Product Type

8.3.5.3.2 By Provider

8.3.5.3.3 By Application

8.3.5.3.4 By end user

8.3.5.4 Italy Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.4.1 By Product Type

8.3.5.4.2 By Provider

8.3.5.4.3 By Application

8.3.5.4.4 By end user

8.3.5.5 Spain Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.5.1 By Product Type

8.3.5.5.2 By Provider

8.3.5.5.3 By Application

8.3.5.5.4 By end user

8.3.5.6 Netherlands Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.6.1 By Product Type

8.3.5.6.2 By Provider

8.3.5.6.3 By Application

8.3.5.6.4 By end user

8.3.5.7 Rest of Europe Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.7.1 By Product Type

8.3.5.7.2 By Provider

8.3.5.7.3 By Application

8.3.5.7.4 By end user

8.4 Asia Pacific Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.1 By Product Type

8.4.2 By Provider

8.4.3 By Application

8.4.4 By end user

8.4.5 By Country

8.4.5.1 China Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.1.1 By Product Type

8.4.5.1.2 By Provider

8.4.5.1.3 By Application

8.4.5.1.4 By end user

8.4.5.2 Japan Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.2.1 By Product Type

8.4.5.2.2 By Provider

8.4.5.2.3 By Application

8.4.5.2.4 By end user

8.4.5.3 India Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.3.1 By Product Type

8.4.5.3.2 By Provider

8.4.5.3.3 By Application

8.4.5.3.4 By end user

8.4.5.4 South Korea Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.4.1 By Product Type

8.4.5.4.2 By Provider

8.4.5.4.3 By Application

8.4.5.4.4 By end user

8.4.5.5 Singapore Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.5.1 By Product Type

8.4.5.5.2 By Provider

8.4.5.5.3 By Application

8.4.5.5.4 By end user

8.4.5.6 Malaysia Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.6.1 By Product Type

8.4.5.6.2 By Provider

8.4.5.6.3 By Application

8.4.5.6.4 By end user

8.4.5.7 Thailand Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.7.1 By Product Type

8.4.5.7.2 By Provider

8.4.5.7.3 By Application

8.4.5.7.4 By end user

8.4.5.8 Indonesia Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.8.1 By Product Type

8.4.5.8.2 By Provider

8.4.5.8.3 By Application

8.4.5.8.4 By end user

8.4.5.9 Vietnam Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.9.1 By Product Type

8.4.5.9.2 By Provider

8.4.5.9.3 By Application

8.4.5.9.4 By end user

8.4.5.10 Taiwan Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.10.1 By Product Type

8.4.5.10.2 By Provider

8.4.5.10.3 By Application

8.4.5.10.4 By end user

8.4.5.11 Rest of Asia Pacific Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.11.1 By Product Type

8.4.5.11.2 By Provider

8.4.5.11.3 By Application

8.4.5.11.4 By end user

8.5 Middle East and Africa Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.1 By Product Type

8.5.2 By Provider

8.5.3 By Application

8.5.4 By end user

8.5.5 By Country

8.5.5.1 Saudi Arabia Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.1.1 By Product Type

8.5.5.1.2 By Provider

8.5.5.1.3 By Application

8.5.5.1.4 By end user

8.5.5.2 U.A.E. Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.2.1 By Product Type

8.5.5.2.2 By Provider

8.5.5.2.3 By Application

8.5.5.2.4 By end user

8.5.5.3 Israel Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.4.3.1 By Product Type

8.5.4.3.2 By Provider

8.5.4.3.3 By Application

8.5.5.3.4 By end user

8.5.5.4 South Africa Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.4.1 By Product Type

8.5.5.4.2 By Provider

8.5.5.4.3 By Application

8.5.5.4.4 By end user

8.5.5.5 Rest of Middle East and Africa Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.5.1 By Product Type

8.5.5.5.2 By Provider

8.5.5.5.2 By Application

8.5.5.5.4 By end user

8.6 Central & South America Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.1 By Product Type

8.6.2 By Provider

8.6.3 By Application

8.6.4 By end user

8.6.5 By Country

8.6.5.1 Brazil Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.1.1 By Product Type

8.6.5.1.2 By Provider

8.6.5.1.3 By Application

8.6.5.1.4 By end user

8.6.5.2 Argentina Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.2.1 By Product Type

8.6.5.2.2 By Provider

8.6.5.2.3 By Application

8.6.5.2.4 By end user

8.6.5.3 Chile Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.3.1 By Product Type

8.6.5.3.2 By Provider

8.6.5.3.3 By Application

8.6.5.5.4 By end user

8.6.5.4 Rest of Central & South America Trade Finance Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.4.1 By Product Type

8.6.5.4.2 By Provider

8.6.5.4.3 By Application

8.6.5.4.4 By end user

9 COMPETITIVE LANDCAPE

9.1 Company Market Share Analysis

9.2 Four Quadrant Positioning Matrix

9.2.1 Market Leaders

9.2.2 Market Visionaries

9.2.3 Market Challengers

9.2.4 Niche Market Players

9.3 Vendor Landscape

9.3.1 North America

9.3.2 Europe

9.3.3 Asia Pacific

9.3.4 Rest of the World

9.4 Company Profiles

9.4.1 Asian Development Bank

9.4.1.1 Business Description & Financial Analysis

9.4.1.2 SWOT Analysis

9.4.1.3 Products & Services Offered

9.4.1.4 Strategic Alliances between Business Partners

9.4.2 Bank of America Corporation

9.4.2.1 Business Description & Financial Analysis

9.4.2.2 SWOT Analysis

9.4.2.3 Products & Services Offered

9.4.2.4 Strategic Alliances between Business Partners

9.4.3 BNP Paribas S.A.

9.4.3.1 Business Description & Financial Analysis

9.4.3.2 SWOT Analysis

9.4.3.3 Products & Services Offered

9.4.3.4 Strategic Alliances between Business Partners

9.4.4 Citigroup Inc.

9.4.4.1 Business Description & Financial Analysis

9.4.4.2 SWOT Analysis

9.4.4.3 Products & Services Offered

9.4.4.4 Strategic Alliances between Business Partners

9.4.5 Euler Hermes Group

9.4.5.1 Business Description & Financial Analysis

9.4.5.2 SWOT Analysis

9.4.5.3 Products & Services Offered

9.4.5.4 Strategic Alliances between Business Partners

9.4.6 HSBC HOLDINGS PLC

9.4.6.1 Business Description & Financial Analysis

9.4.6.2 SWOT Analysis

9.4.6.3 Products & Services Offered

9.4.6.4 Strategic Alliances between Business Partners

9.4.7 JPMorgan Chase & Co

9.4.7.1 Business Description & Financial Analysis

9.4.7.2 SWOT Analysis

9.4.7.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.8 Mitsubishi UFJ Financial Inc.

9.4.8.1 Business Description & Financial Analysis

9.4.8.2 SWOT Analysis

9.4.8.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.9 The Royal Bank of Scotland Group plc

9.4.9.1 Business Description & Financial Analysis

9.4.9.2 SWOT Analysis

9.4.9.3 Products & Services Offered

9.4.9.4 Strategic Alliances between Business Partners

9.4.10 Standard Chartered PLC.

9.4.10.1 Business Description & Financial Analysis

9.4.10.2 SWOT Analysis

9.4.10.3 Products & Services Offered

9.4.10.4 Strategic Alliances between Business Partners

9.4.11 Finastra

9.4.11.1 Business Description & Financial Analysis

9.4.11.2 SWOT Analysis

9.4.11.3 Products & Services Offered

9.4.11.4 Strategic Alliances between Business Partners

9.4.12 Shinhan Bank

9.4.12.1 Business Description & Financial Analysis

9.4.12.2 SWOT Analysis

9.4.12.3 Products & Services Offered

9.4.12.4 Strategic Alliances between Business Partners

9.4.13 GeTS Asia

9.4.13.1 Business Description & Financial Analysis

9.4.13.2 SWOT Analysis

9.4.13.3 Products & Services Offered

9.4.13.4 Strategic Alliances between Business Partners

9.4.14 Sberbank Companies

9.4.14.1 Business Description & Financial Analysis

9.4.14.2 SWOT Analysis

9.4.14.3 Products & Services Offered

9.4.14.4 Strategic Alliances between Business Partners

9.4.15 CGI

9.4.15.1 Business Description & Financial Analysis

9.4.15.2 SWOT Analysis

9.4.15.3 Products & Services Offered

9.4.15.4 Strategic Alliances between Business Partners

9.4.16 we.trade

9.4.16.1 Business Description & Financial Analysis

9.4.16.2 SWOT Analysis

9.4.16.3 Products & Services Offered

9.4.16.4 Strategic Alliances between Business Partners

9.4.17 Ahli United Bank Companies

9.4.17.1 Business Description & Financial Analysis

9.4.17.2 SWOT Analysis

9.4.17.3 Products & Services Offered

9.4.17.4 Strategic Alliances between Business Partners

9.4.18 VTB Bank

9.4.18.1 Business Description & Financial Analysis

9.4.18.2 SWOT Analysis

9.4.18.3 Products & Services Offered

9.4.18.4 Strategic Alliances between Business Partners

9.4.19 TDB

9.4.19.1 Business Description & Financial Analysis

9.4.19.2 SWOT Analysis

9.4.19.3 Products & Services Offered

9.4.19.4 Strategic Alliances between Business Partners

9.4.20 Societe Generale

9.4.11.1 Business Description & Financial Analysis

9.4.11.2 SWOT Analysis

9.4.11.3 Products & Services Offered

9.4.11.4 Strategic Alliances between Business Partners

9.4.21 UniCredit

9.4.21.1 Business Description & Financial Analysis

9.4.21.2 SWOT Analysis

9.4.21.3 Products & Services Offered

9.4.21.4 Strategic Alliances between Business Partners

9.4.22 Arab Bank

9.4.22.1 Business Description & Financial Analysis

9.4.22.2 SWOT Analysis

9.4.22.3 Products & Services Offered

9.4.22.4 Strategic Alliances between Business Partners

9.4.23 BNY Mellon

9.4.23.1 Business Description & Financial Analysis

9.4.23.2 SWOT Analysis

9.4.23.3 Products & Services Offered

9.4.23.4 Strategic Alliances between Business Partners

9.4.24 Converse Bank

9.4.24.1 Business Description & Financial Analysis

9.4.24.2 SWOT Analysis

9.4.24.3 Products & Services Offered

9.4.24.4 Strategic Alliances between Business Partners

9.4.25 Santander

9.4.25.1 Business Description & Financial Analysis

9.4.25.2 SWOT Analysis

9.4.25.3 Products & Services Offered

9.4.25.4 Strategic Alliances between Business Partners

9.4.26 ANZ

9.4.26.1 Business Description & Financial Analysis

9.4.26.2 SWOT Analysis

9.4.26.3 Products & Services Offered

9.4.26.4 Strategic Alliances between Business Partners

9.4.27 BFA

9.4.27.1 Business Description & Financial Analysis

9.4.27.2 SWOT Analysis

9.4.27.3 Products & Services Offered

9.4.27.4 Strategic Alliances between Business Partners

9.4.28 Belfius

9.4.28.1 Business Description & Financial Analysis

9.4.28.2 SWOT Analysis

9.4.28.3 Products & Services Offered

9.4.28.4 Strategic Alliances between Business Partners

9.4.29 Absa Bank Companies

9.4.29.1 Business Description & Financial Analysis

9.4.29.2 SWOT Analysis

9.4.29.3 Products & Services Offered

9.4.29.4 Strategic Alliances between Business Partners

9.4.30 M&T Bank

9.4.30.1 Business Description & Financial Analysis

9.4.30.2 SWOT Analysis

9.4.30.3 Products & Services Offered

9.4.11.4 Strategic Alliances between Business Partners

9.4.31 Other Companies

9.4.31.1 Business Description & Financial Analysis

9.4.31.2 SWOT Analysis

9.4.31.3 Products & Services Offered

9.4.31.4 Strategic Alliances between Business Partners

10 RESEARCH METHODOLOGY

10.1 Market Introduction

10.1.1 Market Definition

10.1.2 Market Scope & Segmentation

10.2 Information Procurement

10.2.1 Secondary Research

10.2.1.1 Purchased Databases

10.2.1.2 GMEs Internal Data Repository

10.2.1.3 Secondary Resources & Third Party Perspectives

10.2.1.4 Company Information Sources

10.2.2 Primary Research

10.2.2.1 Various Types of Respondents for Primary Interviews

10.2.2.2 Number of Interviews Conducted throughout the Research Process

10.2.2.3 Primary Stakeholders

10.2.2.4 Discussion Guide for Primary Participants

10.2.3 Expert Panels

10.2.3.1 Expert Panels Across 30+ Industry

10.2.4 Paid Local Experts

10.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

10.3 Market Estimation

10.3.1 Top-Down Approach

10.3.1.1 Macro-Economic Indicators Considered

10.3.1.2 Micro-Economic Indicators Considered

10.3.2 Bottom Up Approach

10.3.2.1 Company Share Analysis Approach

10.3.2.2 Estimation of Potential Product Sales

10.4 Data Triangulation

10.4.1 Data Collection

10.4.2 Time Series, Cross Sectional & Panel Data Analysis

10.4.3 Cluster Analysis

10.5 Analysis and Output

10.5.1 Inhouse AI Based Real Time Analytics Tool

10.5.2 Output From Desk & Primary Research

10.6 Research Assumptions & Limitations

10.7.1 Research Assumptions

10.7.2 Research Limitations

LIST OF TABLES

1 Global Trade Finance Market, By Product Type, 2020-2028 (USD Mllion)

2 Commercial Letters of Credit (LCs) Market, By Region, 2020-2028 (USD Mllion)

3 Standby Letters of Credit (LCs) Market, By Region, 2020-2028 (USD Mllion)

4 Guarantees Market, By Region, 2020-2028 (USD Mllion)

5 Others Market, By Region, 2020-2028 (USD Mllion)

6 Global Trade Finance Market, By Provider, 2020-2028 (USD Mllion)

7 Banks Market, By Region, 2020-2028 (USD Mllion)

8 Trade Finance Houses Market, By Region, 2020-2028 (USD Mllion)

9 Others Market, By Region, 2020-2028 (USD Mllion)

10 Global Trade Finance Market, By Application, 2020-2028 (USD Mllion)

11 Domestic Market, By Region, 2020-2028 (USD Mllion)

12 International Market, By Region, 2020-2028 (USD Mllion)

13 Global Trade Finance Market, By end user, 2020-2028 (USD Mllion)

14 Traders Market, By Region, 2020-2028 (USD Mllion)

15 Importers Market, By Region, 2020-2028 (USD Mllion)

16 Exporters Market, By Region, 2020-2028 (USD Mllion)

17 Regional Analysis, 2020-2028 (USD Mllion)

18 North America Trade Finance Market, By Product Type, 2020-2028 (USD Million)

19 North America Trade Finance Market, By Provider, 2020-2028 (USD Million)

20 North America Trade Finance Market, By Application, 2020-2028 (USD Million)

21 North America Trade Finance Market, By end user, 2020-2028 (USD Million)

22 North America Trade Finance Market, By Country, 2020-2028 (USD Million)

23 U.S Trade Finance Market, By Product Type, 2020-2028 (USD Million)

24 U.S Trade Finance Market, By Provider, 2020-2028 (USD Million)

25 U.S Trade Finance Market, By Application, 2020-2028 (USD Million)

26 U.S Trade Finance Market, By end user, 2020-2028 (USD Million)

27 Canada Trade Finance Market, By Product Type, 2020-2028 (USD Million)

28 Canada Trade Finance Market, By Provider, 2020-2028 (USD Million)

29 Canada Trade Finance Market, By Application, 2020-2028 (USD Million)

30 CANADA Trade Finance Market, By end user, 2020-2028 (USD Million)

31 Mexico Trade Finance Market, By Product Type, 2020-2028 (USD Million)

32 Mexico Trade Finance Market, By Provider, 2020-2028 (USD Million)

33 Mexico Trade Finance Market, By Application, 2020-2028 (USD Million)

34 mexico Trade Finance Market, By end user, 2020-2028 (USD Million)

35 Europe Trade Finance Market, By Product Type, 2020-2028 (USD Million)

36 Europe Trade Finance Market, By Provider, 2020-2028 (USD Million)

37 Europe Trade Finance Market, By Application, 2020-2028 (USD Million)

38 europe Trade Finance Market, By end user, 2020-2028 (USD Million)

39 Germany Trade Finance Market, By Product Type, 2020-2028 (USD Million)

40 Germany Trade Finance Market, By Provider, 2020-2028 (USD Million)

41 Germany Trade Finance Market, By Application, 2020-2028 (USD Million)

42 germany Trade Finance Market, By end user, 2020-2028 (USD Million)

43 UK Trade Finance Market, By Product Type, 2020-2028 (USD Million)

44 UK Trade Finance Market, By Provider, 2020-2028 (USD Million)

45 UK Trade Finance Market, By Application, 2020-2028 (USD Million)

46 U.kTrade Finance Market, By end user, 2020-2028 (USD Million)

47 France Trade Finance Market, By Product Type, 2020-2028 (USD Million)

48 France Trade Finance Market, By Provider, 2020-2028 (USD Million)

49 France Trade Finance Market, By Application, 2020-2028 (USD Million)

50 france Trade Finance Market, By end user, 2020-2028 (USD Million)

51 Italy Trade Finance Market, By Product Type, 2020-2028 (USD Million)

52 Italy Trade Finance Market, By T Preservation Technique Type, 2020-2028 (USD Million)

53 Italy Trade Finance Market, By Application, 2020-2028 (USD Million)

54 italy Trade Finance Market, By end user, 2020-2028 (USD Million)

55 Spain Trade Finance Market, By Product Type, 2020-2028 (USD Million)

56 Spain Trade Finance Market, By Provider, 2020-2028 (USD Million)

57 Spain Trade Finance Market, By Application, 2020-2028 (USD Million)

58 spain Trade Finance Market, By end user, 2020-2028 (USD Million)

59 Rest Of Europe Trade Finance Market, By Product Type, 2020-2028 (USD Million)

60 Rest Of Europe Trade Finance Market, By Provider, 2020-2028 (USD Million)

61 Rest of Europe Trade Finance Market, By Application, 2020-2028 (USD Million)

62 REST OF EUROPE Trade Finance Market, By end user, 2020-2028 (USD Million)

63 Asia Pacific Trade Finance Market, By Product Type, 2020-2028 (USD Million)

64 Asia Pacific Trade Finance Market, By Provider, 2020-2028 (USD Million)

65 Asia Pacific Trade Finance Market, By Application, 2020-2028 (USD Million)

66 asia Trade Finance Market, By end user, 2020-2028 (USD Million)

67 Asia Pacific Trade Finance Market, By Country, 2020-2028 (USD Million)

68 China Trade Finance Market, By Product Type, 2020-2028 (USD Million)

69 China Trade Finance Market, By Provider, 2020-2028 (USD Million)

70 China Trade Finance Market, By Application, 2020-2028 (USD Million)

71 china Trade Finance Market, By end user, 2020-2028 (USD Million)

72 India Trade Finance Market, By Product Type, 2020-2028 (USD Million)

73 India Trade Finance Market, By Provider, 2020-2028 (USD Million)

74 India Trade Finance Market, By Application, 2020-2028 (USD Million)

75 india Trade Finance Market, By end user, 2020-2028 (USD Million)

76 Japan Trade Finance Market, By Product Type, 2020-2028 (USD Million)

77 Japan Trade Finance Market, By Provider, 2020-2028 (USD Million)

78 Japan Trade Finance Market, By Application, 2020-2028 (USD Million)

79 japan Trade Finance Market, By end user, 2020-2028 (USD Million)

80 South Korea Trade Finance Market, By Product Type, 2020-2028 (USD Million)

81 South Korea Trade Finance Market, By Provider, 2020-2028 (USD Million)

82 South Korea Trade Finance Market, By Application, 2020-2028 (USD Million)

83 south korea Trade Finance Market, By end user, 2020-2028 (USD Million)

84 Middle East and Africa Trade Finance Market, By Product Type, 2020-2028 (USD Million)

85 Middle East and Africa Trade Finance Market, By Provider, 2020-2028 (USD Million)

86 Middle East and Africa Trade Finance Market, By Application, 2020-2028 (USD Million)

87 MIDDLE EAST AND AFRICA Trade Finance Market, By end user, 2020-2028 (USD Million)

88 Middle East and Africa Trade Finance Market, By Country, 2020-2028 (USD Million)

89 Saudi Arabia Trade Finance Market, By Product Type, 2020-2028 (USD Million)

90 Saudi Arabia Trade Finance Market, By Provider, 2020-2028 (USD Million)

91 Saudi Arabia Trade Finance Market, By Application, 2020-2028 (USD Million)

92 saudi arabia Trade Finance Market, By end user, 2020-2028 (USD Million)

93 UAE Trade Finance Market, By Product Type, 2020-2028 (USD Million)

94 UAE Trade Finance Market, By Provider, 2020-2028 (USD Million)

95 UAE Trade Finance Market, By Application, 2020-2028 (USD Million)

96 uae Trade Finance Market, By end user, 2020-2028 (USD Million)

97 Central & South America Trade Finance Market, By Product Type, 2020-2028 (USD Million)

98 Central & South America Trade Finance Market, By Provider, 2020-2028 (USD Million)

99 Central & South America Trade Finance Market, By Application, 2020-2028 (USD Million)

100 CENTRAL & SOUTH AMERICA Trade Finance Market, By end user, 2020-2028 (USD Million)

101 Central & South America Trade Finance Market, By Country, 2020-2028 (USD Million)

102 Brazil Trade Finance Market, By Product Type, 2020-2028 (USD Million)

103 Brazil Trade Finance Market, By Provider, 2020-2028 (USD Million)

104 Brazil Trade Finance Market, By Application, 2020-2028 (USD Million)

105 brazil Trade Finance Market, By end user, 2020-2028 (USD Million)

106 Asian Development Bank: Products & Services Offering

107 Bank of America Corporation: Products & Services Offering

108 BNP Paribas S.A.: Products & Services Offering

109 Citigroup Inc.: Products & Services Offering

110 Euler Hermes Group: Products & Services Offering

111 HSBC HOLDINGS PLC: Products & Services Offering

112 JPMorgan Chase & Co: Products & Services Offering

113 Mitsubishi UFJ Financial Inc.: Products & Services Offering

114 The Royal Bank of Scotland Group plc: Products & Services Offering

115 Standard Chartered PLC.: Products & Services Offering

116 Finastra: Products & Services Offering

117 Shinhan Bank: Products & Services Offering

118 GeTS Asia: Products & Services Offering

119 Sberbank: Products & Services Offering

120 CGI: Products & Services Offering

121 we.trade: Products & Services Offering

122 Ahli United Bank: Products & Services Offering

123 VTB Bank: Products & Services Offering

124 TDB: Products & Services Offering

125 Societe Generale: Products & Services Offering

126 UniCredit: Products & Services Offering

127 Arab Bank: Products & Services Offering

128 BNY Mellon: Products & Services Offering

129 Converse Bank: Products & Services Offering

130 Santander: Products & Services Offering

131 ANZ: Products & Services Offering

132 BFA: Products & Services Offering

133 Belfius: Products & Services Offering

134 Absa Bank: Products & Services Offering

135 M&T Bank: Products & Services Offering

136 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Trade Finance Market Overview

2 Global Trade Finance Market Value From 2020-2028 (USD Mllion)

3 Global Trade Finance Market Share, By Product Type (2022)

4 Global Trade Finance Market Share, By Provider (2022)

5 Global Trade Finance Market Share, By Application (2022)

6 Global Trade Finance Market Share, By end user (2022)

7 Global Trade Finance Market, By Region (Asia Pacific Market)

8 Technological Trends In Global Trade Finance Market

9 Four Quadrant Competitor Positioning Matrix

10 Impact Of Macro & Micro Indicators On The Market

11 Impact Of Key Drivers On The Global Trade Finance Market

12 Impact Of Challenges On The Global Trade Finance Market

13 Porter’s Five Forces Analysis

14 Global Trade Finance Market: By Product Type Scope Key Takeaways

15 Global Trade Finance Market, By Product Type Segment: Revenue Growth Analysis

16 Commercial Letters of Credit (LCs) Market, By Region, 2020-2028 (USD Mllion)

17 Standby Letters of Credit (LCs) Market, By Region, 2020-2028 (USD Mllion)

18 Guarantees Market, By Region, 2020-2028 (USD Mllion)

19 Others Market, By Region, 2020-2028 (USD Mllion)

20 Global Trade Finance Market: By Provider Scope Key Takeaways

21 Global Trade Finance Market, By Provider Segment: Revenue Growth Analysis

22 Banks Market, By Region, 2020-2028 (USD Mllion)

23 Trade Finance Houses Market, By Region, 2020-2028 (USD Mllion)

24 Others Market, By Region, 2020-2028 (USD Mllion)

25 Global Trade Finance Market: By Application Scope Key Takeaways

26 Global Trade Finance Market, By Application Segment: Revenue Growth Analysis

27 Domestic Market, By Region, 2020-2028 (USD Mllion)

28 International Market, By Region, 2020-2028 (USD Mllion)

29 Global Trade Finance Market: By end user Scope Key Takeaways

30 Global Trade Finance Market, By end user Segment: Revenue Growth Analysis

31 Traders Market, By Region, 2020-2028 (USD Mllion)

32 Importers Market, By Region, 2020-2028 (USD Mllion)

33 Exporters Market, By Region, 2020-2028 (USD Mllion)

34 Regional Segment: Revenue Growth Analysis

35 Global Trade Finance Market: Regional Analysis

36 North America Trade Finance Market Overview

37 North America Trade Finance Market, By Product Type

38 North America Trade Finance Market, By Provider

39 North America Trade Finance Market, By Application

40 North America Trade Finance Market, By end user

41 North America Trade Finance Market, By Country

42 U.S. Trade Finance Market, By Product Type

43 U.S. Trade Finance Market, By Provider

44 U.S. Trade Finance Market, By Application

45 U.S. Trade Finance Market, By end user

46 Canada Trade Finance Market, By Product Type

47 Canada Trade Finance Market, By Provider

48 Canada Trade Finance Market, By Application

49 Canada Trade Finance Market, By end user

50 Mexico Trade Finance Market, By Product Type

51 Mexico Trade Finance Market, By Provider

52 Mexico Trade Finance Market, By Application

53 Mexico Trade Finance Market, By end user

54 Four Quadrant Positioning Matrix

55 Company Market Share Analysis

56 Asian Development Bank: Company Snapshot

57 Asian Development Bank: SWOT Analysis

58 Asian Development Bank: Geographic Presence

59 Bank of America Corporation: Company Snapshot

60 Bank of America Corporation: SWOT Analysis

61 Bank of America Corporation: Geographic Presence

62 BNP Paribas S.A.: Company Snapshot

63 BNP Paribas S.A.: SWOT Analysis

64 BNP Paribas S.A.: Geographic Presence

65 Citigroup Inc.: Company Snapshot

66 Citigroup Inc.: Swot Analysis

67 Citigroup Inc.: Geographic Presence

68 Euler Hermes Group: Company Snapshot

69 Euler Hermes Group: SWOT Analysis

70 Euler Hermes Group: Geographic Presence

71 HSBC HOLDINGS PLC: Company Snapshot

72 HSBC HOLDINGS PLC: SWOT Analysis

73 HSBC HOLDINGS PLC: Geographic Presence

74 JPMorgan Chase & Co: Company Snapshot

75 JPMorgan Chase & Co: SWOT Analysis

76 JPMorgan Chase & Co: Geographic Presence

77 Mitsubishi UFJ Financial Inc.: Company Snapshot

78 Mitsubishi UFJ Financial Inc.: SWOT Analysis

79 Mitsubishi UFJ Financial Inc.: Geographic Presence

80 The Royal Bank of Scotland Group plc.: Company Snapshot

81 The Royal Bank of Scotland Group plc.: SWOT Analysis

82 The Royal Bank of Scotland Group plc.: Geographic Presence

83 Standard Chartered PLC.: Company Snapshot

84 Standard Chartered PLC.: SWOT Analysis

85 Standard Chartered PLC.: Geographic Presence

86 Finastra: Company Snapshot

87 Finastra: SWOT Analysis

88 Finastra: Geographic Presence

89 Shinhan Bank: Company Snapshot

90 Shinhan Bank: SWOT Analysis

91 Shinhan Bank: Geographic Presence

92 GeTS Asia: Company Snapshot

93 GeTS Asia: SWOT Analysis

94 GeTS Asia: Geographic Presence

95 Sberbank: Company Snapshot

96 Sberbank: SWOT Analysis

97 Sberbank: Geographic Presence

98 CGI: Company Snapshot

99 CGI: SWOT Analysis

100 CGI: Geographic Presence

101 we.trade: Company Snapshot

102 we.trade: SWOT Analysis

103 we.trade: Geographic Presence

104 Ahli United Bank: Company Snapshot

105 Ahli United Bank: SWOT Analysis

106 Ahli United Bank: Geographic Presence

107 VTB Bank: Company Snapshot

108 VTB Bank: SWOT Analysis

109 VTB Bank: Geographic Presence

110 TDB: Company Snapshot

111 TDB: SWOT Analysis

112 TDB: Geographic Presence

113 Societe Generale: Company Snapshot

114 Societe Generale: SWOT Analysis

115 Societe Generale: Geographic Presence

116 UniCredit: Company Snapshot

117 UniCredit: SWOT Analysis

118 UniCredit: Geographic Presence

119 Arab Bank: Company Snapshot

120 Arab Bank: SWOT Analysis

121 Arab Bank: Geographic Presence

122 BNY Mellon: Company Snapshot

123 BNY Mellon: SWOT Analysis

124 BNY Mellon: Geographic Presence

125 Converse Bank: Company Snapshot

126 Converse Bank: SWOT Analysis

127 Converse Bank: Geographic Presence

128 Santander: Company Snapshot

129 Santander: SWOT Analysis

130 Santander: Geographic Presence

131 ANZ: Company Snapshot

132 ANZ: SWOT Analysis

133 ANZ: Geographic Presence

134 BFA: Company Snapshot

135 BFA: SWOT Analysis

136 BFA: Geographic Presence

137 Belfius: Company Snapshot

138 Belfius: SWOT Analysis

139 Belfius: Geographic Presence

140 Absa Bank : Company Snapshot

141 Absa Bank : SWOT Analysis

142 Absa Bank : Geographic Presence

143 M&T Bank: Company Snapshot

144 M&T Bank: SWOT Analysis

145 M&T Bank: Geographic Presence

146 Other Companies: Company Snapshot

147 Other Companies: SWOT Analysis

148 Other Companies: Geographic Presence

The Global Trade Finance Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Trade Finance Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS