Global Trade Management Market Size, Trends & Analysis - Forecasts to 2028 By Component (Solutions, Services), By Deployment Model (0n-Premises, Cloud), By Organization Size (Small and Medium-Sized Enterprises, Large Enterprises), By End User (Transportation and Logistics, Government and Public, Healthcare and Life Sciences, Aerospace and Defense, Manufacturing, Retail & Consumer Goods, Others), By Region (North America, Asia Pacific, Central & South America, Europe, Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

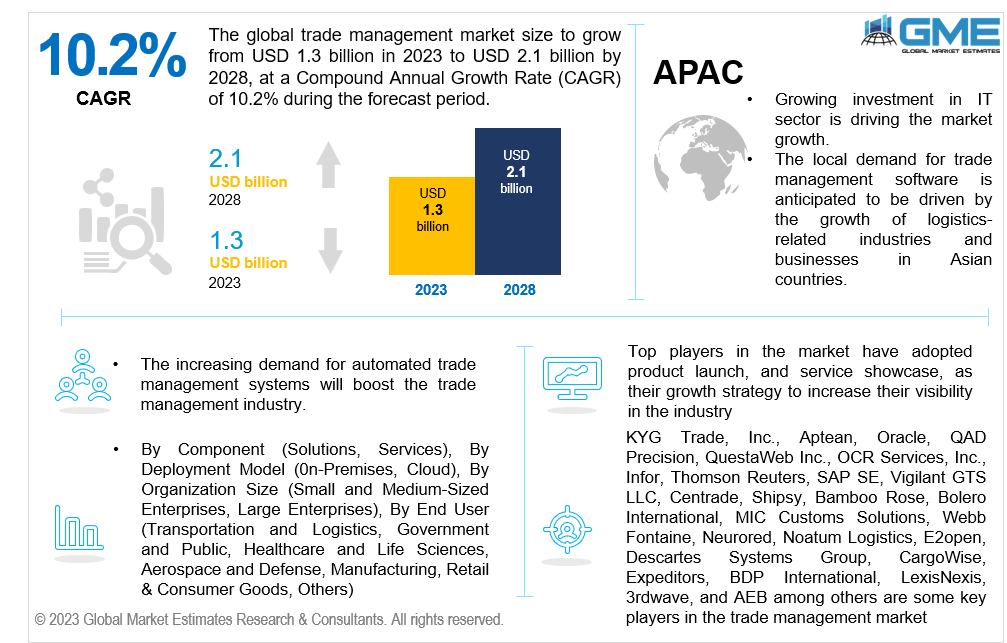

The global trade management market size is projected to grow from USD 1.1 billion in 2022 to USD 2.1 billion by 2028; it is expected to grow at a CAGR of 10.2% from 2023 to 2028. The key driving forces propelling the market's expansion are the burgeoning trend of digitization and the world's fast industrialization. Market expansion is also being aided by traders' widespread adoption of software solutions to automate back-office tasks, save manual labor, and improve corporate operations.

Global trade management (GTM) solutions have been regarded as a viable solution for businesses doing international commerce. As the global trade landscape grew more complex and perplexing over the past two years, these platform makers are undertaking various initiatives to solidify their positions. Their GTM platforms facilitate the flow of information, money, and goods between buyers, sellers, intermediaries (including customs agencies), banks, and freight forwarders by streamlining and automating processes related to customs and regulatory compliance, global logistics, and trade financing.

The global trade management market is also expanding as a result of increased investments in global logistics infrastructure, rising government regulations and compliances, increasing complexities in managing global trade, and strong international trade performance. Organizations that refuse to replace legacy systems and adopt new technology are major roadblocks in the trade management industry. Trade management employs AI & ML and predictive analytics to efficiently assist a business in centralizing and automating cross-border trade activities and processes. Furthermore, the market is expected to grow the fastest owing to factors such as rising demand for automated trade management, and increasing volume of international trade. However, factors such as market distortions in developing and third-world countries, and a lack of capabilities to manage GTM systems are expected to hamper the growth of the market.

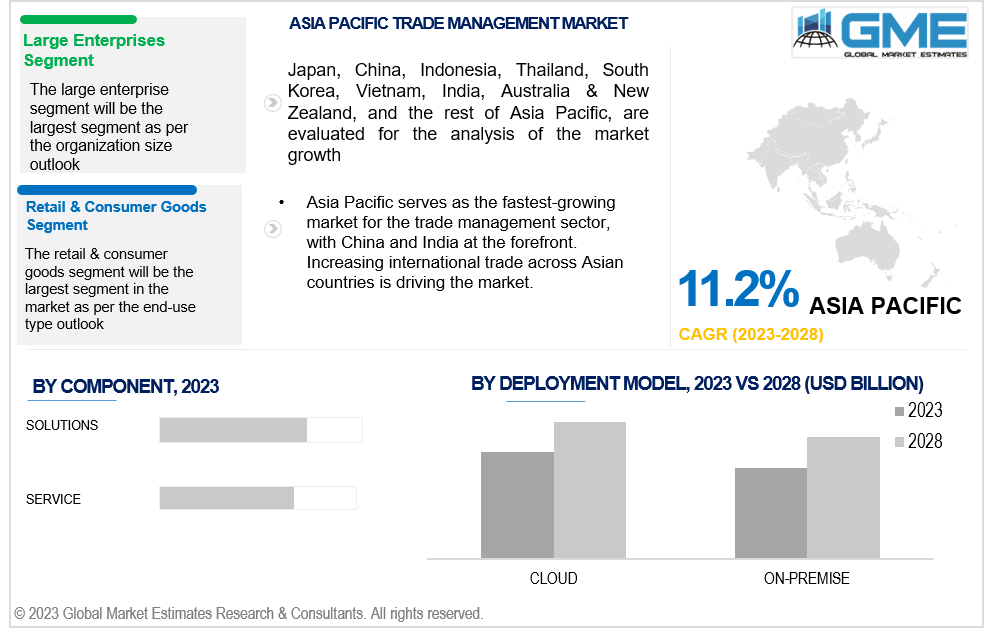

In 2022, the solution segment accounted for over 60% revenue share. Compliance with commercial laws, international trade visibility, and trade execution are all part of the solutions. Global trade management systems are increasing the complexity and global dispersion of the supply chain, which in turn is driving up the need for higher trade volumes. The need for solutions that support global value propositions and international trade rules is also anticipated to fuel this segment's future revenue growth.

The services segment is anticipated to have the fastest CAGR over the projection period. Trade management services make sure that trade management products are correctly linked with the complex network architecture that organizations employ, thereby driving the adoption rate in this segment

Cloud-based trade management solutions captured the maximum revenue share in 2022 owing to the growing shift towards cloud-based solutions from on-premise. Increasing investment in cloud-based solutions is a testament to the growing interest of market players as well as consumers in cloud services.

Furthermore, industrial businesses in western markets like the U.S., are concentrating on international strategies that use trade management software to reduce business risks, uphold their brand's reputation, guarantee customer pleasure, and increase income. Real-time changes during trade compliance are made possible by cloud-based trade systems, which help to prevent compliance errors, associated expenses, and fines. Also, small and medium-sized organizations are using cloud-based deployment strategies more frequently because they provide greater operational agility at reduced costs as a result of Software-as-a-Service (SaaS).

Also, a trader can execute their global trade activity in a private, highly secure cloud environment that is maintained by a trusted partner using the SaaS approach. Compared to the conventional "build or purchase" strategy, this idea offers significant business advantages that help trade management organizations achieve their objectives more successfully and affordably. Increased revenue, operational efficiency, global transparency, high-quality services, and risk reduction are a few of the key advantages.

With the highest revenue share in 2022, North America dominated the global trade management market and is expected to maintain its dominance throughout the forecast period. This can be attributed to the presence of a substantial number of market players, technology providers, and a vast consumer base in the U.S. Moreover, the operating market participants continue to undertake various measures to gain a competitive edge in the international market.

For instance, on May 27, 2021, E2open Parent Holdings, Inc. paid almost USD 1.7 billion to purchase BluJay Solutions. As BluJay uses an integrated SaaS platform with comprehensive solutions for Shippers, Logistics Service Providers (LSPs), and Freight Forwarders, the acquisition will enhance E2open's supply chain execution capabilities with BluJay's top transportation management software and global trade capabilities.

On the other hand, Asia pacific is growing at the fastest CAGR with China & India at the forefront. The local demand for trade management software is anticipated to be driven by the growth of logistics-related industries and businesses in Asian countries. India has negotiated trade agreements with several Asian nations, such as Korea, Japan, and ASEAN nations.

The usage of free trade agreements by importers has greatly increased over time. The Indian government had to implement anti-abuse procedures to prevent the abuse of duty-free access to India's market due to the spike in duty-free imports and the ensuing trade deficit. Customers can use the software to analyze potential cost savings brought on by free trade agreements. In the upcoming years, increased adoption of trade management software is anticipated as a result of these features, thereby driving revenue growth in Asia pacific market.

KYG Trade, Inc., Aptean, Oracle, QAD Precision, Livingston International, QuestaWeb Inc., OCR Services, Inc., Infor, Thomson Reuters, SAP SE, Vigilant GTS LLC, Centrade, Shipsy, Bamboo Rose, Bolero International, MIC Customs Solutions, Webb Fontaine, Neurored, GLOBAL CUSTOMS COMPLIANCE LTD, Noatum Logistics, E2open, Descartes Systems Group, CargoWise, Expeditors, BDP International, LexisNexis, 3rdwave, and AEB among others, are some key players in the Trade Management market.

Please note: This is not an exhaustive list of companies profiled in the report.

The market participants are continuously engaged in embracing this trend to keep pace with the changing logistics and international trade landscape. For example, in December 2021, Bamboo Rose and Blue Yonder announced their new alliance to assist retailers in integrating their innovation, demand planning, product development, and supply chain operations for a more successful, customer-driven product selection strategy. With this, the company expects to cut costs, strengthen supplier relationships, streamline operations, and shorten time to market. Such initiatives by companies are accelerating market growth.

1........... RESEARCH METHODOLOGY

1.1.1 Market SCOPE & SEGMENTATION

1.2 Information Procurement

1.2.1 INTRODUCTION

1.2.2 SECONDARY RESEARCH

1.2.2.1 Purchased Databases

1.2.2.2 GMEs Internal Data Repository

1.2.2.3 Secondary Resources & Third Party Perspectives

1.2.2.4 Company Information Sources

1.2.2.5 Secondary Data Sources

1.2.3 Primary Research

1.2.3.1 Various Type Of Respondents For Primary Interviews

1.2.3.2 Number of Interviews Conducted Throughout the Research Process

1.2.3.3 Primary Stakeholders

1.2.3.4 Discussion Guide: Primary Participants

1.3 market estimation

1.3.1 Top-Down Approach

1.3.2 Bottom-Up Approach

1.4 data triangulation

1.5 analysis and output

1.5.1.1 In-house AI Based Real Time Analytics Tool

1.5.1.2 Final Output From Desk & Primary Research

1.6 Research Assumptions & Limitations

1.6.1 Research ASSUMPTIONS

1.6.2 Research Limitations

2........... EXECUTIVE SUMMARY

2.1 GLOBAL Trade Management MARKET OVERVIEW

3........... STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

3.1 Strategic Opportunity & Attractiveness Analysis

3.1.1 Market Attractiveness Score

3.2 Strategic Initiatives across Business Functions

3.2.1 for chief executive officers

3.2.2 for chief marketing officers

3.2.2.1 Market Segment Analysis & Key Contributing Factors

3.2.1 for chief strategy officers

4........... TECHNOLOGical trends

4.1 ACCELERATING DIGITALIZATION IN TRADE MANAGEMENT

4.2 Increased adoption of AI, ML across GTM solutions

4.3 Predictive analytics in global trade

5........... Trade Management Market- industry outlook

5.1 Market Lineage Outlook

5.1.1 PARENT MARKET OUTLOOK- software INDUSTRY

5.2 Market Dynamic Impact Analysis on THE GLOBAL TRADE MANAGEMENT MARKET

5.3 Market Driver Impact Analysis ON THE GLOBAL TRADE MANAGEMENT MARKET

5.3.1 Rising Demand for Automated Trade Management SOFTWARE

5.4 Market Opportunities Impact Analysis ON THE Global Trade Management MARKET

5.4.1 Advanced features to be linked with existing corporate systems

5.5 Market restraint Impact Analysis ON THE GLOBAL TRADE MANAGEMENT MARKET

5.5.1 Organizations Resilient to change legacy systems or adopt new technologies

5.6 Market Challenges Impact Analysis ON THE GLOBAL TRADE MANAGEMENT MARKET

5.6.1 Lack of capabilities to manage GTM systems

5.7 Supply-Side Analysis

5.7.1 Porter’s Five Forces Analysis

5.7.1.1 Threat Of New Entrants

5.7.1.2 Threat Of Substitutes

5.7.1.3 Bargaining Power of Suppliers

5.7.1.4 Bargaining Power of Buyers

5.7.1.5 The intensity of Competitive Rivalry

6........... global TRADE MANAGEMENT MARKET, BY COMPONENT

6.1 introduction

6.2 BY COMPONENT, Business Analysis

6.3 BY COMPONENT, REVENUE PROGRESS ANALYSIS, 2022 & 2028

6.4 Solutions

6.5 SERVICES

7........... global TRADE MANAGEMENT MARKET, BY ORGANIZATION SIZE

7.1 introduction

7.2 BY ORGANIZATION SIZE, Business Analysis

7.3 BY ORGANIZATION SIZE, REVENUE PROGRESS ANALYSIS, 2022 & 2028

7.4 Large Enterprises

7.5 SMALL & MEDIUM ENTERPRISES

8........... global TRADE MANAGEMENT MARKET, BY DEPLOYMENT MODE

8.1 introduction

8.2 BY DEPLOYMENT MODE, Business Analysis

8.3 BY DEPLOYMENT MODE, REVENUE PROGRESS ANALYSIS, 2022 & 2028

8.4 cloud based

8.5 on-premise based

9........... global TRADE MANAGEMENT MARKET, BY END-USER

9.1 introduction

9.2 BY END-USER, Business Analysis

9.3 BY END-USER, REVENUE PROGRESS ANALYSIS, 2022 & 2028

9.4 TRANSPORTATION AND LOGISTICS

9.5 government AND PUBLIC

9.6 HEALTHCARE AND LIFESCIENCE

9.7 AEROSPACE AND DEFENSE

9.8 MANUFACTURING

9.9 RETAIL & CONSUMER GOODS

9.10 OTHER END-USERS

10......... global TRADE MANAGEMENT MARKET, BY REGION

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 BY COMPONENT

10.2.2 BY ORGANIZATION SIZE

10.2.3 BY DEPLOYMENT MODE

10.2.4 BY END-USER

10.2.5 BY COUNTRY

10.2.6 U.S.

10.2.6.1 BY COMPONENT

10.2.6.2 BY ORGANIZATION SIZE

10.2.6.3 BY DEPLOYMENT MODE

10.2.6.4 BY END-USER

10.2.7 CANADA

10.2.7.1 BY COMPONENT

10.2.7.2 BY ORGANIZATION SIZE

10.2.7.3 BY DEPLOYMENT MODE

10.2.7.4 BY END-USER

10.2.8 MEXICO

10.2.8.1 BY COMPONENT

10.2.8.2 BY ORGANIZATION SIZE

10.2.8.3 BY DEPLOYMENT MODE

10.2.8.4 BY END-USER

10.3 EUROPE

10.3.1 BY COMPONENT

10.3.2 BY ORGANIZATION SIZE

10.3.3 BY DEPLOYMENT MODE

10.3.4 BY END-USER

10.3.5 BY COUNTRY

10.3.6 GERMANY

10.3.6.1 BY COMPONENT

10.3.6.2 BY ORGANIZATION SIZE

10.3.6.3 BY DEPLOYMENT MODE

10.3.6.4 BY END-USER

10.3.7 U.K.

10.3.7.1 BY COMPONENT

10.3.7.2 BY ORGANIZATION SIZE

10.3.7.3 BY DEPLOYMENT MODE

10.3.7.4 BY END-USER

10.3.8 FRANCE

10.3.8.1 BY COMPONENT

10.3.8.2 BY ORGANIZATION SIZE

10.3.8.3 BY DEPLOYMENT MODE

10.3.8.4 BY END-USER

10.3.9 ITALY

10.3.9.1 BY COMPONENT

10.3.9.2 BY ORGANIZATION SIZE

10.3.9.3 BY DEPLOYMENT MODE

10.3.9.4 BY END-USER

10.3.10 SPAIN

10.3.10.1 BY COMPONENT

10.3.10.2 BY ORGANIZATION SIZE

10.3.10.3 BY DEPLOYMENT MODE

10.3.10.4 BY END-USER

10.3.11 NETHERLANDS

10.3.11.1 BY COMPONENT

10.3.11.2 BY ORGANIZATION SIZE

10.3.11.3 BY DEPLOYMENT MODE

10.3.11.4 BY END-USER

10.3.12 REST OF EUROPE

10.3.12.1 BY COMPONENT

10.3.12.2 BY ORGANIZATION SIZE

10.3.12.3 BY DEPLOYMENT MODE

10.3.12.4 BY END-USER

10.4 ASIA PACIFIC

10.4.1 BY COMPONENT

10.4.2 BY ORGANIZATION SIZE

10.4.3 BY DEPLOYMENT MODE

10.4.4 BY END-USER

10.4.5 BY COUNTRY

10.4.6 CHINA

10.4.6.1 BY COMPONENT

10.4.6.2 BY ORGANIZATION SIZE

10.4.6.3 BY DEPLOYMENT MODE

10.4.6.4 BY END-USER

10.4.7 JAPAN

10.4.7.1 BY COMPONENT

10.4.7.2 BY ORGANIZATION SIZE

10.4.7.3 BY DEPLOYMENT MODE

10.4.7.4 BY END-USER

10.4.8 INDIA

10.4.8.1 BY COMPONENT

10.4.8.2 BY ORGANIZATION SIZE

10.4.8.3 BY DEPLOYMENT MODE

10.4.8.4 BY END-USER

10.4.9 SOUTH KOREA

10.4.9.1 BY COMPONENT

10.4.9.2 BY ORGANIZATION SIZE

10.4.9.3 BY DEPLOYMENT MODE

10.4.9.4 BY END-USER

10.4.10 THAILAND

10.4.10.1 BY COMPONENT

10.4.10.2 BY ORGANIZATION SIZE

10.4.10.3 BY DEPLOYMENT MODE

10.4.10.4 BY END-USER

10.4.11 INDONESIA

10.4.11.1 BY COMPONENT

10.4.11.2 BY ORGANIZATION SIZE

10.4.11.3 BY DEPLOYMENT MODE

10.4.11.4 BY END-USER

10.4.12 MALAYSIA

10.4.12.1 BY COMPONENT

10.4.12.2 BY ORGANIZATION SIZE

10.4.12.3 BY DEPLOYMENT MODE

10.4.12.4 BY END-USER

10.4.13 SINGAPORE

10.4.13.1 BY COMPONENT

10.4.13.2 BY ORGANIZATION SIZE

10.4.13.3 BY DEPLOYMENT MODE

10.4.13.4 BY END-USER

10.4.14 VIETNAM

10.4.14.1 BY COMPONENT

10.4.14.2 BY ORGANIZATION SIZE

10.4.14.3 BY DEPLOYMENT MODE

10.4.14.4 BY END-USER

10.4.15 REST OF ASIA PACIFIC

10.4.15.1 BY COMPONENT

10.4.15.2 BY ORGANIZATION SIZE

10.4.15.3 BY DEPLOYMENT MODE

10.4.15.4 BY END-USER

10.5 MIDDLE EAST & AFRICA

10.5.1 BY COMPONENT

10.5.2 BY ORGANIZATION SIZE

10.5.3 BY DEPLOYMENT MODE

10.5.4 BY END-USER

10.5.5 BY COUNTRY

10.5.6 SAUDI ARABIA

10.5.6.1 BY COMPONENT

10.5.6.2 BY ORGANIZATION SIZE

10.5.6.3 BY DEPLOYMENT MODE

10.5.6.4 BY END-USER

10.5.7 UAE

10.5.7.1 BY COMPONENT

10.5.7.2 BY ORGANIZATION SIZE

10.5.7.3 BY DEPLOYMENT MODE

10.5.7.4 BY END-USER

10.5.8 rest of middle east & africa

10.5.8.1 BY COMPONENT

10.5.8.2 BY ORGANIZATION SIZE

10.5.8.3 BY DEPLOYMENT MODE

10.5.8.4 BY END-USER

10.6 CENTRAL & SOUTH AMERICA

10.6.1 BY COMPONENT

10.6.2 BY ORGANIZATION SIZE

10.6.3 BY DEPLOYMENT MODE

10.6.4 BY END-USER

10.6.5 BY COUNTRY

10.6.6 brazil

10.6.6.1 BY COMPONENT

10.6.6.2 BY ORGANIZATION SIZE

10.6.6.3 BY DEPLOYMENT MODE

10.6.6.4 BY END-USER

10.6.7 argentina

10.6.7.1 BY COMPONENT

10.6.7.2 BY ORGANIZATION SIZE

10.6.7.3 BY DEPLOYMENT MODE

10.6.7.4 BY END-USER

10.6.8 chile

10.6.8.1 BY COMPONENT

10.6.8.2 BY ORGANIZATION SIZE

10.6.8.3 BY DEPLOYMENT MODE

10.6.8.4 BY END-USER

10.6.9 rest of central & south america

10.6.9.1 BY COMPONENT

10.6.9.2 BY ORGANIZATION SIZE

10.6.9.3 BY DEPLOYMENT MODE

10.6.9.4 BY END-USER

11......... FOUR QUADRANT COMPETITOR POSITIONING MATRIX

11.1 Leaders

11.2 Challengers

11.3 Visionaries

11.4 Niche Players

12......... Company market share analysis

13......... VENDOR LANDSCAPE

14......... Company profile

14.1 KYG TRADE, INC.

14.1.1 BUSINESS DESCRIPTION

14.1.2 SWOT ANALYSIS

14.1.3 PRODUCTS & SERVICES OFFERED

14.2 APTEAN

14.2.1 BUSINESS DESCRIPTION

14.2.2 SWOT ANALYSIS

14.2.3 PRODUCTS & SERVICES OFFERED

14.3 ORACLE

14.3.1 BUSINESS DESCRIPTION

14.3.2 SWOT ANALYSIS

14.3.3 PRODUCTS & SERVICES OFFERED

14.3.4 STRATEGIC INITIATIVES

14.4 QAD PRECISION

14.4.1 BUSINESS DESCRIPTION

14.4.2 SWOT ANALYSIS

14.4.3 PRODUCTS & SERVICES OFFERED

14.4.4 STRATEGIC INITIATIVES

14.5 Livingston International

14.5.1 BUSINESS DESCRIPTION

14.5.2 SWOT ANALYSIS

14.5.3 PRODUCTS & SERVICES OFFERED

14.6 QuestaWeb Inc.

14.6.1 BUSINESS DESCRIPTION

14.6.2 SWOT ANALYSIS

14.6.3 PRODUCTS & SERVICES OFFERED

14.6.4 STRATEGIC INITIATIVES

14.7 OCR Services, Inc.

14.7.1 BUSINESS DESCRIPTION

14.7.2 SWOT ANALYSIS

14.7.3 PRODUCTS & SERVICES OFFERED

14.7.4 STRATEGIC INITIATIVES

14.8 Infor.

14.8.1 BUSINESS DESCRIPTION

14.8.2 SWOT ANALYSIS

14.8.3 PRODUCTS & SERVICES OFFERED

14.8.4 STRATEGIC INITIATIVES

14.9 Thomson Reuters

14.9.1 BUSINESS DESCRIPTION

14.9.2 SWOT ANALYSIS

14.9.3 PRODUCTS & SERVICES OFFERED

14.10 SAP SE

14.10.1 BUSINESS DESCRIPTION

14.10.2 SWOT ANALYSIS

14.10.3 PRODUCTS & SERVICES OFFERED

14.10.4 STRATEGIC INITIATIVES

14.11 Vigilant GTS LLC

14.11.1 BUSINESS DESCRIPTION

14.11.2 SWOT ANALYSIS

14.11.3 PRODUCTS & SERVICES OFFERED

14.12 CENTRADE

14.12.1 BUSINESS DESCRIPTION

14.12.2 SWOT ANALYSIS

14.12.3 PRODUCTS & SERVICES OFFERED

14.13 SHIPSY

14.13.1 BUSINESS DESCRIPTION

14.13.2 SWOT ANALYSIS

14.13.3 PRODUCTS & SERVICES OFFERED

14.13.4 STRATEGIC INITIATIVES

14.14 Bamboo Rose

14.14.1 BUSINESS DESCRIPTION

14.14.2 SWOT ANALYSIS

14.14.3 PRODUCTS & SERVICES OFFERED

14.14.4 STRATEGIC INITIATIVES

14.15 BOLERO INTERNATIONAL, LTD.

14.15.1 BUSINESS DESCRIPTION

14.15.2 SWOT ANALYSIS

14.15.3 PRODUCTS & SERVICES OFFERED

14.15.4 STRATEGIC INITIATIVES

14.16 MIC CUSTOMS SOLUTIONS

14.16.1 BUSINESS DESCRIPTION

14.16.2 SWOT ANALYSIS

14.16.3 PRODUCTS & SERVICES OFFERED

14.16.4 STRATEGIC INITIATIVES

14.17 WEBB FONTAINE

14.17.1 BUSINESS DESCRIPTION

14.17.2 SWOT ANALYSIS

14.17.3 PRODUCTS & SERVICES OFFERED

14.17.4 STRATEGIC INITIATIVES

14.18 NEURORED

14.18.1 BUSINESS DESCRIPTION

14.18.2 SWOT ANALYSIS

14.18.3 PRODUCTS & SERVICES OFFERED

14.18.4 STRATEGIC INITIATIVES

14.19 GLOBAL CUSTOMS COMPLIANCE LTD

14.19.1 BUSINESS DESCRIPTION

14.19.2 SWOT ANALYSIS

14.19.3 PRODUCTS & SERVICES OFFERED

14.20 Noatum Logistics

14.20.1 BUSINESS DESCRIPTION

14.20.2 SWOT ANALYSIS

14.20.3 PRODUCTS & SERVICES OFFERED

14.20.4 STRATEGIC INITIATIVES

14.21 E2OPEN, LLc

14.21.1 BUSINESS DESCRIPTION

14.21.2 Amber Road, Inc.

14.21.2.1 BUSINESS DESCRIPTION

14.21.3 SWOT ANALYSIS

14.21.4 PRODUCTS & SERVICES OFFERED

14.21.5 STRATEGIC INITIATIVES

14.22 DESCARTES SYSTEMS GROUP

14.22.1 BUSINESS DESCRIPTION

14.22.2 SWOT ANALYSIS

14.22.3 PRODUCTS & SERVICES OFFERED

14.22.4 STRATEGIC INITIATIVES

14.23 CARGOWISE

14.23.1 BUSINESS DESCRIPTION

14.23.2 SWOT ANALYSIS

14.23.3 PRODUCTS & SERVICES OFFERED

14.23.4 STRATEGIC INITIATIVES

14.24 Expeditors

14.24.1 BUSINESS DESCRIPTION

14.24.2 SWOT ANALYSIS

14.24.3 PRODUCTS & SERVICES OFFERED

14.24.4 STRATEGIC INITIATIVES

14.25 BDP International

14.25.1 BUSINESS DESCRIPTION

14.25.2 SWOT ANALYSIS

14.25.3 PRODUCTS & SERVICES OFFERED

14.25.4 STRATEGIC INITIATIVES

14.26 LexisNexis

14.26.1 BUSINESS DESCRIPTION

14.26.2 SWOT ANALYSIS

14.26.3 PRODUCTS & SERVICES OFFERED

14.27 3rdwave

14.27.1 BUSINESS DESCRIPTION

14.27.2 SWOT ANALYSIS

14.27.3 PRODUCTS & SERVICES OFFERED

14.28 AEB

14.28.1 BUSINESS DESCRIPTION

14.28.2 SWOT ANALYSIS

14.28.3 PRODUCTS & SERVICES OFFERED

List of TableS

TABLE 1 GLOBAL TRADE MANAGEMENT MARKET, BY COMPONENT, 2020-2028 (USD Million)

TABLE 2 Solutions: global TRADE MANAGEMENT MARKET, 2020-2028 (USD Million)

TABLE 3 SERVICES: global TRADE MANAGEMENT MARKET, 2020-2028 (USD Million)

TABLE 4 GLOBAL TRADE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 5 Large Enterprises: global TRADE MANAGEMENT MARKET, 2020-2028 (USD Million)

TABLE 6 Small & Medium Enterprises: global TRADE MANAGEMENT MARKET, 2020-2028 (USD Million)

TABLE 7 GLOBAL TRADE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 8 cloud based: global TRADE MANAGEMENT MARKET, 2020-2028 (USD Million)

TABLE 9 on-premise based: global TRADE MANAGEMENT MARKET, 2020-2028 (USD Million)

TABLE 10 GLOBAL TRADE MANAGEMENT MARKET, BY END-USER, 2020-2028 (USD Million)

TABLE 11 TRANSPORTATION AND LOGISTICS: global TRADE MANAGEMENT MARKET, 2020-2028 (USD Million)

TABLE 12 GOVERNMENT AND PUBLIC: global TRADE MANAGEMENT MARKET, 2020-2028 (USD Million)

TABLE 13 HEALTHCARE AND LIFESCIENCE: global TRADE MANAGEMENT MARKET, 2020-2028 (USD Million)

TABLE 14 AEROSPACE AND DEFENSE: global TRADE MANAGEMENT MARKET, 2020-2028 (USD Million)

TABLE 15 MANUFACTURING: global TRADE MANAGEMENT MARKET, 2020-2028 (USD Million)

TABLE 16 RETAIL & CONSUMER GOODS: global TRADE MANAGEMENT MARKET, 2020-2028 (USD Million)

TABLE 17 OTHER END-USERS: global TRADE MANAGEMENT MARKET, 2020-2028 (USD Million)

TABLE 18 global Trade Management Market, by region, 2020-2028 (USD Million)

TABLE 19 NORTH AMERICA Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 20 NORTH AMERICA Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 21 NORTH AMERICA Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 22 NORTH AMERICA TRADE MANAGEMENT MARKET, BY END-USER, 2020-2028 (USD Million)

TABLE 23 NORTH AMERICA, TRADE MANAGEMENT MARKET, BY COUNTRY, 2020-2028 (USD Million)

TABLE 24 U.S. Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 25 U.S. Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 26 U.S. Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 27 U.S. Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 28 CANADA Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 29 CANADA Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 30 CANADA Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 31 CANADA Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 32 MEXICO Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 33 MEXICO Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 34 MEXICO Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 35 MEXICO Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 36 EUROPE Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 37 EUROPE Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 38 EUROPE Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 39 EUROPE TRADE MANAGEMENT MARKET, BY END-USER, 2020-2028 (USD Million)

TABLE 40 EUROPE, TRADE MANAGEMENT MARKET, BY COUNTRY, 2020-2028 (USD Million)

TABLE 41 GERMANY Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 42 GERMANY Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 43 GERMANY Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 44 GERMANY Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 45 U.K. Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 46 U.K. Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 47 U.K. Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 48 U.K. Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 49 FRANCE Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 50 FRANCE Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 51 FRANCE Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 52 FRANCE Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 53 ITALY Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 54 ITALY Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 55 ITALY Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 56 ITALY Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 57 SPAIN Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 58 SPAIN Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 59 SPAIN Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 60 SPAIN Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 61 NETHERLANDS Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 62 NETHERLANDS Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 63 NETHERLANDS Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 64 NETHERLANDS Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 65 REST OF EUROPE Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 66 REST OF EUROPE Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 67 REST OF EUROPE Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 68 REST OF EUROPE Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 69 ASIA PACIFIC Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 70 ASIA PACIFIC Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 71 ASIA PACIFIC Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 72 ASIA PACIFIC TRADE MANAGEMENT MARKET, BY END-USER, 2020-2028 (USD Million)

TABLE 73 ASIA PACIFIC, TRADE MANAGEMENT MARKET, BY COUNTRY, 2020-2028 (USD Million)

TABLE 74 CHINA Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 75 CHINA Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 76 CHINA Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 77 CHINA Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 78 JAPAN Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 79 JAPAN Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 80 JAPAN Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 81 JAPAN Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 82 INDIA Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 83 INDIA Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 84 INDIA Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 85 INDIA Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 86 SOUTH KOREA Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 87 SOUTH KOREA Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 88 SOUTH KOREA Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 89 SOUTH KOREA Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 90 THAILAND Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 91 THAILAND Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 92 THAILAND Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 93 THAILAND Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 94 INDONESIA Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 95 INDONESIA Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 96 INDONESIA Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 97 INDONESIA Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 98 MALAYSIA Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 99 MALAYSIA Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 100 MALAYSIA Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 101 MALAYSIA Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 102 SINGAPORE Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 103 SINGAPORE Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 104 SINGAPORE Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 105 SINGAPORE Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 106 VIETNAM Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 107 VIETNAM Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 108 VIETNAM Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 109 VIETNAM Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 110 REST OF ASIA PACIFIC Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 111 REST OF ASIA PACIFIC Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 112 REST OF ASIA PACIFIC Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 113 rest of asia pacific Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 114 MIDDLE EAST & AFRICA Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 115 MIDDLE EAST & AFRICA Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 116 MIDDLE EAST & AFRICA Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 117 MIDDLE EAST & AFRICA TRADE MANAGEMENT MARKET, BY END-USER, 2020-2028 (USD Million)

TABLE 118 Middle East & Africa, TRADE MANAGEMENT MARKET, BY COUNTRY, 2020-2028 (USD Million)

TABLE 119 SAUDI ARABIA Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 120 SAUDI ARABIA Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 121 SAUDI ARABIA Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 122 Saudi arabia Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 123 UAE Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 124 UAE Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 125 UAE Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 126 UAE Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 127 rest of middle east & africa Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 128 rest of middle east & africa Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 129 rest of middle east & africa Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 130 rest of middle east & africa Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 131 CENTRAL & SOUTH AMERICA Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 132 CENTRAL & SOUTH AMERICA Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 133 CENTRAL & SOUTH AMERICA Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 134 CENTRAL & SOUTH AMERICA TRADE MANAGEMENT MARKET, BY END-USER, 2020-2028 (USD Million)

TABLE 135 CENTRAL & SOUTH AMERICA, TRADE MANAGEMENT MARKET, BY COUNTRY, 2020-2028 (USD Million)

TABLE 136 brazil Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 137 brazil Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 138 brazil Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 139 brazil Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 140 argentina Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 141 argentina Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 142 argentina Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 143 argentina Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 144 chile Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 145 chile Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 146 chile Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 147 chile Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 148 rest of central & south america Trade Management Market, BY COMPONENT, 2020-2028 (USD Million)

TABLE 149 rest of central & south america Trade Management Market, BY ORGANIZATION SIZE, 2020-2028 (USD Million)

TABLE 150 rest of central & south america Trade Management Market, BY DEPLOYMENT MODE, 2020-2028 (USD Million)

TABLE 151 rest of central & south america Trade Management Market, BY END-USER, 2020-2028 (USD Million)

TABLE 152 KYG TRADE, INC.: PRODUCTS/SERVICES OFFERED

TABLE 153 APTEAN: PRODUCTS/SERVICES OFFERED

TABLE 154 ORACLE: PRODUCTS/SERVICES OFFERED

TABLE 155 QAD PRECISION: PRODUCTS/SERVICES OFFERED

TABLE 156 LIVINGSTON INTERNATIONAL: PRODUCTS/SERVICES OFFERED

TABLE 157 QUESTAWEB INC.: PRODUCTS/SERVICES OFFERED

TABLE 158 OCR Services, Inc.: PRODUCTS/SERVICES OFFERED

TABLE 159 INFOR.: PRODUCTS/SERVICES OFFERED

TABLE 160 THOMSON REUTERS: PRODUCTS/SERVICES OFFERED

TABLE 161 SAP SE: PRODUCTS/SERVICES OFFERED

TABLE 162 VIGILANT GTS LLC: PRODUCTS/SERVICES OFFERED

TABLE 163 CENTRADE: PRODUCTS/SERVICES OFFERED

TABLE 164 SHIPSY: PRODUCTS/SERVICES OFFERED

TABLE 165 BAMBOO ROSE: PRODUCTS/SERVICES OFFERED

TABLE 166 BOLERO INTERNATIONAL, LTD.: PRODUCTS/SERVICES OFFERED

TABLE 167 MIC CUSTOMS SOLUTIONS: PRODUCTS/SERVICES OFFERED

TABLE 168 WEBB FONTAINE: PRODUCTS/SERVICES OFFERED

TABLE 169 Neurored: PRODUCTS/SERVICES OFFERED

TABLE 170 GLOBAL CUSTOMS COMPLIANCE LTD: PRODUCTS/SERVICES OFFERED

TABLE 171 NOATUM LOGISTICS: PRODUCTS/SERVICES OFFERED

TABLE 172 E2OPEN, LLC: PRODUCTS/SERVICES OFFERED

TABLE 173 DESCARTES SYSTEMS GROUP: PRODUCTS/SERVICES OFFERED

TABLE 174 CARGOWISE: PRODUCTS/SERVICES OFFERED

TABLE 175 EXPEDITORS: PRODUCTS/SERVICES OFFERED

TABLE 176 BDP INTERNATIONAL: PRODUCTS/SERVICES OFFERED

TABLE 177 LEXISNEXIS: PRODUCTS/SERVICES OFFERED

TABLE 178 3RDWAVE: PRODUCTS/SERVICES OFFERED

TABLE 179 AEB: PRODUCTS/SERVICES OFFERED

List of Figures

FIGURE 1 GLOBAL TRADE MANAGEMENT MARKET OVERVIEW

FIGURE 2 BENEFITS OF GLOBAL TRADE MANAGEMENT

FIGURE 3 GLOBAL TRADE MANAGEMENT (GTM): KEY OPPORTUNITY AREAS

FIGURE 4 GLOBAL TRADE MANAGEMENT (GTM) BEST PRACTICES

FIGURE 5 GLOBAL TRADE MANAGEMENT (GTM) BEST PRACTICES

FIGURE 6 GLOBAL TRADE MANAGEMENT MARKET, 2021-2028 (USD MILLION)

FIGURE 7 PENETRATION AND GROWTH PROSPECT MAPPING, BY GEOGRAPHY

FIGURE 8 KEY SUSTENANCE FOR GROWTH

FIGURE 9 TECHNOLOGY TRENDS IN THE GLOBAL TRADE MANAGEMENT MARKET

FIGURE 10 TRENDS IN GLOBAL EXPORT VALUE OF TRADE IN GOODS FROM 2000 TO 2021

FIGURE 11 VOLUME OF WORLD MERCHANDISE TRADE, FROM 2015-2023

FIGURE 12 PORTER’S FIVE FORCES ANALYSIS

FIGURE 13 GLOBAL TRADE MANAGEMENT MARKET, BY COMPONENT, 2022

FIGURE 14 By Component, Business Analysis

FIGURE 15 By Component Segment: Revenue Progress Analysis

FIGURE 16 SOLUTIONS: GLOBAL TRADE MANAGEMENT MARKET, 2022 VS 2028 (USD MILLION)

FIGURE 17 SERVICES: GLOBAL TRADE MANAGEMENT MARKET, 2022 VS 2028 (USD MILLION)

FIGURE 18 GLOBAL TRADE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022

FIGURE 19 By Organization Size, Business Analysis

FIGURE 20 By Organization Size Segment: Revenue Progress Analysis

FIGURE 21 LARGE ENTERPRISES: GLOBAL TRADE MANAGEMENT MARKET, 2022 VS 2028 (USD MILLION)

FIGURE 22 SMALL & MEDIUM ENTERPRISES: GLOBAL TRADE MANAGEMENT MARKET, 2022 VS 2028 (USD MILLION)

FIGURE 23 GLOBAL TRADE MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2022

FIGURE 24 By Deployment Mode, Business Analysis

FIGURE 25 By Deployment Mode Segment: Revenue Progress Analysis

FIGURE 26 CLOUD BASED: GLOBAL TRADE MANAGEMENT MARKET, 2022 VS 2028 (USD MILLION)

FIGURE 27 ON-PREMISE BASED: GLOBAL TRADE MANAGEMENT MARKET, 2022 VS 2028 (USD MILLION)

FIGURE 28 GLOBAL TRADE MANAGEMENT MARKET, BY END-USER, 2022

FIGURE 29 By End-User, Business Analysis

FIGURE 30 By End-User Segment: Revenue Progress Analysis

FIGURE 31 TRANSPORTATION AND LOGISITICS: GLOBAL TRADE MANAGEMENT MARKET, 2022 VS 2028 (USD MILLION)

FIGURE 32 GOVERNMENT AND PUBLIC: GLOBAL TRADE MANAGEMENT MARKET, 2022 VS 2028 (USD MILLION)

FIGURE 33 HEALTHCARE AND LIFESCIENCE: GLOBAL TRADE MANAGEMENT MARKET, 2022 VS 2028 (USD MILLION)

FIGURE 34 AEROSPACE AND DEFENSE: GLOBAL TRADE MANAGEMENT MARKET, 2022 VS 2028 (USD MILLION)

FIGURE 35 MANUFACTURING: GLOBAL TRADE MANAGEMENT MARKET, 2022 VS 2028 (USD MILLION)

FIGURE 36 RETAIL & CONSUMER GOODS: GLOBAL TRADE MANAGEMENT MARKET, 2022 VS 2028 (USD MILLION)

FIGURE 37 OTHER END-USERS: GLOBAL TRADE MANAGEMENT MARKET, 2022 VS 2028 (USD MILLION)

FIGURE 38 TRADE MANAGEMENT MARKET, BY REGION, 2022

FIGURE 39 REGIONAL SEGMENT: REVENUE PROGRESS ANALYSIS

FIGURE 40 GLOBAL TRADE MANAGEMENT MARKET: REGIONAL ANALYSIS

FIGURE 41 NORTH AMERICA TRADE MANAGEMENT MARKET, BY COMPONENT, 2022 VS 2028 (USD MILLION)

FIGURE 42 NORTH AMERICA TRADE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022 VS 2028 (USD MILLION)

FIGURE 43 NORTH AMERICA TRADE MANAGEMENT MARKET, BY DEPLOYMENT MODE 2022 VS 2028 (USD MILLION)

FIGURE 44 NORTH AMERICA TRADE MANAGEMENT MARKET, BY END-USER 2022 VS 2028 (USD MILLION)

FIGURE 45 NORTH AMERICA, TRADE MANAGEMENT MARKET, BY COUNTRY, 2022

FIGURE 46 EUROPE TRADE MANAGEMENT MARKET, BY COMPONENT, 2022 VS 2028 (USD MILLION)

FIGURE 47 EUROPE TRADE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022 VS 2028 (USD MILLION)

FIGURE 48 EUROPE TRADE MANAGEMENT MARKET, BY DEPLOYMENT MODE 2022 VS 2028 (USD MILLION)

FIGURE 49 EUROPE TRADE MANAGEMENT MARKET, BY END-USER 2022 VS 2028 (USD MILLION)

FIGURE 50 EUROPE, TRADE MANAGEMENT MARKET, BY COUNTRY, 2022

FIGURE 51 ASIA PACIFIC TRADE MANAGEMENT MARKET, BY COMPONENT, 2022 VS 2028 (USD MILLION)

FIGURE 52 ASIA PACIFIC TRADE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022 VS 2028 (USD MILLION)

FIGURE 53 ASIA PACIFIC TRADE MANAGEMENT MARKET, BY DEPLOYMENT MODE 2022 VS 2028 (USD MILLION)

FIGURE 54 ASIA PACIFIC TRADE MANAGEMENT MARKET, BY END-USER 2022 VS 2028 (USD MILLION)

FIGURE 55 ASIA PACIFIC, TRADE MANAGEMENT MARKET, BY COUNTRY, 2022

FIGURE 56 MIDDLE EAST & AFRICA TRADE MANAGEMENT MARKET, BY COMPONENT, 2022 VS 2028 (USD MILLION)

FIGURE 57 MIDDLE EAST & AFRICA TRADE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022 VS 2028 (USD MILLION)

FIGURE 58 MIDDLE EAST & AFRICA TRADE MANAGEMENT MARKET, BY DEPLOYMENT MODE 2022 VS 2028 (USD MILLION)

FIGURE 59 MIDDLE EAST & AFRICA TRADE MANAGEMENT MARKET, BY END-USER 2022 VS 2028 (USD MILLION)

FIGURE 60 MIDDLE EAST & AFRICA, TRADE MANAGEMENT MARKET, BY COUNTRY, 2022

FIGURE 61 CENTRAL & SOUTH AMERICA TRADE MANAGEMENT MARKET, BY COMPONENT, 2022 VS 2028 (USD MILLION)

FIGURE 62 CENTRAL & SOUTH AMERICA TRADE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022 VS 2028 (USD MILLION)

FIGURE 63 CENTRAL & SOUTH AMERICA TRADE MANAGEMENT MARKET, BY DEPLOYMENT MODE 2022 VS 2028 (USD MILLION)

FIGURE 64 CENTRAL & SOUTH AMERICA TRADE MANAGEMENT MARKET, BY END-USER 2022 VS 2028 (USD MILLION)

FIGURE 65 CENTRAL & SOUTH AMERICA, TRADE MANAGEMENT MARKET, BY COUNTRY, 2022

FIGURE 66 FOUR QUADRANT COMPETITOR POSITIONING MATRIX FOR TRADE MANAGEMENT MARKET- TOP MARKET PLAYERS

FIGURE 67 COMPANY MARKET SHARE ANALYSIS, 2022

FIGURE 68 KYG TRADE, INC.: COMPANY SNAPSHOT

FIGURE 69 APTEAN: COMPANY SNAPSHOT

FIGURE 70 ORACLE: COMPANY SNAPSHOT

FIGURE 71 ORACLE: FINANCIAL PERFORMANCE: BUSINESS & GEOGRAPHICAL REVENUE, 2021

FIGURE 72 QAD PRECISION: COMPANY SNAPSHOT

FIGURE 73 QAD PRECISION: FINANCIAL PERFORMANCE: BUSINESS & GEOGRAPHICAL REVENUE, 2021

FIGURE 74 LIVINGSTON INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 75 QUESTAWEB INC.: COMPANY SNAPSHOT

FIGURE 76 QUESTAWEB INC.: FINANCIAL PERFORMANCE: BUSINESS & GEOGRAPHICAL REVENUE, 2021

FIGURE 77 OCR SERVICES, INC.: COMPANY SNAPSHOT

FIGURE 78 INFOR.: COMPANY SNAPSHOT

FIGURE 79 THOMSON REUTERS: COMPANY SNAPSHOT

FIGURE 80 THOMSON REUTERS: FINANCIAL PERFORMANCE: BUSINESS & GEOGRAPHICAL REVENUE, 2021

FIGURE 81 SAP SE: COMPANY SNAPSHOT

FIGURE 82 SAP SE: FINANCIAL PERFORMANCE: BUSINESS & GEOGRAPHICAL REVENUE, 2021

FIGURE 83 VIGILANT GTS LLC: COMPANY SNAPSHOT

FIGURE 84 CENTRADE: COMPANY SNAPSHOT

FIGURE 85 SHIPSY: COMPANY SNAPSHOT

FIGURE 86 BAMBOO ROSE: COMPANY SNAPSHOT

FIGURE 87 BOLERO INTERNATIONAL, LTD.: COMPANY SNAPSHOT

FIGURE 88 MIC CUSTOMS SOLUTIONS: COMPANY SNAPSHOT

FIGURE 89 WEBB FONTAINE : COMPANY SNAPSHOT

FIGURE 90 NEURORED: COMPANY SNAPSHOT

FIGURE 91 GLOBAL CUSTOMS COMPLIANCE LTD: COMPANY SNAPSHOT

FIGURE 92 NOATUM LOGISTICS: COMPANY SNAPSHOT

FIGURE 93 E2OPEN, LLC: COMPANY SNAPSHOT

FIGURE 94 E2OPEN, LLC: FINANCIAL PERFORMANCE: BUSINESS & GEOGRAPHICAL REVENUE, 2022

FIGURE 95 DESCARTES SYSTEMS GROUP: COMPANY SNAPSHOT

FIGURE 96 DESCARTES SYSTEMS GROUP: FINANCIAL PERFORMANCE: BUSINESS & GEOGRAPHICAL REVENUE, 2022

FIGURE 97 CARGOWISE: COMPANY SNAPSHOT

FIGURE 98 CARGOWISE(WISETECH GLOBAL): FINANCIAL PERFORMANCE: BUSINESS & GEOGRAPHICAL REVENUE, 2022

FIGURE 99 EXPEDITORS: COMPANY SNAPSHOT

FIGURE 100 EXPEDITORS: FINANCIAL PERFORMANCE: BUSINESS & GEOGRAPHICAL REVENUE, 2022

FIGURE 101 BDP INTERNATIONAL: COMPANY SNAPSHOT

FIGURE 102 LEXISNEXIS: COMPANY SNAPSHOT

FIGURE 103 3RDWAVE: COMPANY SNAPSHOT

FIGURE 104 AEB: COMPANY SNAPSHOT

The Global Trade Management Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Trade Management Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS