Global Veterinary Dental Equipment Market Size, Trends & Analysis - Forecasts to 2026 By Product (Equipment [Dental X-Ray Systems, Electrosurgical Units, Dental Stations, Dental Lasers, and Powered Units], Hand Instruments [Dental Elevators, Dental Probes, Extraction Forceps, Curettes and Scalers, Retractors, Dental Luxators, and Others], Consumables (Dental Supplies, Prophy Products, and Others], Adjuvants), By Animal Type (Large Animal and Small Animal), By End-Use (Hospitals & Clinics and Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

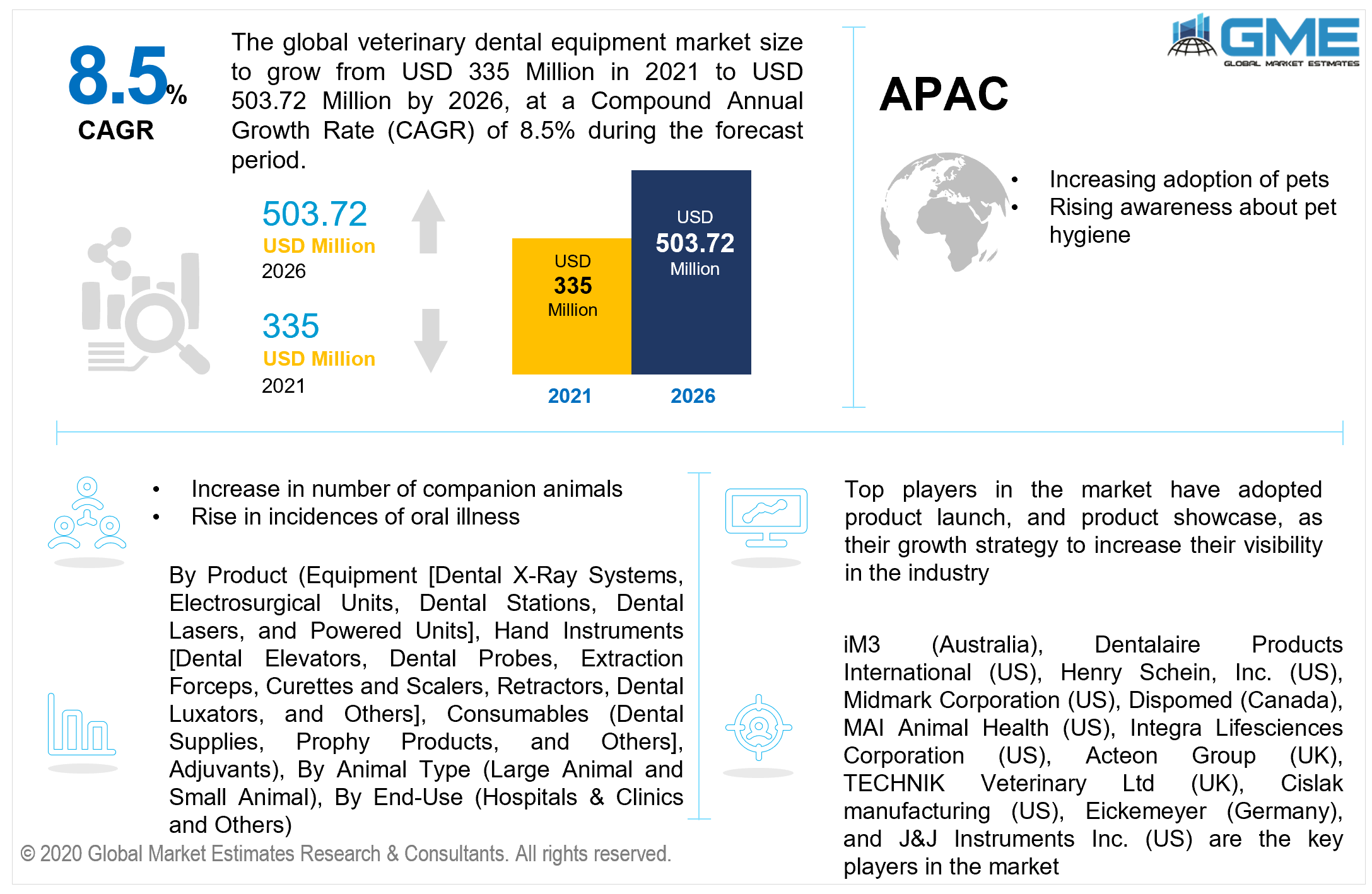

The global veterinary dental equipment market is projected to grow from USD 335 million in 2021 to USD 503.72 million by 2026 at a CAGR value of 8.5% between 2021 to 2026. The overall market is expected to reach new heights. This is mostly due to the global spike in the proportion of domestic animals. Other aspects driving the global market include growth in the multitude of veterinarians, as well as an expansion in the prevalence of animal oral complications. Other important elements assisting expansion include a rise in favorable government efforts and compensation regulations. The market is being pushed forward by an increase in the volume of veterinarian operations.

One factor driving the overall market is the rise in the incidence of oral illnesses among companion animals. Gingivitis and periodontal disease are two frequent dental illnesses in dogs. Aside from that, the market is growing due to increased awareness among pet owners about the availability of veterinary dental equipment. This is mostly due to the leading producers' significant marketing and advertising endeavors. Another reason driving market penetration of veterinary dental devices is the growing need for routine veterinarian oral examinations for preventative care of pets to postpone and prevent different illnesses.

Pets, like people, suffer from a variety of dental problems. Dental problems in pets can include periodontal disease, gingivitis, and the need for tooth extraction. Periodic dental cleanings and consult aid in the prevention of lengthy dental operations and undue pain in dogs. Periodontal disease is the most frequent chronic infection in animals. Periodontal disorders can be avoided. Periodontal disorders, if left untreated, can lead to other serious illnesses such as liver infection, heart disease, stroke, or kidney infection.

The rising prevalence of periodontal disease necessitates the development of more efficient dental solutions for veterinary. In veterinarian dental care, a range of well-designed canine dentistry devices is utilized for management and therapy. Dental diagnosis for periodontitis in small animals, such as dogs and cats, has culminated in a significant need for veterinarian dental treatment, resulting in a boom in the market.

Adjusting, cleaning, extraction, filing, and repair of animal teeth are all part of veterinary dentistry, as are other areas of animal oral healthcare. If left untreated, dental disorders can result in tooth loss, mouth infection, discomfort, and gingivitis, a kind of periodontal disease. The grade of veterinary services has increased in recent years as a result of technological breakthroughs in the field of dentistry. These aspects are presumed to support the overall market expansion.

Based on the product, the market can be segmented as equipment (dental X-ray systems, electrosurgical units, dental stations, dental lasers, and powered units), hand instruments (dental elevators, dental probes, extraction forceps, curettes and scalers, retractors, dental luxators, and others), consumables (dental supplies, prophy products, and others), and adjuvants.

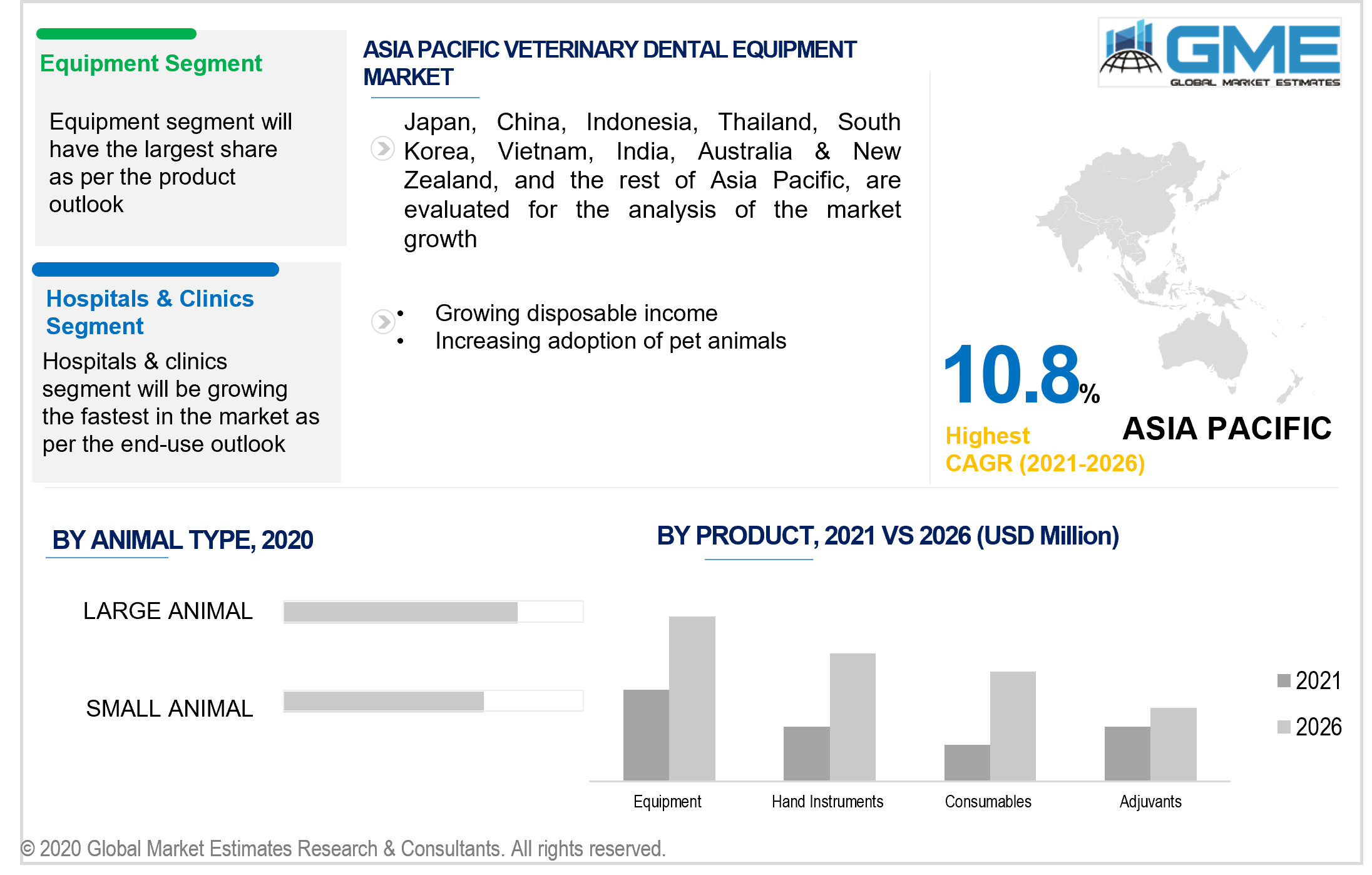

The equipment segment will be dominating the market during the forecast period. Due to related benefits in oral examination and rising acceptance by veterinary practitioners, X-ray systems are likely to see considerable expansion during the forecast period. It improves therapeutic options by providing for the visibility of 50% of the teeth below the gum line.

Based on animal type, the market is divided into large animals and small animals. During the forecast period, the large animal segment will have the highest revenue share. Impoverished breeding, deterioration of health, and insufficient nursing effectiveness are all typical underlying causes of dental disorders. A dental prophylaxis is essential regularly to preserve optimum health. Even though it might be difficult to diagnose from solely exterior indicators, early detection is best for effective therapy.

Small animals, which include dogs and felines, are predicted to expand at a healthy rate throughout the predicted period, owing to rising pet ownership and spending on companion care. The growing prevalence of periodontal disorders in pets is fuelling the market. Timely identification and management are essential because they assist to keep diseases from progressing and creating inconvenience or long-term health issues. The substantial proportion of this segment may be due to the significant price of dental devices and veterinarians' growing income levels, which is culminating in more use of dental systems.

Based on end-use, the market is classified as hospitals & clinics, and others. Hospitals & clinics will hold the largest revenue share throughout the forecast period, accounting for half of the total revenue. This is owed to the provision of a comprehensive spectrum of services and competent professionals. Over the forecast period, the market is likely to be propelled by the growing volume of veterinarian dentistry facilities.

North America will be dominating the global market. Some of the important reasons driving the growth of the veterinary dental equipment market in North America include a rise in the volume of vet clinics, an uptick in the proportion of domestic pets, and a boost in domestic animal welfare spending. Growing demand for pet health coverage and claims will almost certainly translate into an increased need for improved treatment alternatives.

Key companies' endeavors to enhance their goods and guarantee high-quality standards are expected to increase demand for veterinary dental devices items in this area. Furthermore, rising pet ownership and out-of-pocket expenditure by pet owners, improved healthcare facilities, and increased government efforts are expected to drive growth throughout the forecast period.

Due to growing disposable income and the adoption of pet animals, the APAC region is predicted to rise strongly throughout the forecast period. This is especially widespread in rising economies such as China and India, which has resulted in a fast increase of industrial facilities. Soaring R&D expenditure by key players and pharmaceutical firms for the development of this market to generate value-added goods is expected to fuel regional expansion.

iM3 (Australia), Dentalaire Products International (US), Henry Schein, Inc. (US), Midmark Corporation (US), Dispomed (Canada), MAI Animal Health (US), Integra Lifesciences Corporation (US), Acteon Group (UK), TECHNIK Veterinary Ltd (UK), Cislak manufacturing (US), Eickemeyer (Germany), and J&J Instruments Inc. (US) are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Veterinary Dental Equipment Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Animal Type Overview

2.1.4 End-Use Overview

2.1.5 Regional Overview

Chapter 3 Veterinary Dental Equipment Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increased veterinary offices

3.3.1.2 Rising awareness about pet hygiene

3.3.2 Industry Challenges

3.3.2.1 Low animal healthcare awareness in emerging markets

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Animal Type Growth Scenario

3.4.3 End-Use Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Veterinary Dental Equipment Market, By Product

4.1 Product Outlook

4.2 Equipment

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Hand Instruments

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Consumables

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 Adjuvants

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Veterinary Dental Equipment Market, By Animal Type

5.1 Animal Type Outlook

5.2 Large Animal

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Small Animal

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Veterinary Dental Equipment Market, By End-Use

6.1 End-Use Outlook

6.2 Hospitals & clinics

6.2.1 Market size, By Region, 2019-2026 (USD Million)

6.3 Others

6.3.1 Market size, By Region, 2019-2026 (USD Million)

Chapter 7 Veterinary Dental Equipment Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Million)

7.2.2 Market Size, By Product, 2019-2026 (USD Million)

7.2.3 Market Size, By Animal Type, 2019-2026 (USD Million)

7.2.4 Market Size, By End-Use, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.2.5.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.2.5.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.2.6.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.2.6.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Million)

7.3.2 Market Size, By Product, 2019-2026 (USD Million)

7.3.3 Market Size, By Animal Type, 2019-2026 (USD Million)

7.3.4 Market Size, By End-Use, 2019-2026 (USD Million)

7.3.5 Germany

7.2.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.2.5.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.2.5.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.6.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.3.6.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.7.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.3.7.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.8.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.3.8.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.9.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.3.9.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Product, 2019-2026 (USD Million)

7.3.10.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.3.10.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2019-2026 (USD Million)

7.4.2 Market Size, By Product, 2019-2026 (USD Million)

7.4.3 Market Size, By Animal Type, 2019-2026 (USD Million)

7.4.4 Market Size, By End-Use, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.5.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.4.5.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.6.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.4.6.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.7.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.4.7.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.8.2 Market size, By Animal Type, 2019-2026 (USD Million)

7.4.8.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Product, 2019-2026 (USD Million)

7.4.9.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.4.9.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Million)

7.5.2 Market Size, By Product, 2019-2026 (USD Million)

7.5.3 Market Size, By Animal Type, 2019-2026 (USD Million)

7.5.4 Market Size, By End-Use, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.5.5.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.5.5.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.5.6.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.5.6.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Product, 2019-2026 (USD Million)

7.5.7.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.5.7.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2019-2026 (USD Million)

7.6.2 Market Size, By Product, 2019-2026 (USD Million)

7.6.3 Market Size, By Animal Type, 2019-2026 (USD Million)

7.6.4 Market Size, By End-Use, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Product, 2019-2026 (USD Million)

7.6.5.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.6.5.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Product, 2019-2026 (USD Million)

7.6.6.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.6.6.3 Market Size, By End-Use, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Product, 2019-2026 (USD Million)

7.6.7.2 Market Size, By Animal Type, 2019-2026 (USD Million)

7.6.7.3 Market Size, By End-Use, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Im3 Pty Ltd

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Dentalaire Products International

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Henry Schein Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Midmark Corporation

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Dispomed

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 MAI Animal Health

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Integra Lifesciences Corporation

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Acteon Group

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 TECHNIK Veterinary Ltd

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Cislak manufacturing

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Eickemeyer

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 J&J Instruments Inc.

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

8.14 Other Companies

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 Info Graphic Analysis

The Global Veterinary Dental Equipment Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Veterinary Dental Equipment Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS