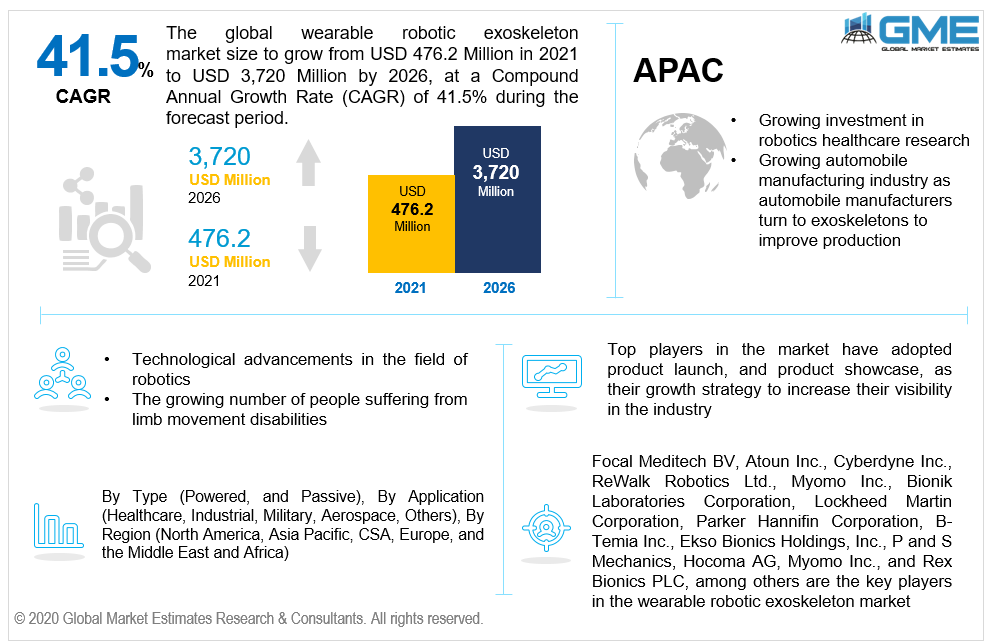

Global Wearable Robotic Exoskeleton Market Size, Trends & Analysis - Forecasts to 2026 By Type (Powered, and Passive), By Application (Healthcare, Industrial, Military, Aerospace, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global wearable robotic exoskeleton market is projected to grow from USD 476.2 million in 2021 to USD 3,720 million by 2026 at a CAGR value of 41.5%. A wearable robotic exoskeleton is designed and manufactured to augment the mobility of humans in various applications. The applications of these exoskeletons vary from assisting manufacturing units in industries to helping trauma victims through the rehabilitation process in the healthcare sector.

Application of wearable robotics exoskeleton in the healthcare domain is rising rapidly. Exoskeletons are capable of carrying the weight of the user and assist in the movement of limbs which can increase endurance and strength, allowing users to maintain positions for much longer durations. With a growing number of people suffering from movement disabilities, these exoskeletons can augment their movements and enhance the rehabilitation process and ultimately help the market grow rapidly. For people suffering from limb disabilities, these exoskeletons offer a new lease on life that allows them to be independent.

Spinal cord injuries are one of the major causes of movement disabilities across the globe. The WHO estimates that every year, around 250,000 to 500,000 people suffer spinal cord injuries from preventable causes like motor vehicle accidents, falls, and violence. After spinal cord injuries, strokes are one of the leading causes of physical disability in people as people who survive strokes often report limb paralysis. The exoskeletons can be used during the recovery stages to rehabilitate patients as they slowly recover from their injuries. They are also used to assist in the movement of geriatric patients who are beginning to lose muscle strength and control over their limbs.

The growing technological advancements in the field of exoskeletons for healthcare are envisaged to be one of the major contributors to the growth of the exoskeleton market. Military robotic exoskeletons have been in use for military applications since the late 19th century. Military applications of wearable exoskeletons focus on improving the strength and endurance of humans to superhuman levels. Extensive investments into the research and development of wearable exoskeletons for medical applications, industrial applications, and military applications are expected to have a significant impact on the growth of the market during the forecast period. Car manufacturers like BMW have already begun using wearable exoskeletons to support their staff. These exoskeletons are generally passive and provide structural support which allows people to hold their positions for long periods. They also improve strength which can lead to better efficiency as people would be able to lift heavier loads and reduces the required manpower.

The market is restrained by the high capital costs involved in developing such exoskeletons which translated into the equipment being more expensive. The costs combined with a lack of insurance coverage restricting the usage of wearable robotic exoskeletons. Technological advancements such as 3D printing, advanced sensors, and other technologies can reduce the costs and improve the applications of exoskeletons which can have a positive impact on the market.

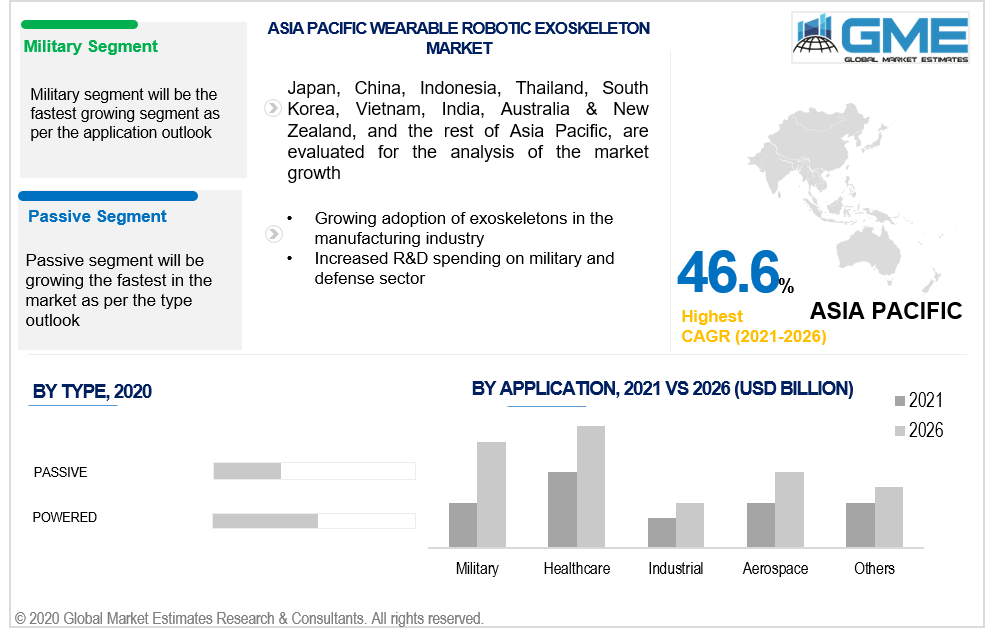

Based on the type of exoskeleton used, the market can be divided into powered and passive segments. The powered segment is envisaged to clutch the most significant share of the market during the forecast period. Powered exoskeletons are used extensively in military and industrial applications to allow people to move heavy loads with minimal fatigue. As military personnel is expected to undergo strenuous physical hardships, these exoskeletons can improve their endurance, allowing them to keep moving for longer.

The passive segment is expected to grow much faster than the powered segment during the forecast period of 2021 to 2026. These exoskeletons are becoming increasingly popular in every application as they are lighter, cheaper, and easier to handle compared to powered exoskeletons.

Based on the various applications where wearable robotic exoskeletons have been used, the market can be classified into aerospace, industrial, military, healthcare, and others. The healthcare segment is analyzed to hold the largest share of the market. The healthcare sector has seen a large number of exoskeleton products being developed for rehabilitation training and to help those suffering from partial or complete paralysis. The large consumer base for exoskeletons in this sector has resulted in greater investments in the research and development of new products, paving the path for the dominance of the healthcare segment.

The military segment is expected to register better growth rates than the other segments during the forecast period. Exoskeletons for military purposes have been receiving heavy investments for the development of new products.

The wearable robotic exoskeleton market can be segmented as per regions into North America, Europe, Central & South America, Middle East & North Africa, and Asia Pacific regions. The North American region is expected to grasp the largest share of the market during the forecast period. The presence of industry leaders in the North American region and rising research and development activities to launch new wearables, are supporting the growth of the market. Heavy spending on healthcare and the military sector by the North American government has also been a factor to drive the market.

The APAC region is expected to log a better growth rate as compared to other regional segments during the forecast period. The growing number of people suffering from disabilities, increased spending on research and development, and the flourishing healthcare sector are some of the factors that are expected to ensure that the region grows faster during the forecast period.

Focal Meditech BV, Atoun Inc., Cyberdyne Inc., ReWalk Robotics Ltd., Myomo Inc., Bionik Laboratories Corporation, Lockheed Martin Corporation, Parker Hannifin Corporation, B-Temia Inc., Ekso Bionics Holdings, Inc., P and S Mechanics, Hocoma AG, Myomo Inc., and Rex Bionics PLC, among others are the key players in the wearable robotic exoskeleton market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Wearable Robotic Exoskeleton Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Wearable Robotic Exoskeleton Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technological advancements in the wearable robotic exoskeleton market

3.3.2 Industry Challenges

3.3.2.1 Requirement of large capital investment and high cost of wearable robotic exoskeletons

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Technology Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Wearable Robotic Exoskeleton Market, By Type

4.1 Type Outlook

4.2 Passive

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Powered

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Wearable Robotic Exoskeleton Market, By Application

5.1 Application Outlook

5.2 Healthcare

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Industrial

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 Military

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

5.5 Aerospace

5.5.1 Market Size, By Region, 2020-2026 (USD Million)

5.6 Others

5.6.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Wearable Robotic Exoskeleton Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Million)

6.2.2 Market Size, By Type, 2020-2026 (USD Million)

6.2.3 Market Size, By Application, 2020-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2020-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2020-2026 (USD Million)

6.2.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Million)

6.3.2 Market Size, By Type, 2020-2026 (USD Million)

6.3.3 Market Size, By Application, 2020-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.6.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.7.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.8.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2020-2026 (USD Million)

6.3.9.2 Market Size, By Application, 2020-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Million)

6.4.2 Market Size, By Type, 2020-2026 (USD Million)

6.4.3 Market Size, By Application, 2020-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Type, 2020-2026 (USD Million)

6.4.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Type, 2020-2026 (USD Million)

6.4.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2020-2026 (USD Million)

6.4.6.2 Market Size, By Application, 2020-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2020-2026 (USD Million)

6.4.7.2 Market size, By Application, 2020-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2020-2026 (USD Million)

6.4.8.2 Market Size, By Application, 2020-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Million)

6.5.2 Market Size, By Type, 2020-2026 (USD Million)

6.5.3 Market Size, By Application, 2020-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2020-2026 (USD Million)

6.5.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2020-2026 (USD Million)

6.5.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2020-2026 (USD Million)

6.5.6.2 Market Size, By Application, 2020-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Million)

6.6.2 Market Size, By Type, 2020-2026 (USD Million)

6.6.3 Market Size, By Application, 2020-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2020-2026 (USD Million)

6.6.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2020-2026 (USD Million)

6.6.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2020-2026 (USD Million)

6.6.6.2 Market Size, By Application, 2020-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Focal Meditech BV

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Atoun Inc.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Cyberdyne Inc.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 ReWalk Robotics Ltd.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Myomo Inc.

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Bionik Laboratories Corporation

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Lockheed Martin Corporation

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Parker Hannifin Corporation

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Wearable Robotic Exoskeleton Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Wearable Robotic Exoskeleton Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS