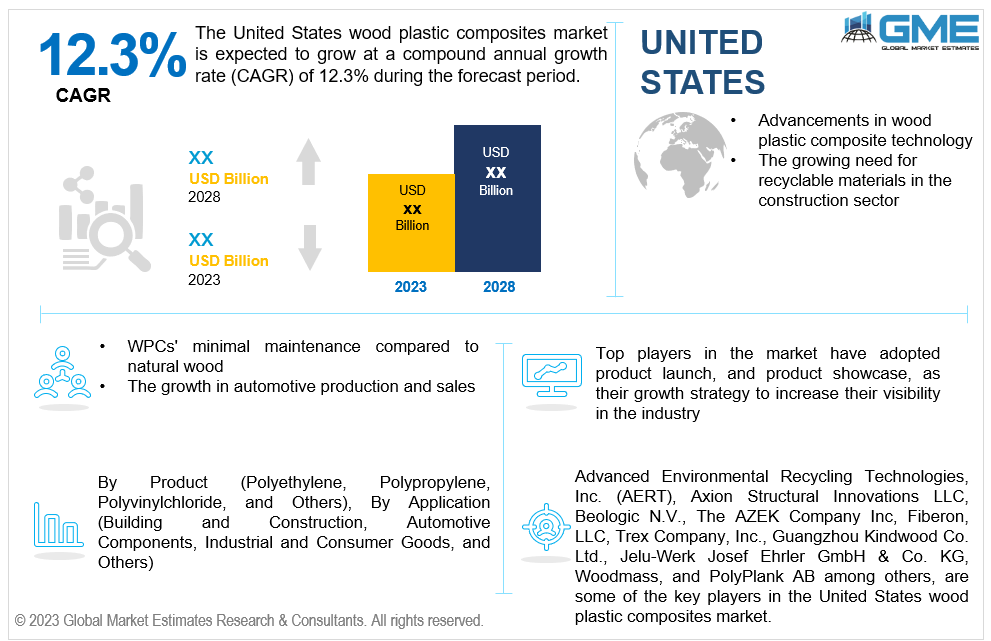

United States Wood Plastic Composites Market Size, Trends & Analysis - Forecasts to 2028 By Product (Polyethylene, Polypropylene, Polyvinylchloride, and Others) and By Application (Building and Construction, Automotive Components, Industrial and Consumer Goods, and Others), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The United States wood plastic composites (WPCs) market is estimated to exhibit a CAGR of 12.3% from 2023 to 2028.

Advancements in wood plastic composite technology and the growing need for recyclable materials in the construction sector are the main drivers of market growth. WPCs are becoming increasingly popular in the building industry due to companies and consumers realizing their advantages for the environment. The wood plastic composite industry in the U.S. is experiencing a surge in demand as sustainability gains prominence. This growth is primarily due to the growing need for recyclable and environmentally friendly materials in building applications. Additionally, advancements in wood plastic composite extrusion technology play a crucial role in meeting the demand for recyclable materials. With the use of recycled materials and appropriate requirements for building applications, this technology makes it possible to produce WPCs efficiently. For instance, the American Chemical Society states that to create highly filled wood plastic composites (WPCs), 30% of the recycled polypropylene (PP) and maleic anhydride grafted polypropylene (MAPP) are combined with 70% wood filler.

WPCs' minimal maintenance compared to natural wood and the growth in automotive production and sales drive the growth of the United States wood polymer composites market. The increase in automotive production and sales contributes to the broader WPC market growth trends in the United States. Positive developments in production, sales, and technical improvements are observed in the entire industry as the need for WPCs rises in the automotive sector. Ongoing innovations in composite material technology, including advancements in the formulation and processing of wood polymer composites, are driving their adoption in the automotive industry. These developments improve the material's qualities, increasing its suitability for various automotive applications. For instance, according to the International Trade Administration, 14.5 million light vehicles were sold in the United States in 2020. In terms of both car production and sales, the United States is the second-largest market in the globe.

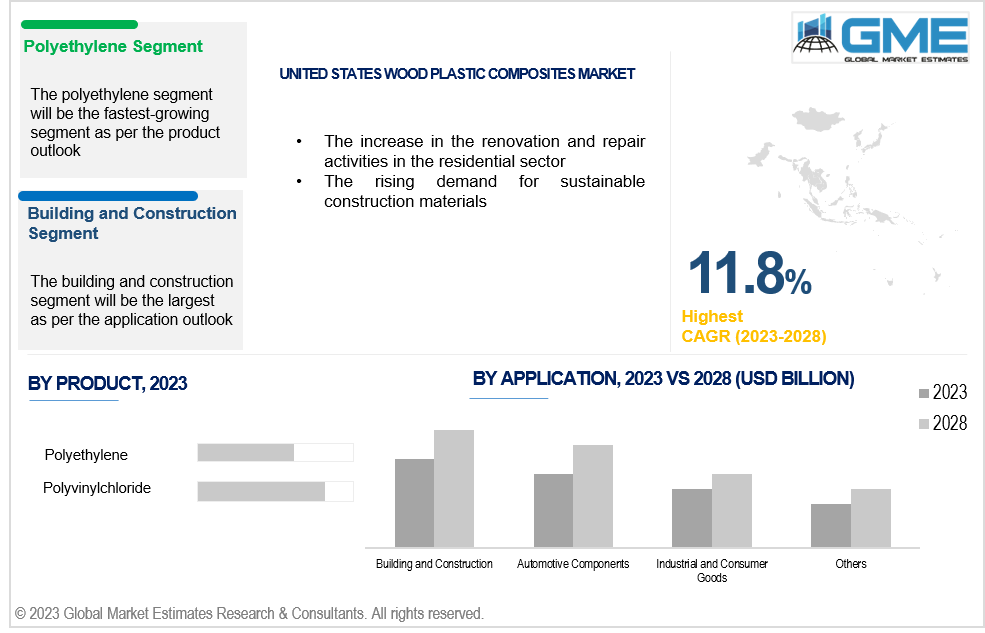

The increase in the residential sector's renovation and repair activities and the rising demand for sustainable construction materials propel market growth. The increasing demand for composite decking materials drives the growth of the U.S. wood plastic composites market. Wood plastic composites satisfy the growing need for composite decking materials by meeting the requirements of customers and builders looking for long-lasting, low-maintenance, and sustainable decking alternatives. Moreover, incorporating wood-plastic composites aligns with the broader trend of using sustainable building materials in the U.S. Materials with low environmental effects that support green construction practices are becoming increasingly popular among builders and homeowners.

The environmental impact of wood plastic composites is being evaluated through life cycle assessments (LCAs) and sustainability metrics. These assessments provide insights into the overall ecological footprint of WPCs and present an opportunity for informed decision-making in the construction sector. Moreover, the dynamics of the U.S. residential and commercial construction trends significantly influence the demand for wood plastic composites. The market for WPCs changes along with these developments, taking advantage of the opportunities they bring and adapting to suit the increasingly challenging demands of the building sector.

However, the rising cost of raw materials and lack of awareness or misconceptions about the properties and benefits of wood plastic composites may hinder the market growth.

The polyvinylchloride (PVC) segment is expected to hold the largest share of the market. The PVC segment's prominence is particularly evident in the United States wood plastic composite decking market. PVC-based composites are frequently used for decking applications due to their strength, moisture resistance, and ease of upkeep. Moreover, the PVC in the WPC market aligns with the broader trend in the US market for eco-friendly building materials. The increasing need for sustainable and environmentally friendly construction materials is partly met by PVC-based composites, especially when such composites contain recycled elements.

The polyethylene segment is expected to be the fastest-growing segment in the market from 2023-2028. Wood plastic composites based on polyethylene are renowned for their adaptability and compatibility. They can be utilized in building materials, decking, automobile parts, and other products. The wide range of applications leads to higher demand in many industries. Polyethylene-based wood plastic composites frequently display favourable performance attributes, such as resilience to moisture, longevity, and little upkeep needs. Their attributes render them appealing for outdoor uses, such as decking, where efficacy is paramount.

The building and construction segment is expected to hold the largest share of the market. Wood plastic composites (WPCs) are adaptable materials with many construction applications. They are useful for various building projects since they can be used for decking, railing, fence, cladding, and other structural and non-structural components. Additionally, the market for environmentally friendly and sustainable building materials is growing. Wood plastic composites align with the industry's emphasis on environmental responsibility, especially when created from recycled resources. This demand for sustainable options is robust in the building and construction sector.

The automotive components segment is anticipated to be the fastest-growing segment in the market from 2023-2028. In order to fulfill stringent pollution regulations and increase fuel efficiency, the automobile industry is putting more effort into making cars lighter. Since wood plastic composites are lighter than conventional materials, they are being explored for use in vehicle components to promote lightweight activities. Moreover, WPCs also provide great moldability and design freedom. Manufacturers can create complex, one-of-a-kind automotive parts due to their adaptability. This flexibility can lead to innovative interior and exterior designs for cars that are more aesthetically pleasing, practical, and ergonomic.

The increasing adoption of WPCs in the U.S. is driven by adherence to green construction requirements. Wood plastic composites that meet the standards of green building certifications, such as Leadership in Energy and Environmental Design (LEED), are given priority in construction projects. For instance, according to the United States Green Building Council (USGBC), in 2022, 1,225 projects totalling almost 353 million gross square feet were certified under LEED in the top 10 U.S. states including Illinois, New York, California, and others.

Advanced Environmental Recycling Technologies, Inc. (AERT), American Wood Fibers Inc., CertainTeed Corporation, Polymera, Inc., PolyPlank AB, TAMKO Building Products, Inc., TimberTech, Trex Company, Inc., Universal Forest Product, and Wellington Polymer Technology, Inc among others, are some of the key players in the United States wood plastic composites market.

Please note: This is not an exhaustive list of companies profiled in the report.

In 2023, CertainTeed, a producer of sustainable building materials in North America, announced the introduction of ONE PRECISION ASSEMBLIESTM (OPA), a prefabricated construction solution.

TimberTech, one of the top manufacturers of high-quality, environmentally friendly decking and outdoor living solutions worldwide, launched a new product line in 2021. French White Oak and Dark Cocoa, two fashionable composite deck board colours, are among the options.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 United States Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 UNITED STATES MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 UNITED STATES WOOD PLASTIC COMPOSITES MARKET, BY PRODUCT

4.1 Introduction

4.2 United States Wood Plastic Composites Market: Product Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Polyethylene

4.4.1 Polyethylene Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Polypropylene

4.5.1 Polypropylene Market Estimates and Forecast, 2020-2028 (USD Million)

4.6 Polyvinylchloride

4.6.1 Polyvinylchloride Market Estimates and Forecast, 2020-2028 (USD Million)

4.7 Others

4.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

5 UNITED STATES WOOD PLASTIC COMPOSITES MARKET, BY APPLICATION

5.1 Introduction

5.2 United States Wood Plastic Composites Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Building and Construction

5.4.1 Building and Construction Market Estimates and Forecast, 2020-2028 (USD Million)

5.5 Automotive Components

5.5.1 Automotive Components Market Estimates and Forecast, 2020-2028 (USD Million)

5.6 Industrial and Consumer Goods

5.6.1 Industrial and Consumer Goods Market Estimates and Forecast, 2020-2028 (USD Million)

5.7 Others

5.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

6 UNITED STATES WOOD PLASTIC COMPOSITES MARKET

6.1 United States Wood Plastic Composites Market Estimates and Forecast, 2020-2028 (USD Million)

6.1.1 By Product

6.1.2 By Application

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 United States

7.4 Company Profiles

7.4.1 Advanced Environmental Recycling Technologies, Inc. (AERT)

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 American Wood Fibers Inc.

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 CertainTeed Corporation

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Polymera, Inc.

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 PolyPlank AB

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 TAMKO Building Products, Inc.

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 TimberTech

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Trex Company, Inc.

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Universal Forest Product

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Wellington Polymer Technology, Inc

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Product of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 United States Wood Plastic Composites Market, By Product, 2020-2028 (USD Mllion)

2 Polyethylene Market, By Country, 2020-2028 (USD Mllion)

3 Polypropylene Market, By Country, 2020-2028 (USD Mllion)

4 Polyvinylchloride Market, By Country, 2020-2028 (USD Mllion)

5 Others Market, By Country, 2020-2028 (USD Mllion)

6 United States Wood Plastic Composites Market, By Application, 2020-2028 (USD Mllion)

7 Building and Construction Market, By Country, 2020-2028 (USD Mllion)

8 Automotive Components Market, By Country, 2020-2028 (USD Mllion)

9 Industrial and Consumer Goods Market, By Country, 2020-2028 (USD Mllion)

10 Others Market, By Country, 2020-2028 (USD Mllion)

11 Regional Analysis, 2020-2028 (USD Mllion)

12 United States Wood Plastic Composites Market, By Product, 2020-2028 (USD Mllion)

13 United States Wood Plastic Composites Market, By Application, 2020-2028 (USD Mllion)

14 Advanced Environmental Recycling Technologies, Inc. (AERT): Products & Services Offering

15 American Wood Fibers Inc.: Products & Services Offering

16 CertainTeed Corporation: Products & Services Offering

17 Polymera, Inc.: Products & Services Offering

18 PolyPlank AB: Products & Services Offering

19 TAMKO BUILDING PRODUCTS, INC.: Products & Services Offering

20 TimberTech : Products & Services Offering

21 Trex Company, Inc.: Products & Services Offering

22 Universal Forest Product, Inc: Products & Services Offering

23 Wellington Polymer Technology, Inc: Products & Services Offering

24 Other Companies: Products & Services Offering

LIST OF FIGURES

1 United States Wood Plastic Composites Market Overview

2 United States Wood Plastic Composites Market Value From 2020-2028 (USD Mllion)

3 United States Wood Plastic Composites Market Share, By Product (2022)

4 United States Wood Plastic Composites Market Share, By Application (2022)

5 Technological Trends In United States Wood Plastic Composites Market

6 Four Quadrant Competitor Positioning Matrix

7 Impact Of Macro & Micro Indicators On The Market

8 Impact Of Key Drivers On The United States Wood Plastic Composites Market

9 Impact Of Challenges On The United States Wood Plastic Composites Market

10 Porter’s Five Forces Analysis

11 United States Wood Plastic Composites Market: By Product Scope Key Takeaways

12 United States Wood Plastic Composites Market, By Product Segment: Revenue Growth Analysis

13 Polyethylene Market, By Country, 2020-2028 (USD Mllion)

14 Polypropylene Market, By Country, 2020-2028 (USD Mllion)

15 Polyvinylchloride Market, By Country, 2020-2028 (USD Mllion)

16 Others Market, By Country, 2020-2028 (USD Mllion)

17 United States Wood Plastic Composites Market: By Application Scope Key Takeaways

18 United States Wood Plastic Composites Market, By Application Segment: Revenue Growth Analysis

19 Building and Construction Market, By Country, 2020-2028 (USD Mllion)

20 Automotive Components Market, By Country, 2020-2028 (USD Mllion)

21 Industrial and Consumer Goods Market, By Country, 2020-2028 (USD Mllion)

22 Others Market, By Country, 2020-2028 (USD Mllion)

23 Country Segment: Revenue Growth Analysis

24 Four Quadrant Positioning Matrix

25 Company Market Share Analysis

26 Advanced Environmental Recycling Technologies, Inc. (AERT): Company Snapshot

27 Advanced Environmental Recycling Technologies, Inc. (AERT): SWOT Analysis

28 Advanced Environmental Recycling Technologies, Inc. (AERT): Geographic Presence

29 American Wood Fibers Inc.: Company Snapshot

30 American Wood Fibers Inc.: SWOT Analysis

31 American Wood Fibers Inc.: Geographic Presence

32 CertainTeed Corporation: Company Snapshot

33 CertainTeed Corporation: SWOT Analysis

34 CertainTeed Corporation: Geographic Presence

35 Polymera, Inc.: Company Snapshot

36 Polymera, Inc.: Swot Analysis

37 Polymera, Inc.: Geographic Presence

38 PolyPlank AB: Company Snapshot

39 PolyPlank AB: SWOT Analysis

40 PolyPlank AB: Geographic Presence

41 TAMKO Building Products, Inc.: Company Snapshot

42 TAMKO Building Products, Inc.: SWOT Analysis

43 TAMKO Building Products, Inc.: Geographic Presence

44 TimberTech : Company Snapshot

45 TimberTech : SWOT Analysis

46 TimberTech : Geographic Presence

47 Trex Company, Inc.: Company Snapshot

48 Trex Company, Inc.: SWOT Analysis

49 Trex Company, Inc.: Geographic Presence

50 Universal Forest Product, Inc.: Company Snapshot

51 Universal Forest Product, Inc.: SWOT Analysis

52 Universal Forest Product, Inc.: Geographic Presence

53 Wellington Polymer Technology, Inc: Company Snapshot

54 Wellington Polymer Technology, Inc: SWOT Analysis

55 Wellington Polymer Technology, Inc: Geographic Presence

56 Other Companies: Company Snapshot

57 Other Companies: SWOT Analysis

58 Other Companies: Geographic Presence

The United States Wood Plastic Composites Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the United States Wood Plastic Composites Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS