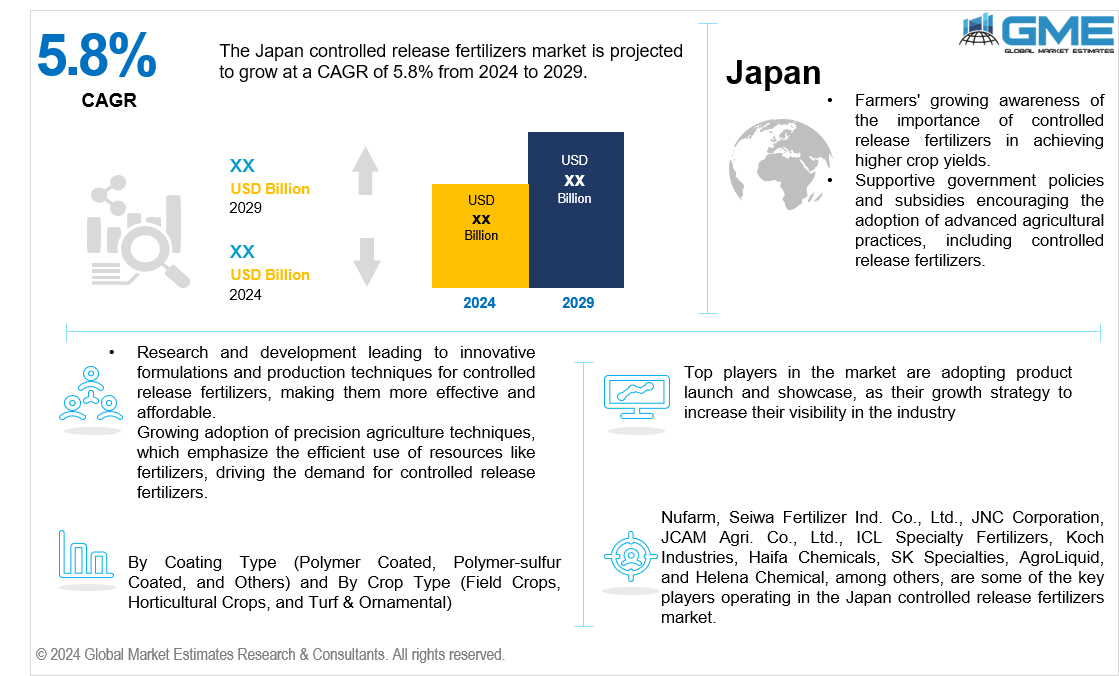

Japan Controlled Release Fertilizers Market Size, Trends & Analysis - Forecasts to 2029 By Coating Type (Polymer Coated, Polymer-sulfur Coated, and Others) and By Crop Type (Field Crops, Horticultural Crops, and Turf & Ornamental), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The Japan controlled release fertilizers market is projected to grow at a CAGR of 5.8% from 2024 to 2029.

Japan's agricultural sector tries to increase productivity to fulfill demographic demands. Controlled release fertilizers (CRF) provide a precise nitrogen delivery strategy, maximizing crop uptake and yields. This method optimizes nutrient consumption throughout the plant's growth cycle, reducing waste and environmental effects. CRF, which reduces runoff and improves soil health, accords with Japan's priorities for sustainable practices. With the rising demand for high-quality produce, CRF offers a solution for increased agricultural efficiency and environmental stewardship in Japan's farming landscape.

CRF technology reduces nutrient runoff and leaching, which helps minimize environmental pollution and protect water bodies. Given Japan's emphasis on sustainability and environmental care, CRF adoption is consistent with these objectives. CRF's controlled release technique guarantees crops absorb nutrients efficiently, improving soil health and reducing waste.

Government activities supporting sustainable agriculture and environmental protection encourage the use of CRF. Subsidies, incentives, and legislation that promote ecologically friendly agriculture methods encourage farmers to switch to CRF. These measures help to link farming methods with environmental goals, resulting in effective fertilizer management and reduced environmental impact. Governments encourage the implementation of CRF by providing financial support and regulatory frameworks, supporting sustainable agriculture and resolving environmental issues.

CRF technology sometimes demands a greater initial investment than conventional fertilizers, which may dissuade some farmers, mainly small-scale farmers, from using it.

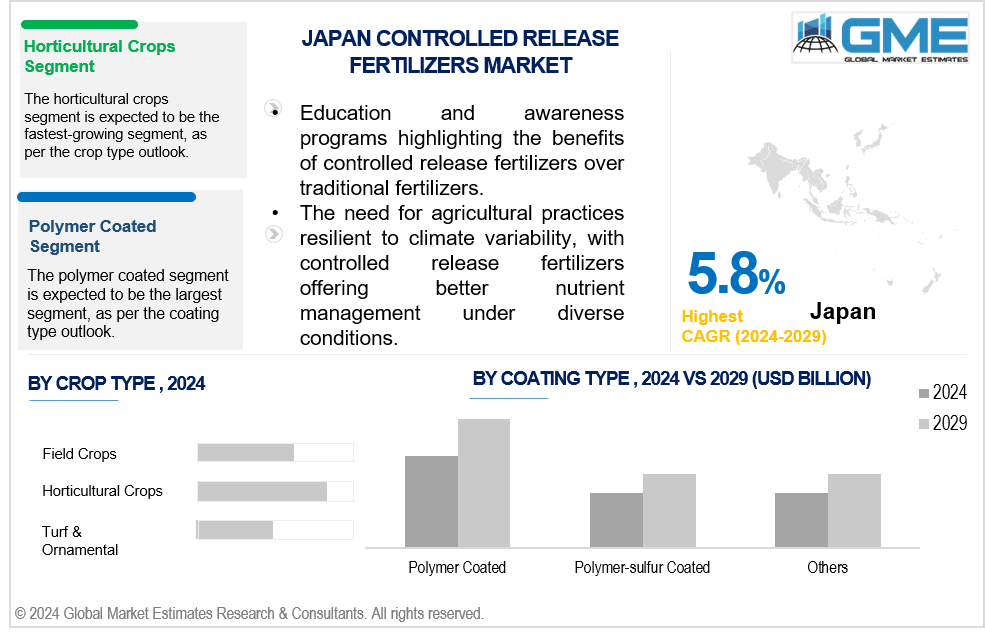

The polymer coated segment is expected to hold the largest share of the market over the forecast period. This expected growth is due to the polymer coated CRF's capacity to provide controlled nutrient delivery over a long period, enabling efficient crop absorption. Polymer-coated CRF offers benefits such as reduced nutrient leaching and increased soil health, which are consistent with Japan's emphasis on sustainable farming techniques and environmental preservation.

The polymer-sulfur coated segment is expected to be the fastest-growing segment in the market from 2024 to 2029. The growth is attributed to the segment's capacity to deliver a steady and consistent release of nutrients, particularly sulfur, which is critical for crop health. Furthermore, the polymer-sulfur coating improves nutrient efficiency and soil fertility, prompting its growing popularity among Japanese farmers looking to improve agricultural production and sustainability.

The horticultural crops segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. This growth is driven by rising demand for high-value crops such as fruits, vegetables, and ornamentals. Horticultural crops require precise nutrition management for optimal development and quality, making CRF technology appealing. The use of CRF in horticulture corresponds with Japan's emphasis on sustainable agriculture and high-quality food.

The field crops segment is expected to hold the largest share of the market. In Japan, field crops such as rice, wheat, and barley are heavily cultivated, driving this trend forward. With the need to improve productivity and sustainability in field crop cultivation, the use of CRF technology provides better nutrient management, higher yields, and lower environmental impact, all of which contribute to the segment's growth.

Nufarm,Seiwa Fertilizer Ind. Co., Ltd., JNC Corporation, JCAM Agri. Co., Ltd., ICL Specialty Fertilizers, Koch Industries, Haifa Chemicals, SK Specialties, AgroLiquid, and Helena Chemical, among others, are some of the key players operating in the Japan controlled release fertilizers market.

Please note: This is not an exhaustive list of companies profiled in the report.

In September 2022, ICL introduced eqo.x, a ground-breaking controlled-release urea technology designed for open-field agriculture to boost crop performance while reducing environmental impact. This innovative solution, achieved through a rapidly biodegradable coating, enhances nutrient use efficiency by up to 80%.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 JAPAN MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 JAPAN CONTROLLED RELEASE FERTILIZERS MARKET, BY COATING TYPE

4.1 Introduction

4.2 Controlled Release Fertilizers Market: Coating Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Polymer Coated

4.4.1 Polymer Coated Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Polymer-Sulfur Coated

4.5.1 Polymer-Sulfur Coated Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Others

4.6.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 JAPAN CONTROLLED RELEASE FERTILIZERS MARKET, BY CROP TYPE

5.1 Introduction

5.2 Controlled Release Fertilizers Market: Crop Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Field Crops

5.4.1 Field Crops Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Horticultural Crops

5.5.1 Horticultural Crops Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Turf & Ornamental

5.6.1 Turf & Ornamental Market Estimates and Forecast, 2021-2029 (USD Million)

6 COMPETITIVE LANDCAPE

6.1 Company Market Share Analysis

6.2 Four Quadrant Positioning Matrix

6.2.1 Market Leaders

6.2.2 Market Visionaries

6.2.3 Market Challengers

6.2.4 Niche Market Players

6.3 Vendor Landscape

6.3.1 Japan

6.4 Company Profiles

6.4.1 Nufarm

6.4.1.1 Business Description & Financial Analysis

6.4.1.2 SWOT Analysis

6.4.1.3 Products & Services Offered

6.4.1.4 Strategic Alliances between Business Partners

6.4.2 Seiwa Fertilizer Ind. Co., Ltd.

6.4.2.1 Business Description & Financial Analysis

6.4.2.2 SWOT Analysis

6.4.2.3 Products & Services Offered

6.4.2.4 Strategic Alliances between Business Partners

6.4.3 JNC Corporation

6.4.3.1 Business Description & Financial Analysis

6.4.3.2 SWOT Analysis

6.4.3.3 Products & Services Offered

6.4.3.4 Strategic Alliances between Business Partners

6.4.4 JCAM Agri. Co., Ltd.

6.4.4.1 Business Description & Financial Analysis

6.4.4.2 SWOT Analysis

6.4.4.3 Products & Services Offered

6.4.4.4 Strategic Alliances between Business Partners

6.4.5 ICL Specialty Fertilizers

6.4.5.1 Business Description & Financial Analysis

6.4.5.2 SWOT Analysis

6.4.5.3 Products & Services Offered

6.4.5.4 Strategic Alliances between Business Partners

6.4.6 Koch Industries

6.4.6.1 Business Description & Financial Analysis

6.4.6.2 SWOT Analysis

6.4.6.3 Products & Services Offered

6.4.6.4 Strategic Alliances between Business Partners

6.4.7 Haifa Chemicals

6.4.7.1 Business Description & Financial Analysis

6.4.7.2 SWOT Analysis

6.4.7.3 Products & Services Offered

6.4.8.4 Strategic Alliances between Business Partners

6.4.8 SK Specialties

6.4.8.1 Business Description & Financial Analysis

6.4.8.2 SWOT Analysis

6.4.8.3 Products & Services Offered

6.4.8.4 Strategic Alliances between Business Partners

6.4.9 AgroLiquid

6.4.9.1 Business Description & Financial Analysis

6.4.9.2 SWOT Analysis

6.4.9.3 Products & Services Offered

6.4.9.4 Strategic Alliances between Business Partners

6.4.10 Helena Chemical

6.4.10.1 Business Description & Financial Analysis

6.4.10.2 SWOT Analysis

6.4.10.3 Products & Services Offered

6.4.10.4 Strategic Alliances between Business Partners

6.4.11 Other Companies

6.4.11.1 Business Description & Financial Analysis

6.4.11.2 SWOT Analysis

6.4.11.3 Products & Services Offered

6.4.11.4 Strategic Alliances between Business Partners

7 RESEARCH METHODOLOGY

7.1 Market Introduction

7.1.1 Market Definition

7.1.2 Market Scope & Segmentation

7.2 Information Procurement

7.2.1 Secondary Research

7.2.1.1 Purchased Databases

7.2.1.2 GMEs Internal Data Repository

7.2.1.3 Secondary Resources & Third Party Perspectives

7.2.1.4 Company Information Sources

7.2.2 Primary Research

7.2.2.1 Various Types of Respondents for Primary Interviews

7.2.2.2 Number of Interviews Conducted throughout the Research Process

7.2.2.3 Primary Stakeholders

7.2.2.4 Discussion Guide for Primary Participants

7.2.3 Expert Panels

7.2.3.1 Expert Panels Across 30+ Industry

7.2.4 Paid Local Experts

7.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

7.3 Market Estimation

7.3.1 Top-Down Approach

7.3.1.1 Macro-Economic Indicators Considered

7.3.1.2 Micro-Economic Indicators Considered

7.3.2 Bottom Up Approach

7.3.2.1 Company Share Analysis Approach

7.3.2.2 Estimation of Potential Product Sales

7.4 Data Triangulation

7.4.1 Data Collection

7.4.2 Time Series, Cross Sectional & Panel Data Analysis

7.4.3 Cluster Analysis

7.5 Analysis and Output

7.5.1 Inhouse AI Based Real Time Analytics Tool

7.5.2 Output From Desk & Primary Research

7.6 Research Assumptions & Limitations

7.7.1 Research Assumptions

7.7.2 Research Limitations

LIST OF TABLES

1 Japan Controlled Release Fertilizers Market, By Coating Type, 2021-2029 (USD Million)

2 Polymer Coated Market, 2021-2029 (USD Million)

3 Polymer-Sulfur Coated Market, 2021-2029 (USD Million)

4 Others Market, 2021-2029 (USD Million)

5 Japan Controlled Release Fertilizers Market, By Crop Type, 2021-2029 (USD Million)

6 Field Crops Market, 2021-2029 (USD Million)

7 Horticultural Crops Market, 2021-2029 (USD Million)

8 Turf & Ornamental Market, 2021-2029 (USD Million)

9 NUFARM: Products & Services Offering

10 Seiwa Fertilizer Ind. Co., Ltd.: Products & Services Offering

11 JNC Corporation: Products & Services Offering

12 JCAM Agri. Co., Ltd.: Products & Services Offering

13 ICL Specialty Fertilizers: Products & Services Offering

14 Koch Industries: Products & Services Offering

15 Haifa Chemicals : Products & Services Offering

16 SK Specialties: Products & Services Offering

17 AgroLiquid, Inc: Products & Services Offering

18 Helena Chemical : Products & Services Offering

19 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Japan Controlled Release Fertilizers Market Overview

2 Japan Controlled Release Fertilizers Market Value From 2021-2029 (USD Million)

3 Japan Controlled Release Fertilizers Market Share, By Coating Type (2023)

4 Japan Controlled Release Fertilizers Market Share, By Crop Type (2023)

5 Technological Trends In Japan Controlled Release Fertilizers Market

6 Four Quadrant Competitor Positioning Matrix

7 Impact Of Macro & Micro Indicators On The Market

8 Impact Of Key Drivers On The Japan Controlled Release Fertilizers Market

9 Impact Of Challenges On The Japan Controlled Release Fertilizers Market

10 Porter’s Five Forces Analysis

11 Japan Controlled Release Fertilizers Market: By Coating Type Scope Key Takeaways

12 Japan Controlled Release Fertilizers Market, By Coating Type Segment: Revenue Growth Analysis

13 Polymer Coated Market, 2021-2029 (USD Million)

14 Polymer-Sulfur Coated Market, 2021-2029 (USD Million)

15 Others Market, 2021-2029 (USD Million)

16 Japan Controlled Release Fertilizers Market: By Crop Type Scope Key Takeaways

17 Japan Controlled Release Fertilizers Market, By Crop Type Segment: Revenue Growth Analysis

18 Field Crops Market, 2021-2029 (USD Million)

19 Horticultural Crops Market, 2021-2029 (USD Million)

20 Turf & Ornamental Market, 2021-2029 (USD Million)

21 Four Quadrant Positioning Matrix

22 Company Market Share Analysis

23 Nufarm: Company Snapshot

24 Nufarm: SWOT Analysis

25 Nufarm: Geographic Presence

26 Seiwa Fertilizer Ind. Co., Ltd.: Company Snapshot

27 Seiwa Fertilizer Ind. Co., Ltd.: SWOT Analysis

28 Seiwa Fertilizer Ind. Co., Ltd.: Geographic Presence

29 JNC Corporation: Company Snapshot

30 JNC Corporation: SWOT Analysis

31 JNC Corporation: Geographic Presence

32 JCAM Agri. Co., Ltd.: Company Snapshot

33 JCAM Agri. Co., Ltd.: Swot Analysis

34 JCAM Agri. Co., Ltd.: Geographic Presence

35 ICL Specialty Fertilizers: Company Snapshot

36 ICL Specialty Fertilizers: SWOT Analysis

37 ICL Specialty Fertilizers: Geographic Presence

38 Koch Industries: Company Snapshot

39 Koch Industries: SWOT Analysis

40 Koch Industries: Geographic Presence

41 Haifa Chemicals : Company Snapshot

42 Haifa Chemicals : SWOT Analysis

43 Haifa Chemicals : Geographic Presence

44 SK Specialties: Company Snapshot

45 SK Specialties: SWOT Analysis

46 SK Specialties: Geographic Presence

47 AgroLiquid, Inc.: Company Snapshot

48 AgroLiquid, Inc.: SWOT Analysis

49 AgroLiquid, Inc.: Geographic Presence

50 Helena Chemical : Company Snapshot

51 Helena Chemical : SWOT Analysis

52 Helena Chemical : Geographic Presence

53 Other Companies: Company Snapshot

54 Other Companies: SWOT Analysis

55 Other Companies: Geographic Presence

The Controlled Release Fertilizers Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Controlled Release Fertilizers Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS