Global Veterinary Services Market Size, Trends & Analysis - Forecasts to 2026 By Animal Type (Companion Animal [Horses {Artificial Insemination, Hoof Care, Dental Care, Grooming, Others}, Dogs {Grooming, Dental Care, Vaccinations, Diagnostic Services, Others}, Cats {Grooming, Dental Care, Vaccinations, Diagnostic Services, Others}, and Others], and Production Animal [Swine {Reproductive Consulting, Biosecurity, Diagnostic Services, and Others}, Cattle {Hoof Care, Artificial Insemination, Diagnostic Services, Others}, Poultry {Reproductive Consulting, Biosecurity, Diagnostic Services, Others}, and Others]), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

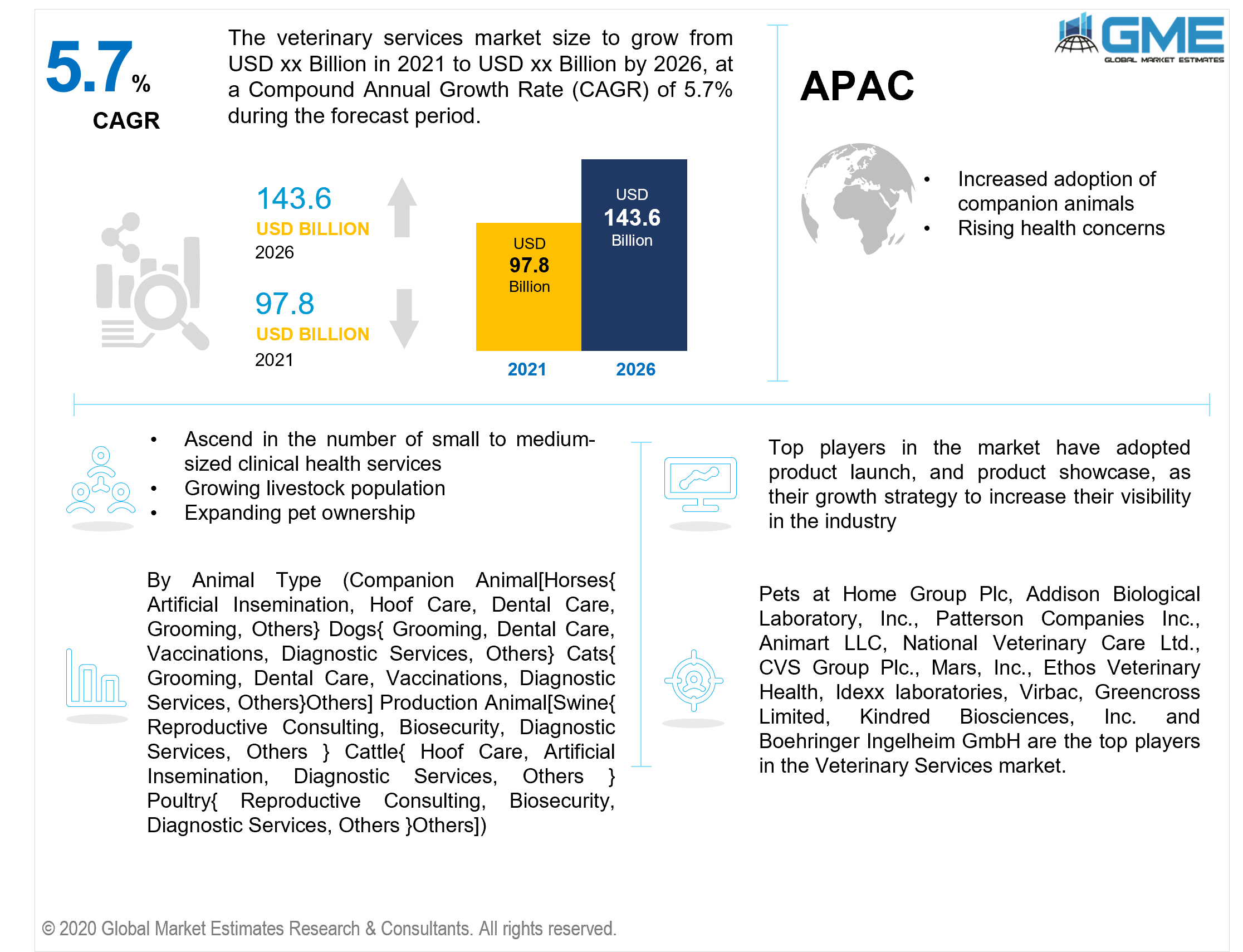

The global veterinary services market is projected to grow from USD 97.8 billion in 2021 to USD 143.6 billion by 2026 at a CAGR value of 5.7% from 2021 to 2026. Veterinary services are provided to animals to diagnose, prevent, and treat diseases and injuries sustained by animals. Veterinary pharmaceuticals are readily accessible and can be administered with or without the assistance of a veterinarian. Veterinary services contribute to the safe commercialization of live animals and their products, such as meat, that are OIE worldwide standards-compliant. Officials certify food of animal origin as safe for human consumption and are compliant with animal health and food safety regulations after going through a series of testing procedures, necessitating livestock welfare.

Growing Incidences of zoonotic and other illnesses are on the rise and increased ownership of pets are two of the major drivers of the market in recent years. Pet adoption has surged in recent years, and people are spending more money on the well-being of their pets. Social media awareness has resulted in people becoming more sensitive to animals increasing the demand for small to medium-sized clinical health services.

Policies are geared at long-term viability, which can be attained by combining increased output with increased concern for animal veterinarian care. According to the Food and Agriculture Organization, animal-based food products account for 33.3% of human protein intake in emerging regions. As a result, cattle efficiency is rising, which is crucial for meeting the dietary needs of the world's rising population. These variables, taken combined, account for a sizable portion of the veterinary services market held by producing animals over the projected timeline.

In developed markets, the pet insurance sector is introducing new veterinarian service product lines. The insurance coverage enables pet owners to investigate a variety of treatment choices, assuring improved animal care.

The market is restrained by the growing number of vegans which can lead to lower demand for animal products.

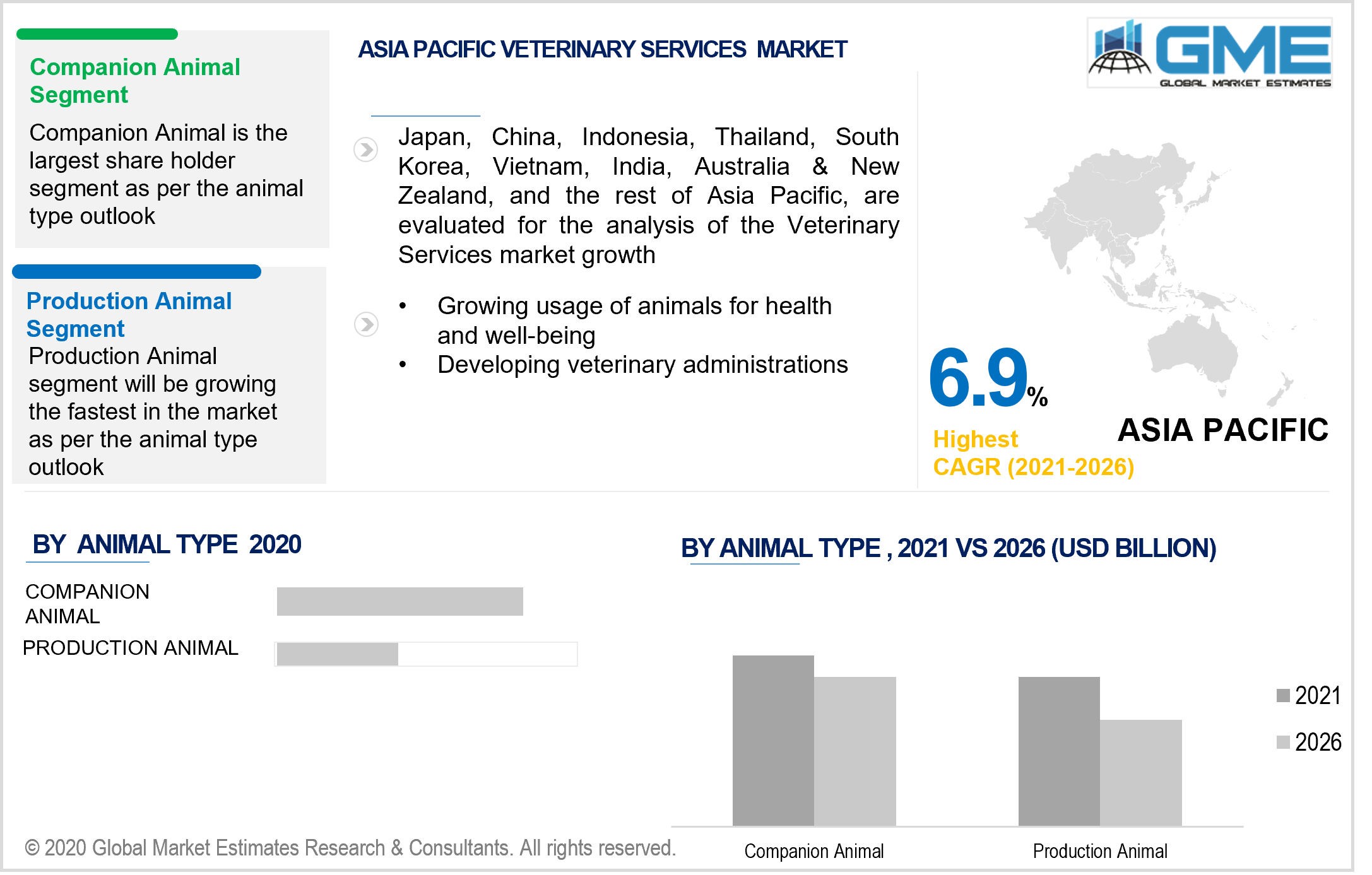

Based on the animal type, the market can be segregated into companion animals and production animals. During the projected timeframe, the companion animal segment of the veterinary services market is likely to occupy a significant market share. Companion animal surgery is actively progressing including advances and improvements in human surgical treatments.

A considerable rise in the prevalence of several diseases within pet animals has also been observed. Various programs have been initiated around the world to improve the efficiency and administration of veterinary services and veterinary medications for companion animals, which is expected to fuel market expansion.

As per the geographical analysis, the market of veterinary services can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central South America.

In the veterinary services market, North America had the biggest market share, accounting for a significant percentage in past years. The European nations trail the United States in dominance. Increased animal disease prevalence and positive repayment schemes are two key contributors to the market's progress. In particular, the growing acceptance of pet health care coverage in the United States is likely to boost the market growth.

The market for veterinary medicines in the Asia Pacific is expected to develop rapidly over the forecast years. Market growth in the Asia Pacific has been aided by aspects such as increased adoption of companion animals and rising health concerns. Likewise, the growing usage of animals for health and well-being, as well as veterinary administrations and the cow population, are pushing the veterinary drug industry. Pet adoption is increasing in countries like India and China, which will help the market develop even more.

During the forthcoming years, Latin America is predicted to develop at a noteworthy CAGR.

Pets at Home Group Plc, Addison Biological Laboratory, Inc., Patterson Companies Inc., Animart LLC, National Veterinary Care Ltd., CVS Group Plc., Mars, Inc., Ethos Veterinary Health, Idexx laboratories, Virbac, Greencross Limited, Kindred Biosciences, Inc., and Boehringer Ingelheim GmbH are the top players in the veterinary services market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Veterinary Services Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Animal Type Overview

2.1.3 Regional Overview

Chapter 3 Veterinary Services Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technology Advancement in Healthcare Industry

3.3.1.2 Increasing Expenditure on Healthcare

3.3.2 Industry Challenges

3.3.2.1 Limited Study and Industry Participants

3.4 Prospective Growth Scenario

3.4.1 Animal Type Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Veterinary Services Market, By Animal Type

4.1 Animal Type Outlook

4.2 Production Animal

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Companion Animal

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Others

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Veterinary Services Market, By Region

5.1 Regional outlook

5.2 North America

5.2.1 Market Size, By Country 2016-2026 (USD Million)

5.2.2 Market Size, By Animal Type, 2016-2026 (USD Million)

5.2.3 U.S.

7.2.3.1 Market Size, By Animal Type, 2016-2026 (USD Million)

5.2.4 Canada

5.2.4.1 Market Size, By Animal Type, 2016-2026 (USD Million)

5.3 Europe

5.3.1 Market Size, By Country 2016-2026 (USD Million)

5.3.2 Market Size, By Animal Type, 2016-2026 (USD Million)

5.3.3 Germany

5.2.3.1 Market Size, By Animal Type, 2016-2026 (USD Million)

5.3.4 UK

5.3.4.1 Market Size, By Animal Type, 2016-2026 (USD Million)

5.3.5 France

5.3.5.1 Market Size, By Animal Type, 2016-2026 (USD Million)

5.3.6 Italy

7.3.6.1 Market Size, By Animal Type, 2016-2026 (USD Million)

5.3.7 Spain

5.3.7.1 Market Size, By Animal Type, 2016-2026 (USD Million)

5.3.8 Russia

5.3.8.1 Market Size, By Animal Type, 2016-2026 (USD Million)

5.4 Asia Pacific

5.4.1 Market Size, By Country 2016-2026 (USD Million)

5.4.2 Market Size, By Animal Type, 2016-2026 (USD Million)

5.4.3 China

5.4.3.1 Market Size, By Animal Type, 2016-2026 (USD Million)

5.4.4 India

5.4.4.1 Market Size, By Animal Type, 2016-2026 (USD Million)

5.4.5 Japan

5.4.5.1 Market Size, By Animal Type, 2016-2026 (USD Million)

5.4.6 Australia

5.4.6.1 Market Size, By Animal Type, 2016-2026 (USD Million)

5.4.7 South Korea

5.4.7.1 Market Size, By Animal Type, 2016-2026 (USD Million)

5.5 Latin America

5.5.1 Market Size, By Country 2016-2026 (USD Million)

5.5.2 Market Size, By Animal Type, 2016-2026 (USD Million)

5.5.3 Brazil

5.5.3.1 Market Size, By Animal Type, 2016-2026 (USD Million)

5.5.4 Mexico

5.5.4.1 Market Size, By Animal Type, 2016-2026 (USD Million)

5.5.5 Argentina

5.5.5.1 Market Size, By Animal Type, 2016-2026 (USD Million)

5.6 MEA

5.6.1 Market Size, By Country 2016-2026 (USD Million)

5.6.2 Market Size, By Animal Type, 2016-2026 (USD Million)

5.6.3 Saudi Arabia

5.6.3.1 Market Size, By Animal Type, 2016-2026 (USD Million)

5.6.4 UAE

5.6.5.1 Market Size, By Animal Type, 2016-2026 (USD Million)

5.6.6 South Africa

5.6.6.1 Market Size, By Animal Type, 2016-2026 (USD Million)

Chapter 6 Company Landscape

6.1 Competitive Analysis, 2020

6.2 Pets at Home Group Plc

6.2.1 Company Overview

6.2.2 Financial Analysis

6.2.3 Strategic Positioning

6.2.4 Info Graphic Analysis

6.3 Addison Biological Laboratory, Inc.

6.3.1 Company Overview

6.3.2 Financial Analysis

6.3.3 Strategic Positioning

6.3.4 Info Graphic Analysis

6.4 Patterson Companies Inc.

6.4.1 Company Overview

6.4.2 Financial Analysis

6.4.3 Strategic Positioning

6.4.4 Info Graphic Analysis

6.5 Animart LLC

6.5.1 Company Overview

6.5.2 Financial Analysis

6.5.3 Strategic Positioning

6.5.4 Info Graphic Analysis

6.6 National Veterinary Care Ltd.

6.6.1 Company Overview

6.6.2 Financial Analysis

6.6.3 Strategic Positioning

6.6.4 Info Graphic Analysis

6.7 CVS Group Plc.

6.7.1 Company Overview

6.7.2 Financial Analysis

6.7.3 Strategic Positioning

6.7.4 Info Graphic Analysis

6.8 Mars, Inc.

6.8.1 Company Overview

6.8.2 Financial Analysis

6.8.3 Strategic Positioning

6.8.4 Info Graphic Analysis

6.9 Ethos Veterinary Health

6.9.1 Company Overview

6.9.2 Financial Analysis

6.9.3 Strategic Positioning

6.9.4 Info Graphic Analysis

6.10 Idexx laboratories

6.10.1 Company Overview

6.10.2 Financial Analysis

6.10.3 Strategic Positioning

6.10.4 Info Graphic Analysis

6.11 Greencross Limited

6.11.1 Company Overview

6.11.2 Financial Analysis

6.11.3 Strategic Positioning

6.11.4 Info Graphic Analysis

6.12 Kindred Biosciences, Inc.

6.12.1 Company Overview

6.12.2 Financial Analysis

6.12.3 Strategic Positioning

6.12.4 Info Graphic Analysis

6.13 Boehringer Ingelheim GmbH

6.13.1 Company Overview

6.13.2 Financial Analysis

6.13.3 Strategic Positioning

6.13.4 Info Graphic Analysis

6.14 Virbac

6.14.1 Company Overview

6.14.2 Financial Analysis

6.14.3 Strategic Positioning

6.14.4 Info Graphic Analysis

6.15 Other Companies

6.15.1 Company Overview

6.15.2 Financial Analysis

6.15.3 Strategic Positioning

6.15.4 Info Graphic Analysis

The Global Veterinary Services Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Veterinary Services Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS