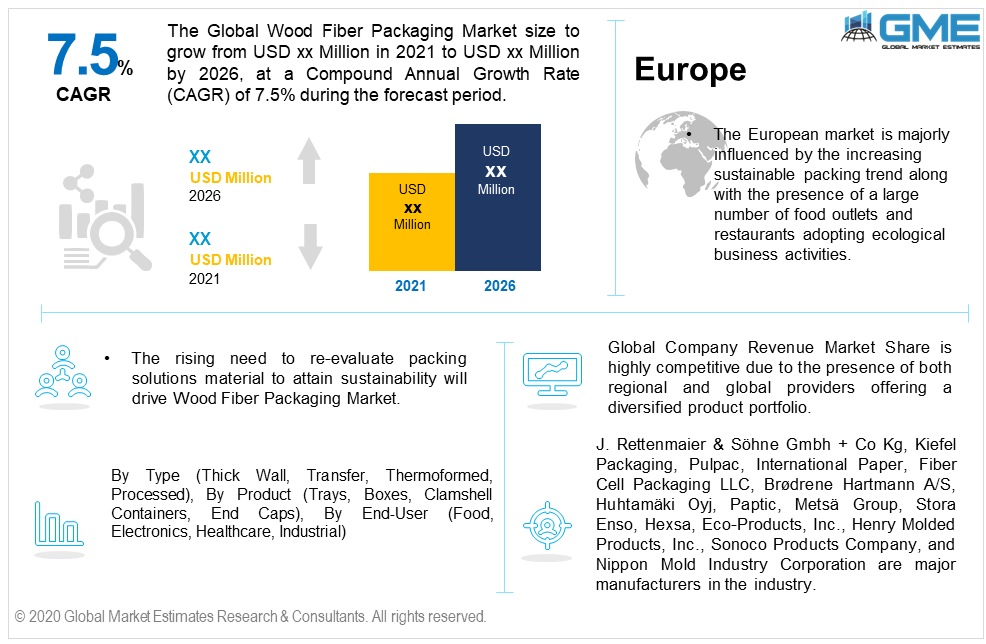

Global Wood Fiber Packaging Market Size, Trends & Analysis - Forecasts to 2026 By Type (Thick Wall, Transfer, Thermoformed, Processed), By Product (Trays, Boxes, Clamshell Containers, End Caps), By End-User (Food, Electronics, Healthcare, Industrial), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

The rising need to re-evaluate packing solutions material to attain sustainability will drive wood fiber packaging market. Stringent regulations on the usage of environmentally hazardous packaging materials made from polymers have induced the investment towards the production and adoption of environmentally friendly packing solutions made from pulp and cellulose.

The Global Wood Fiber Packaging Market size will observe more than 7.5% CAGR up to 2026. These packing solutions are advanced materials to suit both food and non-food applications. Another factor which is supporting the adoption of these materials is the product and environmental safety at economical pricing.

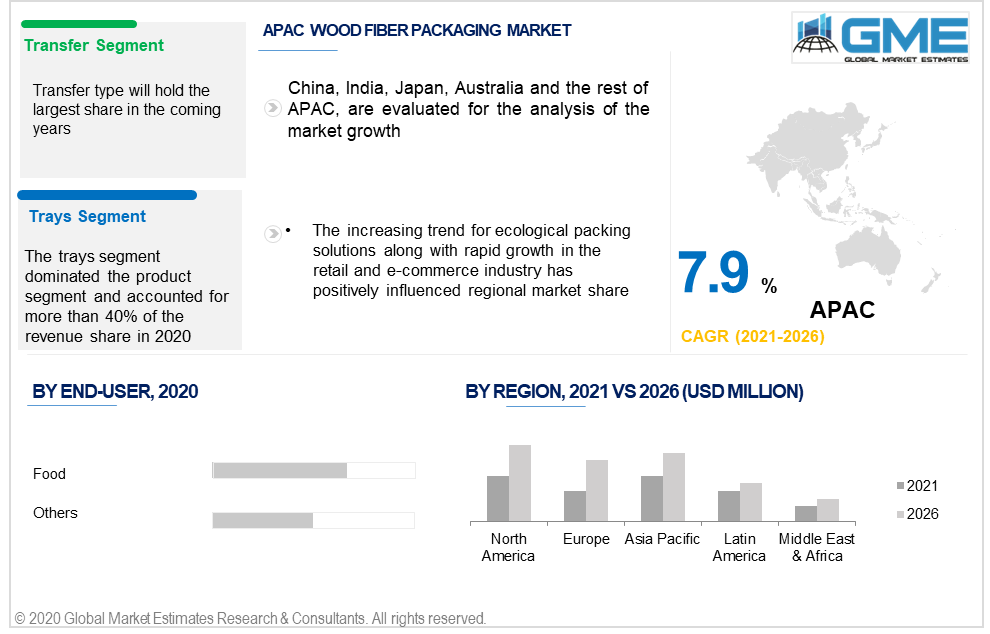

Transfer, thick wall, thermoformed, and processed are key packing types present in the industry. Transfer molds led to the overall consumption and accounted for over 50% of the demand in 2019. Benefits such as air permeability, extended shelf life, hygroscopic properties, and prevention from shocks make the product highly lucrative for the packing of wine bottles and eggs.

Various end-use companies are investing in the procurement of thick wall packing types. Thick wall packing provides the unfinished surface on one side and a smoother surface on the other side which is mainly used in the production of end caps and trays. These packing types find major applications in industrial products.

By product, the industry is divided into boxes, trays, clamshell containers, and end-caps among others. Trays dominated the overall product segment and held more than 40% of global demand in 2019. High convenience, stability during the transition, and shock absorption are the primary factors to stimulate adoption in this segment. Other factors such as temperature optimization, minimal contamination risk, compatibility to use them in both microwave and conventional ovens make them an ideal solution for food packing applications.

Another key product that is gaining high popularity is the end-caps. Cost efficiency and biodegradability are the major attributing factors to drive growth in this segment. Also, reduction and decline in the production and consumption of single-use plastics to encourage eco-friendly packaging solutions will induce demand in this product segment.

By end-user, the wood fiber packaging market is comprised of food, electronics, healthcare, and industrial among others. The food industry dominated the overall end-user segment and held more than 42% of the revenue share in 2019. High demand for the packing of the vegetable and fruits to aid in regulating respiration and ethylene density is the prime factor to stimulate penetration in this segment.

Another application in the same industry is the packing of ready-to-eat meals, on-the-go snacks, and beverages in multiple restaurants and food outlets. Changing lifestyles due to hectic and busy schedules has instigated the adoption of sustainable materials-based bowls, cups, clamshells, and plates. These products are highly beneficial for on-the-go snacks due to their easy recyclability and minimal harm to the environment.

The electronics industry is projected to observe notable growth from 2021 to 2026. Increasing sale of electronic products such as computers, laptops, printers, modem, and cell phones which needs safer packing solutions will support the product penetration in the electronics industry.

The Asia Pacific Wood Fiber Packaging Market dominated the overall demand in 2019 and accounted for more than 38% of the revenue share in the same year. The increasing trend for ecological packing solutions along with rapid growth in the retail and e-commerce industry has positively influenced regional market share. China, Japan, South Korea, and India are the major countries to invest in these packing solutions. Another environmental factor such as the ban on single-use plastic will proliferate the industry expansion.

North America is anticipated to witness significant growth and stood as the second-largest revenue-generating region in the industry. HORECA's industry expansion along with the high percentage of people depending on ready-made food from fast-food outlets, restaurants, and online food ordering will induce regional penetration.

The European market is majorly influenced by the increasing sustainable packing trend along with the presence of a large number of food outlets and restaurants adopting ecological business activities.

Global Company Revenue Market Share is highly competitive due to the presence of both regional and global providers offering a diversified product portfolio. Wide product availability in different colors, shapes, sizes, and forms to cover a large variety of applications makes the industry highly competitive. Product solutions customization as per consumer-specific requirements is among the prime strategy witnessed in the industry. Attractive and new variety product launches to uplift marketing campaigns are also witnessed in recent years.

J. Rettenmaier & Söhne Gmbh + Co Kg, Kiefel Packaging, Pulpac, International Paper, Fiber Cell Packaging LLC, Brødrene Hartmann A/S, Huhtamäki Oyj, Paptic, Metsä Group, Stora Enso, Hexsa, Eco-Products, Inc., Henry Molded Products, Inc., Sonoco Products Company, and Nippon Mold Industry Corporation are major manufacturers in the industry.

Please note: This is not an exhaustive list of companies profiled in the report.

Currently, only a few companies are into product customization at a wide market level. But, the rising trend of product customization aligned with different branding and marketing strategies is expected to encourage more manufacturers to invest in customization. Collaboration with the raw material providers to enhance the profitability across the value chain is another strategy to be witnessed during the forecast period.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Wood fiber packaging industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Type overview

2.1.3 Product overview

2.1.4 End-User overview

2.1.5 Regional overview

Chapter 3 Wood Fiber Packaging Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Wood Fiber Packaging Market, By Type

4.1 Type Outlook

4.2 Thick Wall

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Transfer

4.3.1 Market size, by region, 2019-2026 (USD Million)

4.4 Thermoformed

4.4.1 Market size, by region, 2019-2026 (USD Million)

4.5 Processed

4.5.1 Market size, by region, 2019-2026 (USD Million)

4.6 Others

4.6.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 Wood Fiber Packaging Market, By Product

5.1 Product Outlook

5.2 Trays

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.3 Boxes

5.3.1 Market size, by region, 2019-2026 (USD Million)

5.4 Clamshell containers

5.4.1 Market size, by region, 2019-2026 (USD Million)

5.5 End caps

5.5.1 Market size, by region, 2019-2026 (USD Million)

5.6 Others

5.6.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 Wood Fiber Packaging Market, By End-User

6.1 End-User Outlook

6.2 Food

6.2.1 Market size, by region, 2019-2026 (USD Million)

6.3 Electronics

6.3.1 Market size, by region, 2019-2026 (USD Million)

6.4 Healthcare

6.4.1 Market size, by region, 2019-2026 (USD Million)

6.5 Industrial

6.5.1 Market size, by region, 2019-2026 (USD Million)

6.6 Others

6.6.1 Market size, by region, 2019-2026 (USD Million)

Chapter 7 Wood Fiber Packaging Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market size, by country 2019-2026 (USD Million)

7.2.2 Market size, by type, 2019-2026 (USD Million)

7.2.3 Market size, by product, 2019-2026 (USD Million)

7.2.4 Market size, by end-user, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market size, by type, 2019-2026 (USD Million)

7.2.5.2 Market size, by product, 2019-2026 (USD Million)

7.2.5.3 Market size, by end-user, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market size, by type, 2019-2026 (USD Million)

7.2.6.2 Market size, by product, 2019-2026 (USD Million)

7.2.6.3 Market size, by end-user, 2019-2026 (USD Million)

7.2.7 Mexico

7.2.7.1 Market size, by type, 2019-2026 (USD Million)

7.2.7.2 Market size, by product, 2019-2026 (USD Million)

7.2.7.3 Market size, by end-user, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market size, by country 2019-2026 (USD Million)

7.3.2 Market size, by type, 2019-2026 (USD Million)

7.3.3 Market size, by product, 2019-2026 (USD Million)

7.3.4 Market size, by end-user, 2019-2026 (USD Million)

7.3.5 Germany

7.2.5.1 Market size, by type, 2019-2026 (USD Million)

7.2.5.2 Market size, by product, 2019-2026 (USD Million)

7.2.5.3 Market size, by end-user, 2019-2026 (USD Million)

7.3.6 Spain

7.3.6.1 Market size, by type, 2019-2026 (USD Million)

7.3.6.2 Market size, by product, 2019-2026 (USD Million)

7.3.6.3 Market size, by end-user, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market size, by type, 2019-2026 (USD Million)

7.3.7.2 Market size, by product, 2019-2026 (USD Million)

7.3.7.3 Market size, by end-user, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market size, by type, 2019-2026 (USD Million)

7.3.8.2 Market size, by product, 2019-2026 (USD Million)

7.3.8.3 Market size, by end-user, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market size, by country 2019-2026 (USD Million)

7.4.2 Market size, by type, 2019-2026 (USD Million)

7.4.3 Market size, by product, 2019-2026 (USD Million)

7.4.4 Market size, by end-user, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market size, by type, 2019-2026 (USD Million)

7.4.5.2 Market size, by product, 2019-2026 (USD Million)

7.4.5.3 Market size, by end-user, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market size, by type, 2019-2026 (USD Million)

7.4.6.2 Market size, by product, 2019-2026 (USD Million)

7.4.6.3 Market size, by end-user, 2019-2026 (USD Million)

7.4.7 Malaysia

7.4.7.1 Market size, by type, 2019-2026 (USD Million)

7.4.7.2 Market size, by product, 2019-2026 (USD Million)

7.4.7.3 Market size, by end-user, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market size, by type, 2019-2026 (USD Million)

7.4.8.2 Market size, by product, 2019-2026 (USD Million)

7.4.8.3 Market size, by end-user, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market size, by type, 2019-2026 (USD Million)

7.4.9.2 Market size, by product, 2019-2026 (USD Million)

7.4.9.3 Market size, by end-user, 2019-2026 (USD Million)

7.5 Central & South America

7.5.1 Market size, by country 2019-2026 (USD Million)

7.5.2 Market size, by type, 2019-2026 (USD Million)

7.5.3 Market size, by product, 2019-2026 (USD Million)

7.5.4 Market size, by end-user, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market size, by type, 2019-2026 (USD Million)

7.5.5.2 Market size, by product, 2019-2026 (USD Million)

7.5.5.3 Market size, by end-user, 2019-2026 (USD Million)

7.5.6 Argentina

7.5.6.1 Market size, by type, 2019-2026 (USD Million)

7.5.6.2 Market size, by product, 2019-2026 (USD Million)

7.5.6.3 Market size, by end-user, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market size, by country 2019-2026 (USD Million)

7.6.2 Market size, by type, 2019-2026 (USD Million)

7.6.3 Market size, by product, 2019-2026 (USD Million)

7.6.4 Market size, by end-user, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market size, by type, 2019-2026 (USD Million)

7.6.5.2 Market size, by product, 2019-2026 (USD Million)

7.6.5.3 Market size, by end-user, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market size, by type, 2019-2026 (USD Million)

7.6.6.2 Market size, by product, 2019-2026 (USD Million)

7.6.6.3 Market size, by end-user, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market size, by type, 2019-2026 (USD Million)

7.6.7.2 Market size, by product, 2019-2026 (USD Million)

7.6.7.3 Market size, by end-user, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive analysis, 2020

8.2 J. Rettenmaier & Söhne Gmbh + Co Kg

8.2.1 Company overview

8.2.2 Financial analysis

8.2.3 Strategic positioning

8.2.4 Info graphic analysis

8.3 Kiefel Packaging

8.3.1 Company overview

8.3.2 Financial analysis

8.3.3 Strategic positioning

8.3.4 Info graphic analysis

8.4 Pulpac

8.4.1 Company overview

8.4.2 Financial analysis

8.4.3 Strategic positioning

8.4.4 Info graphic analysis

8.5 International paper

8.5.1 Company overview

8.5.2 Financial analysis

8.5.3 Strategic positioning

8.5.4 Info graphic analysis

8.6 Fiber cell packaging LLC

8.6.1 Company overview

8.6.2 Financial analysis

8.6.3 Strategic positioning

8.6.4 Info graphic analysis

8.7 Brødrene Hartmann A/S

8.7.1 Company overview

8.7.2 Financial analysis

8.7.3 Strategic positioning

8.7.4 Info graphic analysis

8.8 Huhtamäki Oyj

8.8.1 Company overview

8.8.2 Financial analysis

8.8.3 Strategic positioning

8.8.4 Info graphic analysis

8.9 Paptic

8.9.1 Company overview

8.9.2 Financial analysis

8.9.3 Strategic positioning

8.9.4 Info graphic analysis

8.10 Metsä Group

8.10.1 Company overview

8.10.2 Financial analysis

8.10.3 Strategic positioning

8.10.4 Info graphic analysis

8.11 Stora Enso

8.11.1 Company overview

8.11.2 Financial analysis

8.11.3 Strategic positioning

8.11.4 Info graphic analysis

8.12 Hexsa

8.12.1 Company overview

8.12.2 Financial analysis

8.12.3 Strategic positioning

8.12.4 Info graphic analysis

8.13 Eco-Products, Inc.

8.13.1 Company overview

8.13.2 Financial analysis

8.13.3 Strategic positioning

8.13.4 Info graphic analysis

8.14 Henry Molded Products, Inc.

8.14.1 Company overview

8.14.2 Financial analysis

8.14.3 Strategic positioning

8.14.4 Info graphic analysis

8.15 Sonoco Products Company

8.15.1 Company overview

8.15.2 Financial analysis

8.15.3 Strategic positioning

8.15.4 Info graphic analysis

8.16 Nippon Mold Industry Corporation

8.16.1 Company overview

8.16.2 Financial analysis

8.16.3 Strategic positioning

8.16.4 Info graphic analysis

The Global Wood Fiber Packaging Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Wood Fiber Packaging Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS