Global Veterinary Chemistry Analyzer Market Size, Trends & Analysis - Forecasts to 2026 By Application (Urinalysis, Blood Chemistry Analysis, Blood Gas & Electrolyte Analysis and Glucose Monitoring) By End-User (Clinical Laboratories and Hospitals) By Type (Portable and Benchtop) By Product (Instruments [Urine analyzer, Glucometers, Blood Gas & Electrolyte Analyzer and Blood Chemistry Analyzers] and Consumables [Panels, Reagents, and Strips]), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

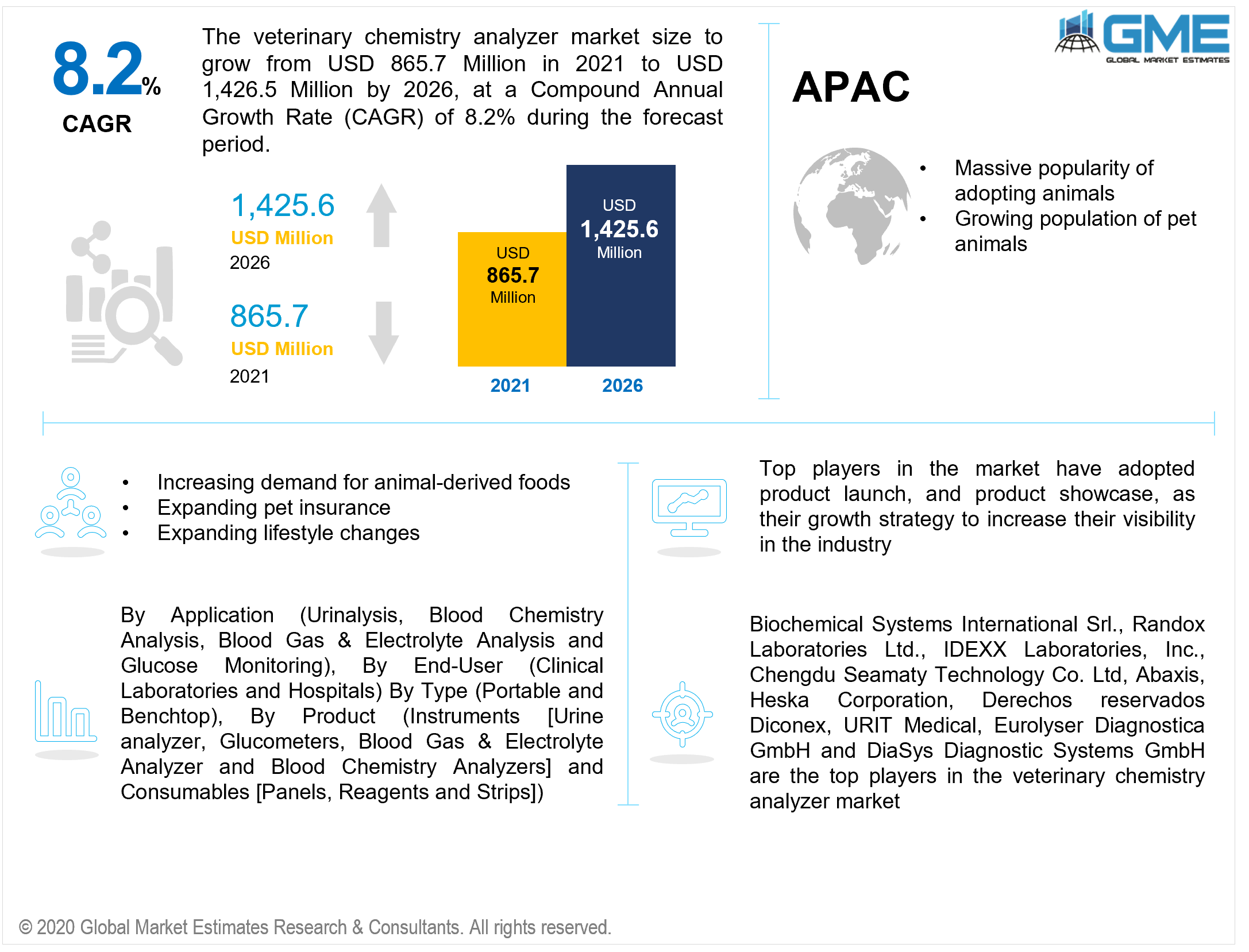

The global veterinary chemistry analyzer market is projected to grow from USD 865.7 million in 2021 to USD 1,425.6 million by 2026 at a CAGR value of 8.2% between 2021 to 2026.

Veterinary chemistry analyzers are used to identify metabolites, proteins, electrolytes, and/or medicines in blood, urine, plasma, cerebrospinal fluid, and/or other animal body fluids.

The growing cost of various treatment procedures for pets along with the rising pet ownership numbers will cause a further rise in the demand for veterinary chemical analyzers. The regulations on pet welfare in various countries, the need for mandatory pet insurance, and registration with a local body have also increased the demand for these analyzers.

The growing number of veterinarians and the growing number of animal welfare organizations is expected to further enhance the demand for veterinary treatment procedures and diagnostic tests.

The rising demand for animal products and animal-derived proteins in the food industry has led to an increase in the number of livestock being reared by livestock breeders. The growing need for breeders to prevent the spread of diseases and ensure near-perfect health among their livestock is expected to increase the demand for veterinary chemical analyzers.

Livestock illnesses are leading to several issues in the livestock industry. These issues include lost productivity, uncertain food security, and lost revenue, among others, all of which have a negative impact on human health. As a result, the rising prevalence of animal diseases is driving up demand for veterinary chemical analyzers all over the world. Mounting pet care expenditures, on the other hand, may limit the market's expansion to some extent.

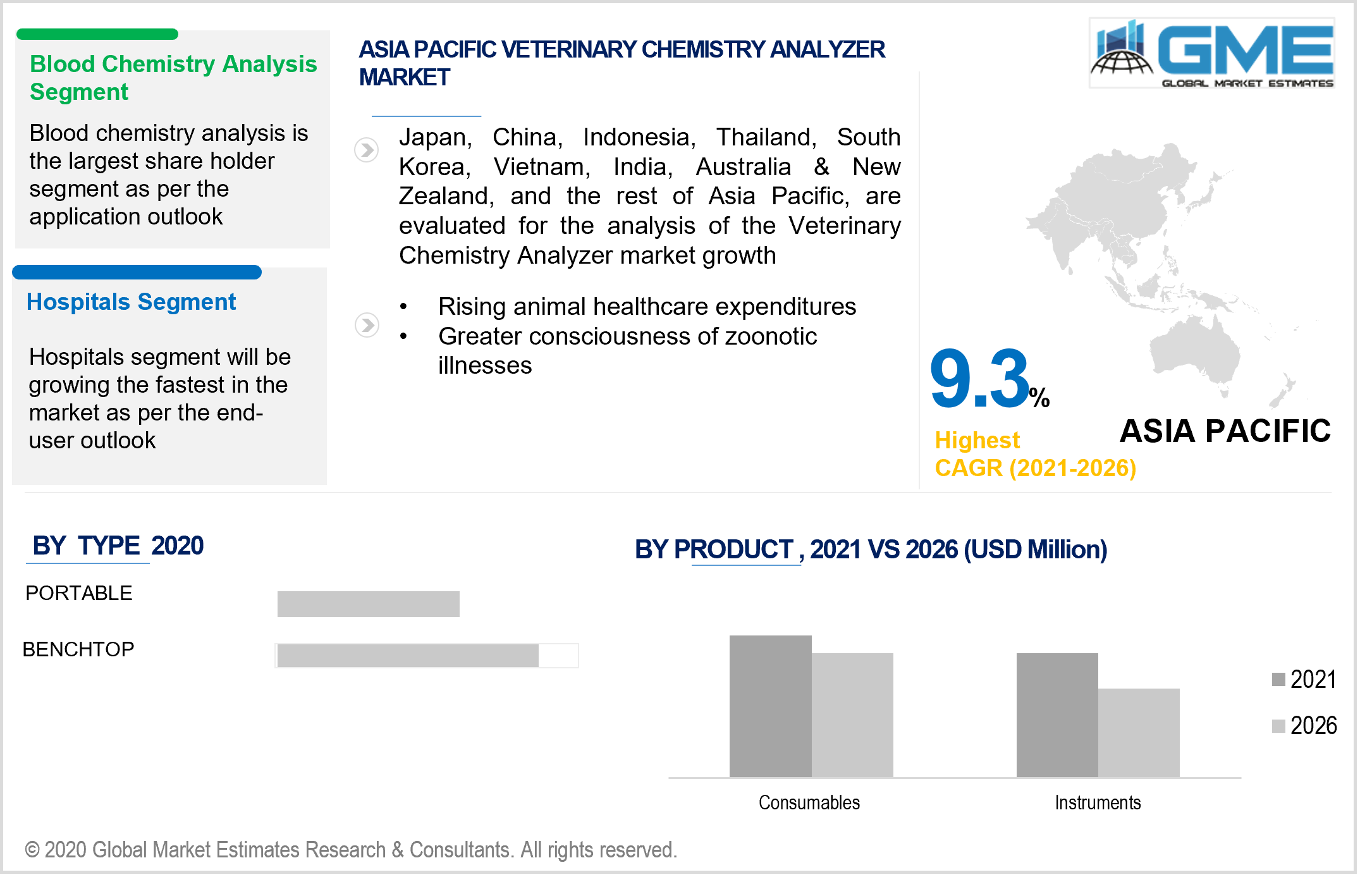

Based on the application, the market can be segmented into urinalysis, blood chemistry analysis, blood gas & electrolyte analysis, and glucose monitoring. Because of the increased frequency of zoonotic illnesses and the rising number of veterinary practitioners, the blood chemistry analysis segment led the veterinary chemistry analyzer market during the forecast period. Pathogens originating from animals or animal products have triggered around three-quarters of new diseases that have harmed humans in the last decade.

During the projected period, the blood gas and electrolyte analysis segment is predicted to grow at the fastest rate. Blood gas and electrolyte analyses are becoming more popular as a result of the development of point-of-care analyzers. It is expected that there would be an increasing demand for analysis that supports test findings for both electrolyte and blood count in a given sample of serum, plasma, or urine.

Based on the end-user, the market can be segregated into clinical laboratories and hospitals. Due to the rising demand for domestic veterinary chemistry analyzers, hospitals currently hold the largest market share, which is expected to remain over the projection period. Better knowledge of the benefits of in-house analyzers, such as faster turnaround times and improved security with pre-anesthetic testing, is driving up demand. Obesity, renal disease, cancer, and animal drug abnormalities are only a few of the primary drivers that are projected to drive industry growth.

Given the type, the market for veterinary chemistry analyzer market can be divided into portable and benchtop. About 50% of the revenue was generated by the category of benchtop veterinary chemistry analyzers in the previous years. These analyzers are effective in diagnosing some disorders in pets, which is one of the main reasons for this segment's significant market share. During the projected period, the portable segment is expected to grow at a significant annual rate.

Given the product, the market for veterinary chemistry analyzer market can be divided into instruments and consumables. During the previous years, reagents made up more than a third of the consumables market. Consumables such as reagents, panels, and strips are projected to grow in popularity, boosting the entire market. Also, driving the expansion of the consumables market are periodic purchase requirements, easy-to-use reagents, and the presence of most reagents in liquid form, which involves no processing.

As per the geographical analysis, the market of veterinary chemistry analyzer market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central South America.

Aggregate demand for animal food products, rising animal healthcare expenditures, expanding animal population, and greater consciousness of zoonotic illnesses are all driving the regional industry.

Because of the massive popularity of adopting animals and the growing population of pet animals in North America, the region is expected to dominate the worldwide veterinary chemistry analyzers market. In the veterinary chemistry analyzers market, Europe is likely to trail North America. In the projected term, the veterinary chemistry analyzer market in the Asia Pacific and MEA is expected to increase significantly.

Biochemical Systems International Srl., Randox Laboratories Ltd., IDEXX Laboratories, Inc., Chengdu Seamaty Technology Co. Ltd, Abaxis, Heska Corporation, Derechos reservados Diconex, URIT Medical, Eurolyser Diagnostica GmbH, and DiaSys Diagnostic Systems GmbH are the top players in the veterinary chemistry analyzer market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Veterinary Chemistry Analyzer Market Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 End-User Overview

2.1.3 Application Overview

2.1.4 Product Overview

2.1.5 Type Overview

2.1.6 Regional Overview

Chapter 3 Veterinary Chemistry Analyzer Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technology Advancement in Healthcare Industry

3.3.1.2 Increasing Expenditure on Healthcare

3.3.2 Industry Challenges

3.3.2.1 Limited Study and Industry Participants

3.4 Prospective Growth Scenario

3.4.1 End-User Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 Product Growth Scenario

3.4.4 Type Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Veterinary Chemistry Analyzer Market, By End-User

4.1 End-User Outlook

4.2 Clinical Laboratories

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Hospitals

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Veterinary Chemistry Analyzer Market, By Application

5.1 Application Outlook

5.2 Urinalysis

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Blood Chemistry Analysis

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Blood Gas & Electrolyte Analysis

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.5 Glucose Monitoring

5.5.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Veterinary Chemistry Analyzer Market, By Product

6.1 Product Outlook

6.2 Instruments

6.2.1 Market size, By Region, 2016-2026 (USD Million)

6.3 Consumables

6.3.1 Market size, By Region, 2016-2026 (USD Million)

Chapter 7 Veterinary Chemistry Analyzer Market, By Type

7.1 Type Outlook

7.2 Portable

7.2.1 Market size, By Region, 2016-2026 (USD Million)

7.3 Benchtop

7.3.1 Market size, By Region, 2016-2026 (USD Million)

Chapter 8 Veterinary Chemistry Analyzer Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2016-2026 (USD Million)

8.2.2 Market Size, By End-User, 2016-2026 (USD Million)

8.2.3 Market Size, By Application, 2016-2026 (USD Million)

8.2.4 Market Size, By Product, 2016-2026 (USD Million)

8.2.5 Market Size, By Type, 2016-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By End-User, 2016-2026 (USD Million)

8.2.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.2.6.3 Market Size, By Product, 2016-2026 (USD Million)

8.2.6.4 Market Size, By Type, 2016-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By End-User, 2016-2026 (USD Million)

8.2.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.2.7.3 Market Size, By Product, 2016-2026 (USD Million)

8.2.7.4 Market Size, By Type, 2016-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2016-2026 (USD Million)

8.3.2 Market Size, By End-User, 2016-2026 (USD Million)

8.3.3 Market Size, By Application, 2016-2026 (USD Million)

8.3.4 Market Size, By Product, 2016-2026 (USD Million)

8.3.5 Market Size, By Type, 2016-2026 (USD Million)

8.3.4 Germany

8.3.4.1 Market Size, By End-User, 2016-2026 (USD Million)

8.3.4.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.4.3 Market Size, By Product, 2016-2026 (USD Million)

8.3.4.4 Market Size, By Type, 2016-2026 (USD Million)

8.3.5 UK

8.3.5.1 Market Size, By End-User, 2016-2026 (USD Million)

8.3.5.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.5.3 Market Size, By Product, 2016-2026 (USD Million)

8.3.5.4 Market Size, By Type, 2016-2026 (USD Million)

8.3.6 France

8.3.6.1 Market Size, By End-User, 2016-2026 (USD Million)

8.3.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.6.3 Market Size, By Product, 2016-2026 (USD Million)

8.3.6.4 Market Size, By Type, 2016-2026 (USD Million)

8.3.7 Italy

8.3.7.1 Market Size, By End-User, 2016-2026 (USD Million)

8.3.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.7.3 Market Size, By Product, 2016-2026 (USD Million)

8.3.7.4 Market Size, By Type, 2016-2026 (USD Million)

8.3.8 Spain

8.3.8.1 Market Size, By End-User, 2016-2026 (USD Million)

8.3.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.8.3 Market Size, By Product, 2016-2026 (USD Million)

8.3.8.4 Market Size, By Type, 2016-2026 (USD Million)

8.3.9 Russia

8.3.9.1 Market Size, By End-User, 2016-2026 (USD Million)

8.3.9.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.9.3 Market Size, By Product, 2016-2026 (USD Million)

8.3.9.4 Market Size, By Type, 2016-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2016-2026 (USD Million)

8.4.2 Market Size, By End-User, 2016-2026 (USD Million)

8.4.3 Market Size, By Application, 2016-2026 (USD Million)

8.4.4 Market Size, By Product, 2016-2026 (USD Million)

8.4.5 Market Size, By Type, 2016-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By End-User, 2016-2026 (USD Million)

8.4.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.6.3 Market Size, By Product, 2016-2026 (USD Million)

8.4.6.4 Market Size, By Type, 2016-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By End-User, 2016-2026 (USD Million)

8.4.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.7.3 Market Size, By Product, 2016-2026 (USD Million)

8.4.7.4 Market Size, By Type, 2016-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By End-User, 2016-2026 (USD Million)

8.4.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.8.3 Market Size, By Product, 2016-2026 (USD Million)

8.4.8.4 Market Size, By Type, 2016-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By End-User, 2016-2026 (USD Million)

8.4.9.2 Market size, By Application, 2016-2026 (USD Million)

8.4.9.3 Market Size, By Product, 2016-2026 (USD Million)

8.4.9.4 Market Size, By Type, 2016-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By End-User, 2016-2026 (USD Million)

8.4.10.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.10.3 Market Size, By Product, 2016-2026 (USD Million)

8.4.10.4 Market Size, By Type, 2016-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2016-2026 (USD Million)

8.5.2 Market Size, By End-User, 2016-2026 (USD Million)

8.5.3 Market Size, By Application, 2016-2026 (USD Million)

8.5.4 Market Size, By Product, 2016-2026 (USD Million)

8.5.5 Market Size, By Type, 2016-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By End-User, 2016-2026 (USD Million)

8.5.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.6.3 Market Size, By Product, 2016-2026 (USD Million)

8.5.6.4 Market Size, By Type, 2016-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By End-User, 2016-2026 (USD Million)

8.5.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.7.3 Market Size, By Product, 2016-2026 (USD Million)

8.5.7.4 Market Size, By Type, 2016-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By End-User, 2016-2026 (USD Million)

8.5.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.8.3 Market Size, By Product, 2016-2026 (USD Million)

8.5.8.4 Market Size, By Type, 2016-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2016-2026 (USD Million)

8.6.2 Market Size, By End-User, 2016-2026 (USD Million)

8.6.3 Market Size, By Application, 2016-2026 (USD Million)

8.6.4 Market Size, By Product, 2016-2026 (USD Million)

8.6.5 Market Size, By Type, 2016-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By End-User, 2016-2026 (USD Million)

8.6.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.6.3 Market Size, By Product, 2016-2026 (USD Million)

8.6.6.4 Market Size, By Type, 2016-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By End-User, 2016-2026 (USD Million)

8.6.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.7.3 Market Size, By Product, 2016-2026 (USD Million)

8.6.7.4 Market Size, By Type, 2016-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By End-User, 2016-2026 (USD Million)

8.6.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.8.3 Market Size, By Product, 2016-2026 (USD Million)

8.6.8.4 Market Size, By Type, 2016-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Biochemical Systems International Srl.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Randox Laboratories Ltd.

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 IDEXX Laboratories, Inc.

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Chengdu Seamaty Technology Co. Ltd

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Abaxis

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Heska Corporation

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Derechos reservados Diconex

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 URIT Medical

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Eurolyser Diagnostica GmbH

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 DiaSys Diagnostic Systems GmbH

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.12 Other Companies

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info Graphic Analysis

The Global Veterinary Chemistry Analyzer Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Veterinary Chemistry Analyzer Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS