Global Virtual ICU Market Size, Trends & Analysis - Forecasts to 2026 By Component (Hardware [Computer System, Communication Lines, Physiological Monitors, Therapeutic Devices, Video Feeds, Display Panels], Software), By Type (Traditional Medical ICU (TMICU), Cardiac Care Unit (CCU), Neonatal ICU (NICU), Pediatric ICU (PICU), Trauma ICU (TICU), Psychiatric ICU (PICU), High-Dependency Unit (HDU)), By End-User (Payer, Patient, Provider), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

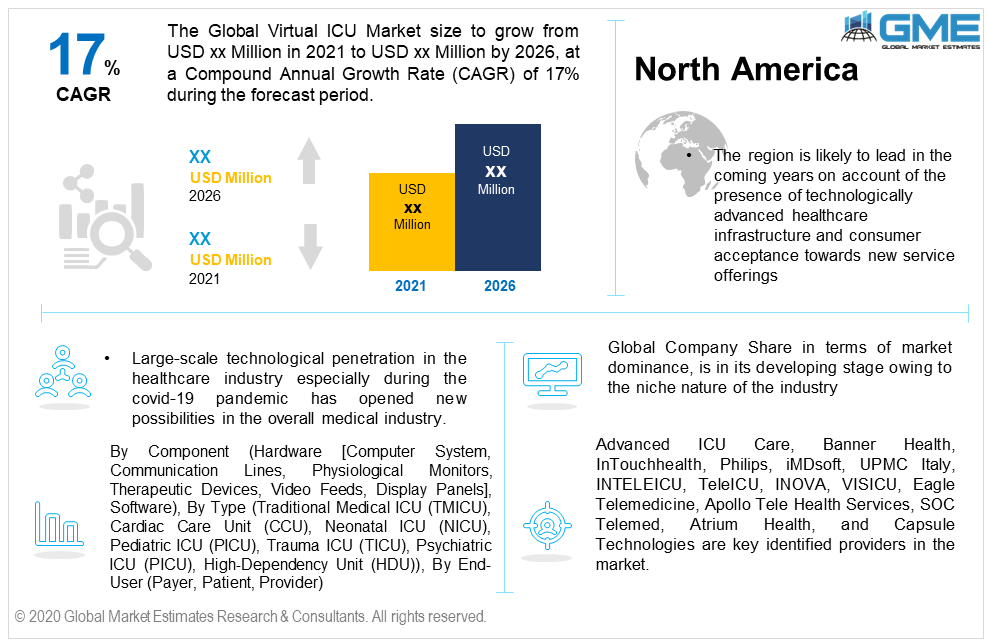

The global virtual ICU Market will witness more than 17% CAGR up to 2026, with North America dominating the demand accounting for 60% of the revenue. Large-scale technological penetration in the healthcare industry especially during the covid-19 pandemic has opened new possibilities in the overall medical industry. The virtual ICU is among the highly successful and challenging launches in the history of the medical industry.

Factors such as remote monitoring, adequate treatment, time & resource management, and successful results are the key attributes that made the concept successful. Lack of digital infrastructure and transformation in developing countries made the concept been utilized in a developed nation only. However, the advancement and success in a short duration are likely to encourage developing countries to invest in the technology.

The concept was novel and under trials in pre-pandemic duration. However, owing to the sudden lockdown owing to the Covid-19 virus spread, the market faced a rapid demand for numerous treatment services, and this up-rising trend is projected to continue during the forecast period.

By component, the report is segregated into software and hardware. Later, the hardware segment is sub-divided into the communication lines, computer system, physiological monitors, video feeds, display panels, and therapeutic devices. Hardware tools dominated the market and held over 85% of the revenue share in 2020. The presence of numerous tools and machinery for different purposes along with their deployment at a large scale are the core reasons to stimulate high penetration in this segment.

The software component links the service gap and carries it together with the physical and digital worlds. Periodical updates in the software to improvise the overall program and machines integration will promote faster growth in this segment.

Traditional Medical ICU, Cardiac Care Unit, Neonatal ICU, Pediatric ICU, Trauma ICU, Psychiatric ICU, and High-Dependency Unit among others are the major types identified in the market. Currently, the traditional medical type is majorly deployed in the industry. Ease in handling, monitoring, decision making, and compatibility with the system is the major factor engaging patient traffic in this segment. It is among the most essential service offering in the industry.

Another type that gained immense attention is the Pediatric section. Safety, minimal risk on children’s health and better medication are the major factors to drive growth in this segment.

By end-user, the report is segmented based on the patient, payer, and provider. Rising patient preference to adopt remote monitoring solutions during the covid-19 pandemic to avoid virus transmission will support the growth in the patient segment. Social distancing, lockdown, and preference to avoid unnecessary contact have instigated the penetration in this segment.

Informed decision making, better analytics, and data reliability are the main features that attracted the provider to invest in these solutions. Artificial intelligence avoids unnecessary tests, diagnoses, and therapies. The solution effectively understands the requirement through medical history analysis which sometimes might be overlooked manually.

North America dominated the global deployment of these services and accounted for more than 60% of the total revenue generation in 2020. The region is likely to lead in the coming years as well on account of the presence of technologically advanced healthcare infrastructure and consumer acceptance towards new service offerings. Artificial intelligence penetration across numerous industries especially inpatient monitoring is likely to support regional penetration.

Europe, being the second-largest revenue generator in the industry will foresee notable growth from 2021 to 2026. The increasing need to maintain social distancing and limited public gatherings especially in hospitals will promote the service offerings. The region is witnessing the diagnosis of numerous covid-19 virus mutants which can be a serious threat to the vaccinated population as well. Thus, the promotion of remote patient monitoring is a highly recommended and preferred tool in the regional healthcare industry.

The Asia Pacific is the fastest-growing region and is likely to observe several opportunities and possibilities during the forecast period. The region holds high prominence owing to rapid technological advancement and digitalization in China, South Korea, India, and Singapore. The aforementioned countries are keen on improvising their healthcare infrastructure to provide an enhanced experience to the patient and provider.

The global revenue share in terms of domination is in its nascent phase due to its limited exposure in the market. Furthermore, technical knowledge programs in hospitals and institutions to train the healthcare workers and other service providers to maximize the utilization are prime strategies in the market.

Advanced ICU Care, Banner Health, InTouchhealth, Philips, iMDsoft, UPMC Italy, INTELEICU, TeleICU, INOVA, VISICU, Eagle Telemedicine, Apollo Tele Health Services, SOC Telemed, Atrium Health, and Capsule Technologies are key identified providers in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Currently, there are only a few reliable service providers in the industry. The penetration is limited owing to the presence of inadequate infrastructure to support these services. Nevertheless, rapid expansion in digital transformation in the medical field will support the adoption.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Virtual ICU industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Component overview

2.1.3 Type overview

2.1.4 End-User overview

2.1.5 Regional overview

Chapter 3 Virtual ICU Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Virtual ICU Market, By Component

4.1 Component Outlook

4.2 Software

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Hardware

4.3.1 Market size, by region, 2019-2026 (USD Million)

4.3.2 Computer System

4.3.2.1 Market size, by region, 2019-2026 (USD Million)

4.3.3 Communication Lines

4.3.3.1 Market size, by region, 2019-2026 (USD Million)

4.3.4 Physiological Monitors

4.3.4.1 Market size, by region, 2019-2026 (USD Million)

4.3.5 Therapeutic Devices

4.3.5.1 Market size, by region, 2019-2026 (USD Million)

4.3.6 Video Feeds

4.3.6.1 Market size, by region, 2019-2026 (USD Million)

4.3.7 Display Panels

4.3.7.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 Virtual ICU Market, By Type

5.1 Type Outlook

5.2 Traditional Medical ICU (TMICU)

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.3 Cardiac Care Unit (CCU)

5.3.1 Market size, by region, 2019-2026 (USD Million)

5.4 Neonatal ICU (NICU)

5.4.1 Market size, by region, 2019-2026 (USD Million)

5.5 Pediatric ICU (PICU)

5.5.1 Market size, by region, 2019-2026 (USD Million)

5.6 Psychiatric ICU (PICU)

5.6.1 Market size, by region, 2019-2026 (USD Million)

5.6 High-Dependency Unit (HDU)

5.6.1 Market size, by region, 2019-2026 (USD Million)

5.7 Others

5.7.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 Virtual ICU Market, By End-User

6.1 End-User Outlook

6.2 Payer

6.2.1 Market size, by region, 2019-2026 (USD Million)

6.3 Patient

6.3.1 Market size, by region, 2019-2026 (USD Million)

6.4 Provider

6.4.1 Market size, by region, 2019-2026 (USD Million)

Chapter 7 Virtual ICU Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market size, By Country 2019-2026 (USD Million)

7.2.2 Market size, By Component, 2019-2026 (USD Million)

7.2.3 Market size, By Type, 2019-2026 (USD Million)

7.2.4 Market size, By End-User, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market size, By Component, 2019-2026 (USD Million)

7.2.5.2 Market size, By Type, 2019-2026 (USD Million)

7.2.5.3 Market size, By End-User, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market size, By Component, 2019-2026 (USD Million)

7.2.6.2 Market size, By Type, 2019-2026 (USD Million)

7.2.6.3 Market size, By End-User, 2019-2026 (USD Million)

7.2.7 Mexico

7.2.7.1 Market size, By Component, 2019-2026 (USD Million)

7.2.7.2 Market size, By Type, 2019-2026 (USD Million)

7.2.7.3 Market size, By End-User, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market size, By Country 2019-2026 (USD Million)

7.3.2 Market size, By Component, 2019-2026 (USD Million)

7.3.3 Market size, By Type, 2019-2026 (USD Million)

7.3.4 Market size, By End-User, 2019-2026 (USD Million)

7.3.5 Germany

7.2.5.1 Market size, By Component, 2019-2026 (USD Million)

7.2.5.2 Market size, By Type, 2019-2026 (USD Million)

7.2.5.3 Market size, By End-User, 2019-2026 (USD Million)

7.3.6 Spain

7.3.6.1 Market size, By Component, 2019-2026 (USD Million)

7.3.6.2 Market size, By Type, 2019-2026 (USD Million)

7.3.6.3 Market size, By End-User, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market size, By Component, 2019-2026 (USD Million)

7.3.7.2 Market size, By Type, 2019-2026 (USD Million)

7.3.7.3 Market size, By End-User, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market size, By Component, 2019-2026 (USD Million)

7.3.8.2 Market size, By Type, 2019-2026 (USD Million)

7.3.8.3 Market size, By End-User, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market size, By Country 2019-2026 (USD Million)

7.4.2 Market size, By Component, 2019-2026 (USD Million)

7.4.3 Market size, By Type, 2019-2026 (USD Million)

7.4.4 Market size, By End-User, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market size, By Component, 2019-2026 (USD Million)

7.4.5.2 Market size, By Type, 2019-2026 (USD Million)

7.4.5.3 Market size, By End-User, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market size, By Component, 2019-2026 (USD Million)

7.4.6.2 Market size, By Type, 2019-2026 (USD Million)

7.4.6.3 Market size, By End-User, 2019-2026 (USD Million)

7.4.7 Malaysia

7.4.7.1 Market size, By Component, 2019-2026 (USD Million)

7.4.7.2 Market size, By Type, 2019-2026 (USD Million)

7.4.7.3 Market size, By End-User, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market size, By Component, 2019-2026 (USD Million)

7.4.8.2 Market size, By Type, 2019-2026 (USD Million)

7.4.8.3 Market size, By End-User, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market size, By Component, 2019-2026 (USD Million)

7.4.9.2 Market size, By Type, 2019-2026 (USD Million)

7.4.9.3 Market size, By End-User, 2019-2026 (USD Million)

7.5 Central & South America

7.5.1 Market size, By Country 2019-2026 (USD Million)

7.5.2 Market size, By Component, 2019-2026 (USD Million)

7.5.3 Market size, By Type, 2019-2026 (USD Million)

7.5.4 Market size, By End-User, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market size, By Component, 2019-2026 (USD Million)

7.5.5.2 Market size, By Type, 2019-2026 (USD Million)

7.5.5.3 Market size, By End-User, 2019-2026 (USD Million)

7.5.6 Argentina

7.5.6.1 Market size, By Component, 2019-2026 (USD Million)

7.5.6.2 Market size, By Type, 2019-2026 (USD Million)

7.5.6.3 Market size, By End-User, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market size, By Country 2019-2026 (USD Million)

7.6.2 Market size, By Component, 2019-2026 (USD Million)

7.6.3 Market size, By Type, 2019-2026 (USD Million)

7.6.4 Market size, By End-User, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market size, By Component, 2019-2026 (USD Million)

7.6.5.2 Market size, By Type, 2019-2026 (USD Million)

7.6.5.3 Market size, By End-User, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market size, By Component, 2019-2026 (USD Million)

7.6.6.2 Market size, By Type, 2019-2026 (USD Million)

7.6.6.3 Market size, By End-User, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market size, By Component, 2019-2026 (USD Million)

7.6.7.2 Market size, By Type, 2019-2026 (USD Million)

7.6.7.3 Market size, By End-User, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive analysis, 2020

8.2 Advanced ICU Care

8.2.1 Company overview

8.2.2 Financial analysis

8.2.3 Strategic positioning

8.2.4 Info graphic analysis

8.3 Banner Health

8.3.1 Company overview

8.3.2 Financial analysis

8.3.3 Strategic positioning

8.3.4 Info graphic analysis

8.4 InTouchhealth

8.4.1 Company overview

8.4.2 Financial analysis

8.4.3 Strategic positioning

8.4.4 Info graphic analysis

8.5 Philips

8.5.1 Company overview

8.5.2 Financial analysis

8.5.3 Strategic positioning

8.5.4 Info graphic analysis

8.6 iMDsoft

8.6.1 Company overview

8.6.2 Financial analysis

8.6.3 Strategic positioning

8.6.4 Info graphic analysis

8.7 UPMC Italy

8.7.1 Company overview

8.7.2 Financial analysis

8.7.3 Strategic positioning

8.7.4 Info graphic analysis

8.8 INTELEICU

8.8.1 Company overview

8.8.2 Financial analysis

8.8.3 Strategic positioning

8.8.4 Info graphic analysis

8.9 TeleICU

8.9.1 Company overview

8.9.2 Financial analysis

8.9.3 Strategic positioning

8.9.4 Info graphic analysis

8.10 INOVA

8.10.1 Company overview

8.10.2 Financial analysis

8.10.3 Strategic positioning

8.10.4 Info graphic analysis

8.11 VISICU

8.11.1 Company overview

8.11.2 Financial analysis

8.11.3 Strategic positioning

8.11.4 Info graphic analysis

8.12 Eagle Telemedicine

8.12.1 Company overview

8.12.2 Financial analysis

8.12.3 Strategic positioning

8.12.4 Info graphic analysis

8.13 Apollo Tele Health Services

8.13.1 Company overview

8.13.2 Financial analysis

8.13.3 Strategic positioning

8.13.4 Info graphic analysis

8.14 SOC Telemed

8.14.1 Company overview

8.14.2 Financial analysis

8.14.3 Strategic positioning

8.14.4 Info graphic analysis

8.15 Atrium Health

8.15.1 Company overview

8.15.2 Financial analysis

8.15.3 Strategic positioning

8.15.4 Info graphic analysis

8.16 Capsule Technologies

8.16.1 Company overview

8.16.2 Financial analysis

8.16.3 Strategic positioning

8.16.4 Info graphic analysis

The Global Virtual ICU Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Virtual ICU Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS