Global Transradial Access Market Size, Trends & Analysis - Forecasts to 2026 By Product (Catheters, Guidewires, Sheaths & Sheath Introducers, Accessories, Hyperalimentation), By Application (Drug Administration, Fluid & Nutrition Administration, Blood Transfusion), By End-User (Hospitals & Clinics, Ambulatory Surgical Centers, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

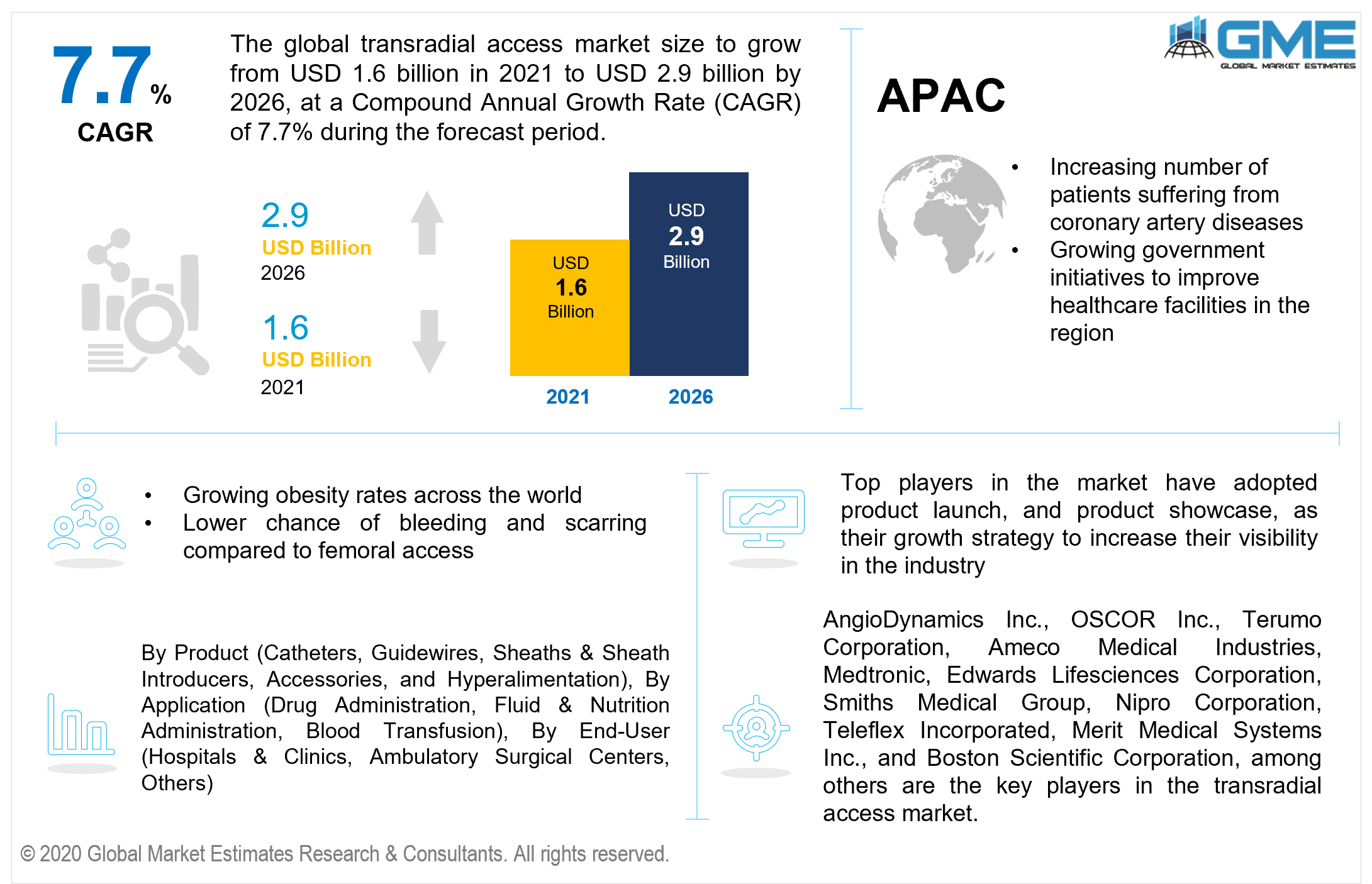

The global transradial access market is projected to grow from USD 1.6 billion in 2021 to USD 2.9 billion by 2026 at a CAGR value of 7.7%. Transradial catheterization is a key technological innovation in the field of percutaneous coronary intervention (PCI). PCI is a form of treatment for the shrinking of the coronary arteries in the hearts of patients suffering from coronary artery diseases. The transradial technique is seen as an alternative to the more standard procedure of femoral access due to the advantages it has over the femoral access technique. The transradial access market is driven by the lower cost of the procedure compared to femoral access, reduced hematoma formation, lesser recovery period and hospitalization, and lower risk of mortality due to reduced risk of bleeding.

The transradial approach is often preferred for high-risk patients like the morbidly obese, geriatric patients, patients on anticoagulants, and those suffering from severe peripheral vascular diseases. The number of patients suffering from coronary arterial diseases has been increasing steadily in recent years. The growing geriatric population in the developed nations and the growing obesity numbers across the globe has contributed to the growing number of patients suffering from coronary heart diseases.

Coronary heart disease is the most common form of heart disease among patients. Over 365,914 deaths were the result of coronary heart diseases in the U.S in 2017 alone. Obesity is one of the leading causes of heart disease in the 21st century and obesity numbers have tripled since 1975. Such high obesity numbers have made the transradial approach more common in percutaneous coronary intervention. There has also been an increase in the number of children and young adults suffering from coronary heart diseases in recent years. According to the CDC, 18.2 million adults over the age of 20 suffer from coronary arterial diseases in the United States alone.

The market is restrained by the cost of transradial access devices and treatment procedures, the lack of healthcare insurances in developing nations, and low reimbursement numbers. Companies and research institutions are investing heavily in the development of new transradial approaches like robot-assisted transradial devices which can improve the success rates of the transradial approaches and further increase their applicability. The development of new and improved techniques will offer lucrative opportunities to the trasnradial access device manufacturers during the forecast period.

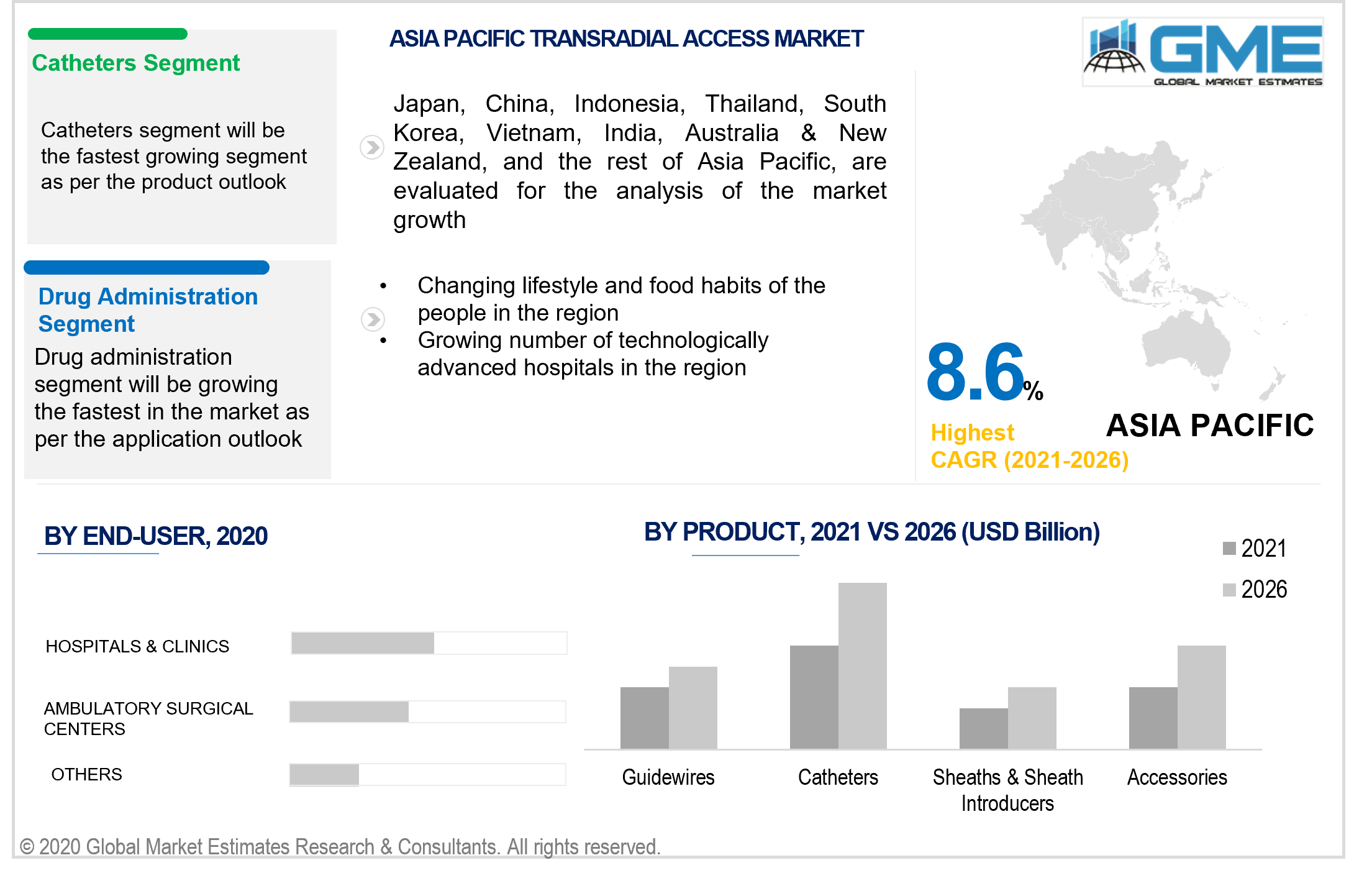

Based on the product used, the market can be segmented into sheaths & sheath introducers, accessories, guidewires, catheters, and hyperalimentation. The catheters segment is expected to hold the largest share of the market during the forecast period. Catheters are preferred over the other segments as they are shown to have a lower risk of complications after the procedure is completed and will significantly reduce the chance of scars. Catheters are therefore the more commonly preferred option among patients. The growing number of patients suffering from coronary heart diseases who require intervention is envisaged to result in the segment having the fastest growth rate among the other segments.

Based on the various applications in which the transradial approach is used, the market can be segmented as fluid & nutrition assessment, blood transfusion, and drug administration. The drug administration segment held the lion’s share of the market. Growing usage of vascular drug delivery systems for the treatment of infectious diseases and chronic diseases like cancer have been the major driver of this segment. Drug administration through the transradial approach offers better absorption of the drug and the effect of the drug can be observed more quickly.

Based on the end-users of such devices, the market can be segmented as hospitals & clinics, ambulatory surgical centers, and others. The hospitals and clinics segment is envisaged to hold the dominant share of the market during the forecast period. Hospitals are often more well equipped due to greater funding and capital investment which allows them to invest heavily in new equipment. Hospitals also have more experienced caregivers and staff who tend to serve patients better. Patient preference for hospitals and greater funding are expected to influence the growth of this segment during the forecast period.

Ambulatory surgical centers are expected to register significantly higher growth rates than the other segments during the forecast period. Ambulatory surgical centers are capable of providing same-day discharge and are more cost-effective than hospitals.

Based on region, the market can be broken into various regions such as North America, Europe, CSA, MENA, and the Asia Pacific regions. The North American region is expected to predominate in the market during the forecast period. The region has been witnessing an increased number of cardiovascular diseases as the geriatric population in the region increases as well as the soaring rates of obesity. The heavy spending on research and development of new techniques and devices have also contributed to the dominance of this region in the market. The presence of the key players of the industry in the region and the excellent healthcare facilities in the region are some of the other contributors to the dominance of this region.

The APAC region is envisaged to log significantly greater growth rates than the other regions during the forecast period. The growing number of patients suffering from coronary artery diseases, changing lifestyle and food habits, and increased spending on healthcare by governments in the region are the major factors that contribute to the growth of this market in this area.

AngioDynamics Inc., OSCOR Inc., Terumo Corporation, Ameco Medical Industries, Medtronic, Edwards Lifesciences Corporation, Smiths Medical Group, Nipro Corporation, Teleflex Incorporated, Merit Medical Systems Inc., and Boston Scientific Corporation, among others, are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Transradial Access Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Application Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Transradial Access Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising number of coronary heart disease patients

3.3.1.2 Advantages like lower bleeding and lower postop recovery compared to femoral access

3.3.2 Industry Challenges

3.3.2.1 High cost of transcardial access devices

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Transradial Access Market, By Product

4.1 Product Outlook

4.2 Catheters

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Sheaths & Sheath Introducers

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Accessories

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Hyperalimentation

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Transradial Access Market, By Application

5.1 Application Outlook

5.2 Drug Administration

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Fluid & Nutrition Administration

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Blood Transfusion

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Transradial Access Market, By End-User

6.1 End-User Outlook

6.2 Hospitals & Clinics

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Ambulatory Surgical Centers

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Others

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Transradial Access Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Product, 2020-2026 (USD Billion)

7.2.3 Market Size, By Application, 2020-2026 (USD Billion)

7.2.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Product, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Application, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Product, 2020-2026 (USD Billion)

7.3.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Product, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Product, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Product, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Product, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Product, 2020-2026 (USD Billion)

7.4.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Product, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Product, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Application, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Product, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Product, 2020-2026 (USD Billion)

7.5.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Product, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Product, 2020-2026 (USD Billion)

7.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Product, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.8 South Africa

7.6.7.1 Market Size, By Product, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 AngioDynamics Inc.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Edwards Lifesciences Corporation

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Boston Scientific Corporation

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Ameco Medical Industries

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Smiths Medical Group

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Medtronic

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Teleflex Incorporated

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Merit Medical Systems Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 OSCOR Inc.

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Terumo Corporation

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Nipro Corporation

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Other Companies

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

The Global Transradial Access Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Transradial Access Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS