Global Fire-Retardant Fabric Market Size, Trends & Analysis - Forecasts to 2027 By Material (Cotton, Nylon, Aramid, Polyesters, and Others), By Application Type (Protective Wear, Upholstery, Tents and Coverings, Curtains and Drapes, and Others), By Processing Method (Woven, Non-woven, Knitted), Company Market Share Analysis, and Competitor Analysis

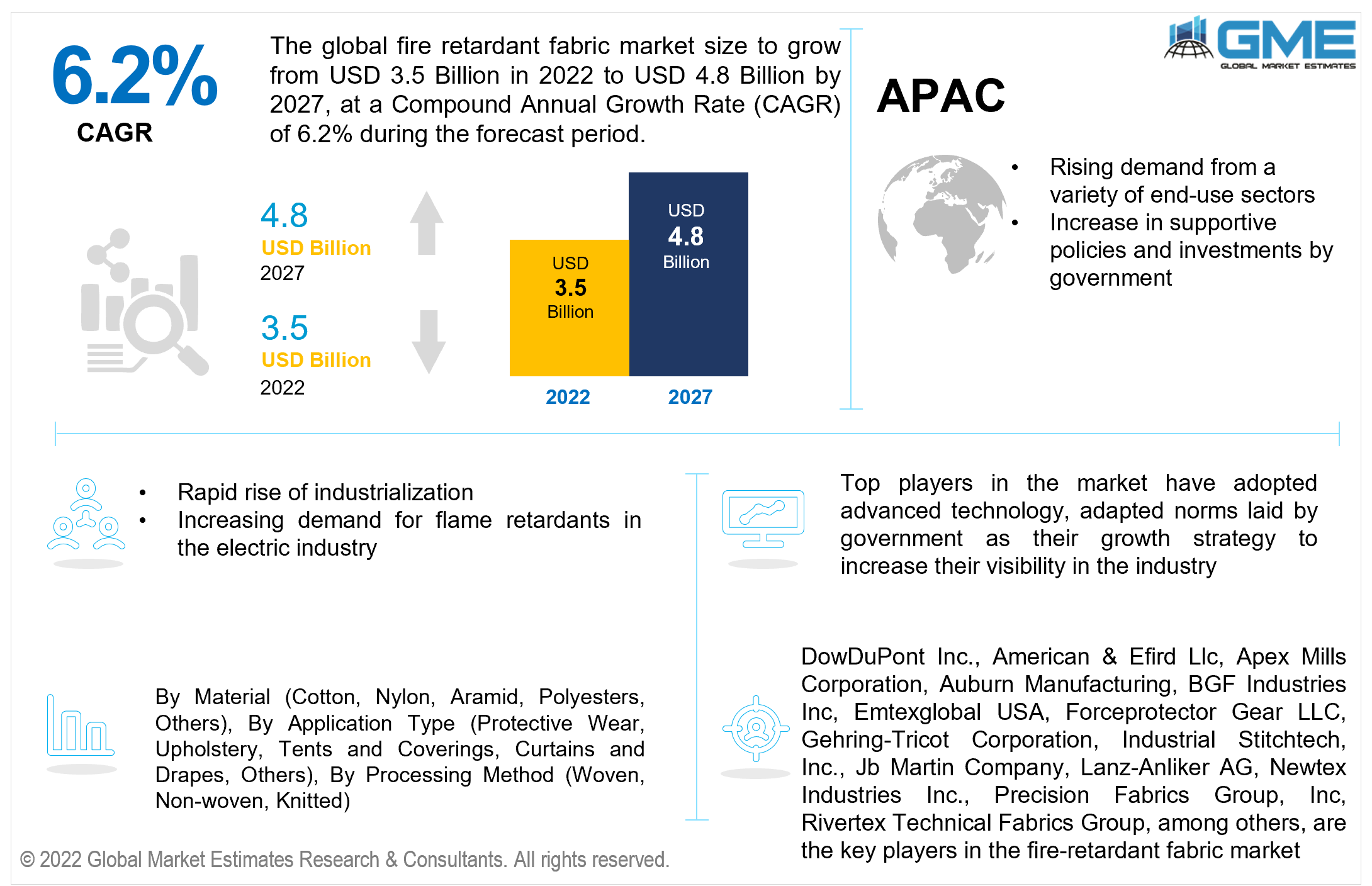

The global fire-retardant fabric market is projected to grow from USD 3.5 billion in 2022 to USD 4.8 billion by 2027 at a CAGR value of 6.2% from 2022 to 2027. Flame-resistant fabrics are textiles with flame resistance capabilities that are used to make clothes, furnishings, and garments for usage in sectors such as oil and gas, infrastructure sector, manufacturing, defense, and chemicals to protect workers. The demand for fire retardant fabrics in the United States is expected to grow at a rate of 3% per year, bringing the market to over 1 billion by 2050.

The rapid rise of industrialization has brought with it a slew of known and undiscovered threats, which has shifted the attention to safety, necessitating the use of flame retardant materials. Furthermore, the demand for flame retardants in the electric industry to reduce the combustibility of semiconductors, as well as the desire for flame retardant chemical compounds by numerous end-users such as the automotive manufacturing and construction materials, are driving the global flame retardant fabrics market.

The market is likely to benefit from rising flame-resistant fabric demand for theatrical drapery used in public venues such as theatres, schools, and other special events, as well as the availability of different fabric-fire procedures such as CRIB-5 and BS-476. Furthermore, the use of fire-resistant fabrics in firefighters' uniforms and gear to reduce fire hazards is expected to boost global demand. However, the high R&D cost for developing innovative technologies will negatively affect the market, hindering growth.

The available variety of flame retardants (FRs) is useable for various types of materials including cellulose, PET, polyamides, plastics, polyolefin, wood, cables, electrical and electronic products. The burgeoning world's population, infrastructural facilities, and industrialization all have an impact on the use of flame retardant materials. Furthermore, increased community and widespread information on safety and disaster mitigation, fire legislation, and workplace safety may be vital for market growth.

Wool is widely regarded as the most fire-resistant natural fiber since it is challenging to ignite and it may self-extinguish minor flames. Silk also burns gradually, is difficult to ignite, and in some cases, self-extinguishes. Wool production in the United Kingdom (UK) reached a high point in 2019, with an output of 70.5 thousand tonnes as there were more than 22 million sheep in the UK in 2019 whereas, India produced roughly 36 million kg of wool in 2019, a decline from the prior fiscal year. The wool industry is among the most important segments of the country's textile industry.

Textiles are now one of the most common product categories in which flame retardants are used. Textiles were one of five primary product types that consumed 88 % of global flame retardant sales in 2019, with building items, insulated wire and cable, electronic devices, and motor vehicles accounting for the other four.

The pandemic harmed the fire-resistant fabric business. As a result, the price and quantity chain was interrupted, which had an impact on the market. Due to the epidemic situation, businesses, industrial equipment, and mining companies have been put on pause for the previous two years, resulting in the non-use of protective apparel.

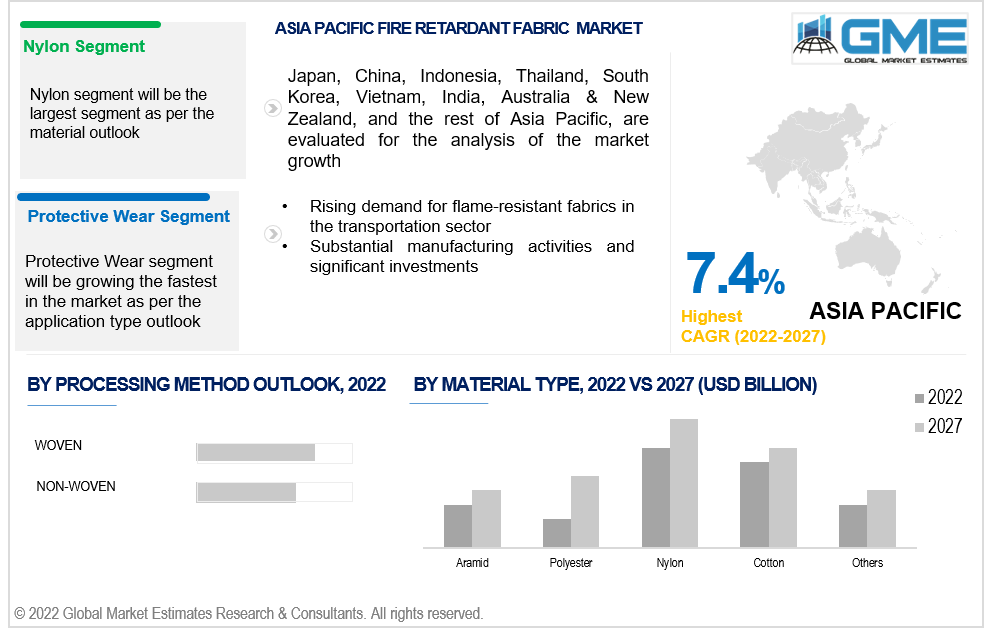

Based on the material, the market is segmented into cotton, nylon, aramid, and polyesters. The material or apparel market segment holds the largest fire market share. The nylon material segment is expected to grow the fastest in the market from 2022 to 2027. The growth can be because this material is due to its resistance to high heat and durability compared to cotton and polyester materials further nylon’s growing demand mainly by many industries, fire companies, defense, and the government is contributing to this segment’s growth.

Based on the application type, the fire-retardant fabric market is segmented into protective wear, upholstery, tents and coverings, curtains and drapes, and others. The protective wear segment is expected to hold a larger share as compared to other segments. Flame-resistant and retardant fabrics are being widely used in the production of industrial protective apparel to establish a stable and passive barrier for workers exposed to high temperatures. This provides great safety against temperature extremes and direct flame contact for the user, boosting its appeal among professionals and fueling global demand.

Woven, non-woven, and knitted based are the segmentations depending on the processing method. The knitted-based segment is expected to grow the fastest in the fire-retardant fabric market from 2022 to 2027. Knit is a cool, permeable fabric, but woven is thicker and more wind resistant. Knit fabric has a lower labor cost of manufacture than woven fabric since it is made from a single yarn. In addition, the knit fabric resists wrinkles, whereas woven fabric holds creases effectively. Furthermore, woven cloth frays easily and requires more finishing than knit fabric.

As per the geographical analysis, the fire retardant fabric market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America). North America (the United States, Canada, and Mexico), will have a dominant share in the fire-retardant fabric market from 2022 to 2027. The region's growing demand for fire-resistant draperies fabrics, strict government code of conduct, and evolving advanced technology are propelling growth during the forecast period.

Moreover, the Asia-Pacific region is expected to be the fastest-growing segment in the fire-retardant fabric market during the forecast period as a result of rising demand from a variety of end-use sectors, including chemicals and oil and gas. Additionally, rising demand for flame-resistant fabrics in the transportation sector, particularly in growing nations like India and China, as well as substantial manufacturing activities and significant investments, are expected to support the Asia Pacific market throughout the forecast period.

DowDuPont Inc., American & Efird Llc, Apex Mills Corporation, Auburn Manufacturing, BGF Industries Inc, Emtexglobal USA, Forceprotector Gear LLC, Gehring-Tricot Corporation, Industrial Stitchtech, Inc., Jb Martin Company, Lanz-Anliker AG, Newtex Industries Inc., Precision Fabrics Group, Inc, Rivertex Technical Fabrics Group, among others, are the key players in the fire-retardant fabric market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Fire-Retardant Fabric Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Material Overview

2.1.3 Application Type Overview

2.1.4 Processing Method Overview

2.1.5 Regional Overview

Chapter 3 Fire Retardant Fabric Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.2 Increasing desire for flame retardant chemical compounds by numerous end-users such as the automotive manufacturing and construction materials

3.3.2 Industry Challenges

3.3.2.1 High R&D cost for developing innovative technologies

3.4 Prospective Growth Scenario

3.4.1 Material Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 Processing Method Growth Scenario

3.4.4 Regional Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Materials Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Fire Retardant Fabric Market, By Material

4.1 Material Outlook

4.2 Cotton

4.2.1 Market Size, By Region, 2022-2027(USD Billion)

4.3 Nylon

4.3.1 Market Size, By Region, 2022-2027(USD Billion)

4.4 Aramid

4.4.1 Market Size, By Region, 2022-2027(USD Billion)

4.5 Polyesters

4.5.1 Market Size, By Region, 2022-2027(USD Billion)

4.6 Others

4.6.1 Market Size, By Region, 2022-2027(USD Billion)

Chapter 5 Fire Retardant Fabric Market, By Application Type

5.1 Application Type Outlook

5.2 Protective Wear

5.2.1 Market Size, By Region, 2022-2027(USD Billion)

5.3 Upholstery

5.3.1 Market Size, By Region, 2022-2027(USD Billion)

5.4 Tents and Coverings

5.4.1 Market Size, By Region, 2022-2027(USD Billion)

5.5 Curtains and Drapes

5.5.1 Market Size, By Region, 2022-2027(USD Billion)

5.6 Others

5.6.1 Market Size, By Region, 2022-2027(USD Billion)

Chapter 6 Fire Retardant Fabric Market, By Processing Method

6.1 Woven

6.1.1 Market Size, By Region, 2022-2027(USD Billion)

6.2 non-Woven

6.2.1 Market Size, By Region, 2022-2027(USD Billion)

6.3 Knitted

6.3.1 Market Size, By Region, 2022-2027(USD Billion)

Chapter 7 Fire Retardant Fabric Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2022-2027(USD Billion)

7.2.2 Market Size, By Type, 2022-2027(USD Billion)

7.2.3 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.2.4 Market Size, By End-User, 2022-2027(USD Billion)

7.2.5 Market Size, By Materials, 2022-2027(USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Type, 2022-2027(USD Billion)

7.2.4.2 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.2.4.3 Market Size, By End-User, 2022-2027(USD Billion)

Market Size, By Materials, 2022-2027(USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Type, 2022-2027(USD Billion)

7.2.7.2 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.2.7.3 Market Size, By End-User, 2022-2027(USD Billion)

7.2.7.4 Market Size, By Materials, 2022-2027(USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2022-2027(USD Billion)

7.3.2 Market Size, By Type, 2022-2027(USD Billion)

7.3.3 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.3.4 Market Size, By End-User, 2022-2027(USD Billion)

7.3.5 Market Size, By Materials, 2022-2027(USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Type, 2022-2027(USD Billion)

7.3.6.2 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.3.6.3 Market Size, By End-User, 2022-2027(USD Billion)

7.3.6.4 Market Size, By Materials, 2022-2027(USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Type, 2022-2027(USD Billion)

7.3.7.2 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.3.7.3 Market Size, By End-User, 2022-2027(USD Billion)

7.3.7.4 Market Size, By Materials, 2022-2027(USD Billion)

7.3.8 France

7.3.8.1 Market Size, By Type, 2022-2027(USD Billion)

7.3.8.2 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.3.8.3 Market Size, By End-User, 2022-2027(USD Billion)

7.3.8.4 Market Size, By Materials, 2022-2027(USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Type, 2022-2027(USD Billion)

7.3.9.2 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.3.9.3 Market Size, By End-User, 2022-2027(USD Billion)

7.3.9.4 Market Size, By Materials, 2022-2027(USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Type, 2022-2027(USD Billion)

7.3.10.2 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.3.10.3 Market Size, By End-User, 2022-2027(USD Billion)

7.3.10.4 Market Size, By Materials, 2022-2027(USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Type, 2022-2027(USD Billion)

7.3.11.2 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.3.11.3 Market Size, By End-User, 2022-2027(USD Billion)

7.3.11.4 Market Size, By Materials, 2022-2027(USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2022-2027(USD Billion)

7.4.2 Market Size, By Type, 2022-2027(USD Billion)

7.4.3 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.4.4 Market Size, By End-User, 2022-2027(USD Billion)

7.4.5 Market Size, By Materials, 2022-2027(USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Type, 2022-2027(USD Billion)

7.4.6.2 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.4.6.3 Market Size, By End-User, 2022-2027(USD Billion)

7.4.6.4 Market Size, By Materials, 2022-2027(USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Type, 2022-2027(USD Billion)

7.4.7.2 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.4.7.3 Market Size, By End-User, 2022-2027(USD Billion)

7.4.7.4 Market Size, By Materials, 2022-2027(USD Billion)

7.4.8 Japan

7.4.8.1 Market Size, By Type, 2022-2027(USD Billion)

7.4.8.2 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.4.8.3 Market Size, By End-User, 2022-2027(USD Billion)

7.4.8.4 Market Size, By Materials, 2022-2027(USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Type, 2022-2027(USD Billion)

7.4.9.2 Market size, By Manufacturing Method, 2022-2027(USD Billion)

7.4.9.3 Market Size, By End-User, 2022-2027(USD Billion)

7.4.9.4 Market Size, By Materials, 2022-2027(USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Type, 2022-2027(USD Billion)

7.4.10.2 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.4.10.3 Market Size, By End-User, 2022-2027(USD Billion)

7.4.10.4 Market Size, By Materials, 2022-2027(USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2022-2027(USD Billion)

7.5.2 Market Size, By Type, 2022-2027(USD Billion)

7.5.3 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.5.4 Market Size, By End-User, 2022-2027(USD Billion)

7.5.5 Market Size, By Materials, 2022-2027(USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Type, 2022-2027(USD Billion)

7.5.6.2 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.5.6.3 Market Size, By End-User, 2022-2027(USD Billion)

7.5.6.4 Market Size, By Materials, 2022-2027(USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Type, 2022-2027(USD Billion)

7.5.7.2 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.5.7.3 Market Size, By End-User, 2022-2027(USD Billion)

7.5.7.4 Market Size, By Materials, 2022-2027(USD Billion)

7.5.8 Argentina

7.5.8.1 Market Size, By Type, 2022-2027(USD Billion)

7.5.8.2 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.5.8.3 Market Size, By End-User, 2022-2027(USD Billion)

7.5.8.4 Market Size, By Materials, 2022-2027(USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2022-2027(USD Billion)

7.6.2 Market Size, By Type, 2022-2027(USD Billion)

7.6.3 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.6.4 Market Size, By End-User, 2022-2027(USD Billion)

7.6.5 Market Size, By Materials, 2022-2027(USD Billion)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Type, 2022-2027(USD Billion)

7.6.6.2 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.6.6.3 Market Size, By End-User, 2022-2027(USD Billion)

7.6.6.4 Market Size, By Materials, 2022-2027(USD Billion)

7.6.7 UAE

7.6.7.1 Market Size, By Type, 2022-2027(USD Billion)

7.6.7.2 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.6.7.3 Market Size, By End-User, 2022-2027(USD Billion)

7.6.7.4 Market Size, By Materials, 2022-2027(USD Billion)

7.6.8 South Africa

7.6.8.1 Market Size, By Type, 2022-2027(USD Billion)

7.6.8.2 Market Size, By Manufacturing Method, 2022-2027(USD Billion)

7.6.8.3 Market Size, By End-User, 2022-2027(USD Billion)

7.6.8.4 Market Size, By Materials, 2022-2027(USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2022

8.2 DowDuPont Inc.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 American & Efird Llc

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Apex Mills Corporation

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Auburn Manufacturing, Inc

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 BGF Industries Inc

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Emtexglobal USA

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Forceprotector Gear, LLC

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Gehring-Tricot Corporation

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Industrial Stitchtech, Inc.

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 JB Martin Company

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Lanz-Anliker AG

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Newtex Industries Inc.

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

8.14 Precision Fabrics Group, Inc

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 Info Graphic Analysis

8.15 Rivertex Technical Fabrics Group

8.15.1 Company Overview

8.15.2 Financial Analysis

8.15.3 Strategic Positioning

8.15.4 Info Graphic Analysis

8.16 Other Companies

8.16.1 Company Overview

8.16.2 Financial Analysis

8.16.3 Strategic Positioning

8.16.4 Info Graphic Analysis

The Global Fire-Retardant Fabric Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Fire-Retardant Fabric Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS