Global Veterinary Diagnostics Market Size, Trends & Analysis - Forecasts to 2026 By Product (Consumables, Instruments), By Animal Type (Companion Animals, Livestock), By Technology (Molecular Diagnostics, Hematology, Immunodiagnostics, Clinical Biochemistry, Urinalysis, Other Veterinary Diagnostic Technologies), By End-User (Veterinary Reference Laboratories, Veterinary Hospitals & Clinics, Point-of-Care/ In-House Testing, Veterinary Research Institutes & Universities), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Vendor Landscape, and Company Market Share Analysis and Competitor Analysis

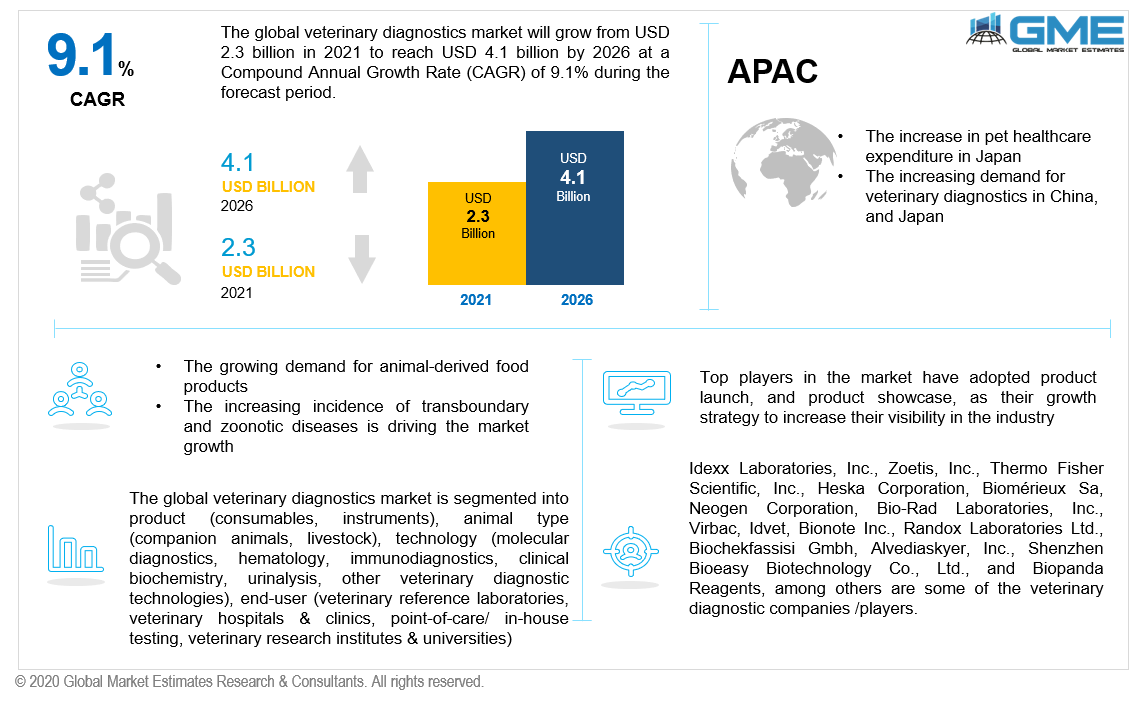

The global veterinary diagnostics market will grow from USD 2.3 billion in 2021 to reach USD 4.1 billion in 2026, with a CAGR of 9.1% during the forecast period.

The veterinary laboratory provides a secure environment for conducting medical tests on infectious agents or toxicity found in animal diagnostic samples. Animal samples are submitted for analysis by veterinary specialists representing public officials such as scientists, wildlife management, public health, or animal owners. The veterinary diagnostics market size is increasing due to the factors such as the growing incidence of zoonotic diseases, and an increasing number of veterinary professionals in the developing regions, rising expenses of animal healthcare, an increase in the demand for pet insurance, and high disposable income of the developed countries.

Furthermore, the rising need for animal-derived food products and an increasing number of pets are driving the global veterinary diagnostics market. As per the American Pet Products Association's (APPA), National Pet Owners Survey (2019–2020), around 67 % of US homes, or 84.9 million families, owned a pet. Latest veterinary diagnostics tests work on technologies such as wearables, nanotechnology, biosensors, and biomarkers are influencing the global veterinary market size.

However, companies in this market are likely to increase their investments in expanding their manufacturing facilities, which will impact the demand and supply for veterinary diagnostics in developing regions. Furthermore, the veterinary diagnostics market size is expected to rise due to rising animal healthcare expenses and favorable government regulation for diagnostic approval.

As per The Atlantic Monthly Group's COVID Tracking Project, the United States had only performed 27,157 tests by March 12, 2020, due to a shortage of technology to conduct elevated nucleic acid extraction in public health labs. Domestic animals may not contract COVID-19 in the same way that humans do, although in the outdoors, domestic cats and, to a lesser extent, pet dogs may become infected with SARS-CoV-2 following close and continuous contact with a COVID-19-positive person.

The veterinary diagnostics products are categorized into consumables and instruments. The consumables segment is analyzed to be the fastest-growing segment in the market from 2021 to 2026. The overall market picture is formed by thoroughly evaluating the demand for these products from veterinary hospitals, labs, clinics, etc. Furthermore, pet owners are increasing their desire for point-of-care diagnostics.

Urine strips, Blood glucose monitors, pregnancy kits, and other point-of-care diagnostics are often utilized for companion animals, whereas tests for livestock are mostly limited to labs due to the high sensitivity and efficacy needed in disease diagnosis.

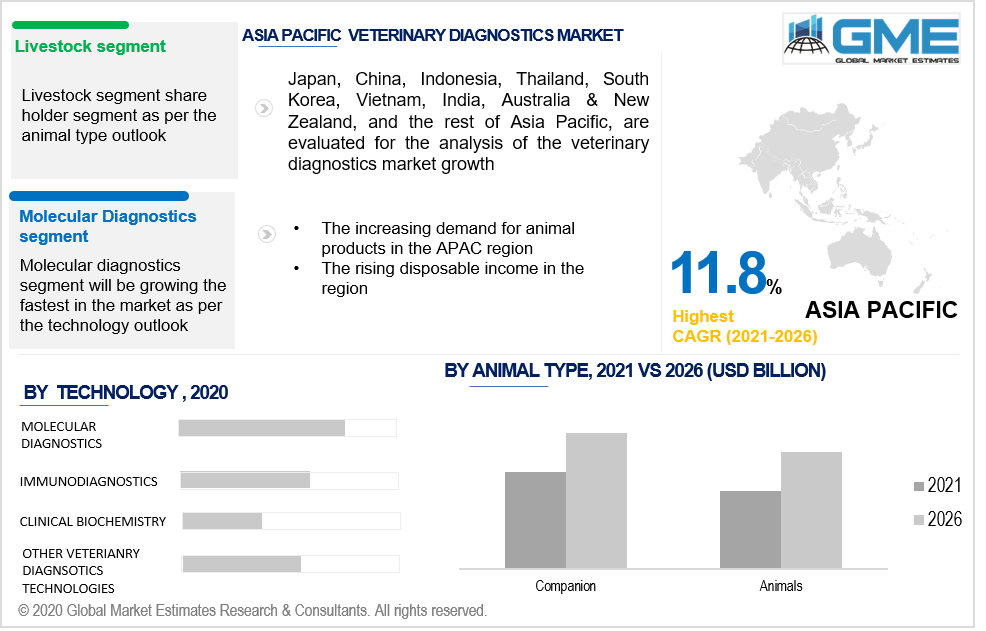

Companion animals and livestock are the major segments of the global veterinary diagnostics market. The livestock segment will be the largest shareholder of the market owing to factors such as the rising occurrence of zoonotic diseases among cattle and increasing demand for animal protein and products.

According to the World Health Organization, the global livestock sector is rapidly expanding. From 218 million tonnes in 1997 to 376 million tonnes in 2030, global meat production is anticipated to rise. Pork accounted for roughly 40.0 percent of total meat consumption in 2015, according to a USDA poll.

The market segmented based on technology are molecular diagnostics, hematology, immunodiagnostics, clinical biochemistry, urinalysis, and other veterinary diagnostic technologies. The molecular diagnostics segment will be the fastest-growing segment with the highest CAGR value from 2021 to 2026, due to the increasing use for research purposes. It comprises detecting pathogens either directly by looking for RNA or DNA in the host or indirectly by amplification of the infectious agent's genome. Furthermore, improvements to a molecular diagnostic test such as PCR have resulted in a huge array of rapid, reliable, and specific assays with widespread veterinary diagnostic applications.

Veterinary reference laboratories, veterinary hospitals & clinics, point-of-care/ in-house testing, and veterinary research institutes & universities are the end-users of the market. Veterinary hospitals & clinics will be the largest shareholder of the market during the forecast period due to the vast range of diagnostic options in these facilities.

The point-of-care/ in-house testing segment will be the fastest-growing segment with the highest CAGR value from 2021 to 2026. Diagnostics that are technologically advanced, such as in-house analyzers and point-of-care devices, are more convenient and deliver faster results, enhancing client satisfaction. Research institutes are also important in the development and application of these diagnostics.

As per the geographical analysis, the veterinary diagnostics market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America). North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026. The high share of this region is mainly due to the growing dairy and meat products, increasing veterinary healthcare expenditure, the high adoption rate for point of care management, and the increasing availability of reference laboratories. In addition, the Veterinary Diagnostics Market UK will be growing the fastest followed by North America countries.

Furthermore, the Asia Pacific region will grow with the highest CAGR rate in the market. Rising expenses in animal healthcare, increasing demand for animal care products, and the growing availability of pet insurance will impact the veterinary diagnostics market in India positively.

Idexx Laboratories, Inc., Zoetis, Inc., Thermo Fisher Scientific, Inc., Heska Corporation, Biomérieux Sa, Neogen Corporation, Bio-Rad Laboratories, Inc., Virbac, Idvet, Bionote Inc., Randox Laboratories Ltd., Biochekfassisi Gmbh, Alvediaskyer, Inc., Shenzhen Bioeasy Biotechnology Co., Ltd., and Biopanda Reagents, among others are some of the veterinary diagnostic companies /players.

Please note: This is not an exhaustive list of companies profiled in the report.

In June 2021, Idexx Laboratories, Inc. signed an acquisition agreement with rVetLink. rVetLink is engaged in cloud-based software technology and referral management solutions for veterinary specialty care hospitals and animal diagnostics.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Veterinary Diagnostics Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 End-User Overview

2.1.4 Animal Type Overview

2.1.5 Technology Overview

2.1.6 Regional Overview

Chapter 3 Veterinary Diagnostics Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing incidence of transboundary and zoonotic diseases

3.3.1.2 Rising demand for pet insurance and growing animal health expenditure

3.3.2 Industry Challenges

3.3.2.1 Shortage of veterinary practitioners in developing markets

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Technology Growth Scenario

3.4.3 Animal Type Growth Scenario

3.4.4 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Veterinary Diagnostics Market, By Product

4.1 Product Outlook

4.2 Consumables

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Instruments

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Veterinary Diagnostics Market, By End-User

5.1 End-User Outlook

5.2 Veterinary Reference Laboratories

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Veterinary Hospitals & Clinics

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Point-Of-Care/In-House Testing

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Veterinary Research Institutes & Universities

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Veterinary Diagnostics Market, By Animal Type

6.1 Animal Type Outlook

6.2 Companion Animals

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Livestock

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Veterinary Diagnostics Market, By Technology

7.1 Technology Outlook

7.2 Molecular Diagnostics

7.2.1 Market Size, By Region, 2020-2026 (USD Billion)

7.3 Hematology

7.3.1 Market Size, By Region, 2020-2026 (USD Billion)

7.4 Immunodiagnostics

7.4.1 Market Size, By Region, 2020-2026 (USD Billion)

7.5 Clinical Biochemistry

7.5.1 Market Size, By Region, 2020-2026 (USD Billion)

7.6 Urinalysis

7.6.1 Market Size, By Region, 2020-2026 (USD Billion)

7.7 Other Veterinary Diagnostic Technologies

7.7.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 8 Veterinary Diagnostics Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2020-2026 (USD Billion)

8.2.2 Market Size, By Product, 2020-2026 (USD Billion)

8.2.3 Market Size, By Technology, 2020-2026 (USD Billion)

8.2.4 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.2.5 Market Size, By End-User, 2020-2026 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Product, 2020-2026 (USD Billion)

8.2.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.2.6.3 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.2.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Product, 2020-2026 (USD Billion)

8.2.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.2.7.3 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.2.7.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2020-2026 (USD Billion)

8.3.2 Market Size, By Product, 2020-2026 (USD Billion)

8.3.3 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.4 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.3.5 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Product, 2020-2026 (USD Billion)

8.3.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.6.3 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.3.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Product, 2020-2026 (USD Billion)

8.3.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.7.3 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.3.7.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Product, 2020-2026 (USD Billion)

8.3.8.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.8.3 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.3.8.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Product, 2020-2026 (USD Billion)

8.3.9.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.9.3 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.3.9.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Product, 2020-2026 (USD Billion)

8.3.10.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.10.3 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.3.10.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Product, 2020-2026 (USD Billion)

8.3.11.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.11.3 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.3.11.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2020-2026 (USD Billion)

8.4.2 Market Size, By Product, 2020-2026 (USD Billion)

8.4.3 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.4 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.4.5 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Product, 2020-2026 (USD Billion)

8.4.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.6.3 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.4.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Product, 2020-2026 (USD Billion)

8.4.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.7.3 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.4.7.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Product, 2020-2026 (USD Billion)

8.4.8.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.8.3 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.4.8.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Product, 2020-2026 (USD Billion)

8.4.9.2 Market size, By Technology, 2020-2026 (USD Billion)

8.4.9.3 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.4.9.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Product, 2020-2026 (USD Billion)

8.4.10.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.10.3 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.4.10.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2020-2026 (USD Billion)

8.5.2 Market Size, By Product, 2020-2026 (USD Billion)

8.5.3 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.4 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.5.5 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Product, 2020-2026 (USD Billion)

8.5.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.6.3 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.5.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Product, 2020-2026 (USD Billion)

8.5.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.7.3 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.5.7.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Product, 2020-2026 (USD Billion)

8.5.8.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.8.3 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.5.8.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2020-2026 (USD Billion)

8.6.2 Market Size, By Product, 2020-2026 (USD Billion)

8.6.3 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.4 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.6.5 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Product, 2020-2026 (USD Billion)

8.6.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.6.3 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.6.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Product, 2020-2026 (USD Billion)

8.6.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.7.3 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.6.7.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Product, 2020-2026 (USD Billion)

8.6.8.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.8.3 Market Size, By Animal Type, 2020-2026 (USD Billion)

8.6.8.4 Market Size, By End-User, 2020-2026 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Idexx Laboratories, Inc.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info-Graphic Analysis

9.3 Zoetis, Inc.

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info-Graphic Analysis

9.4 Thermo Fisher Scientific, Inc.

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info-Graphic Analysis

9.5 Heska Corporation

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info-Graphic Analysis

9.6 Biomérieux Sa

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info-Graphic Analysis

9.7 Neogen Corporation

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info-Graphic Analysis

9.8 Bio-Rad Laboratories, Inc.

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info-Graphic Analysis

9.9 Virbac

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info-Graphic Analysis

9.10 Idvet

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info-Graphic Analysis

9.11 Bionote Inc.

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info-Graphic Analysis

9.12 Other Companies

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info-Graphic Analysis

The Global Veterinary Diagnostics Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Veterinary Diagnostics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS