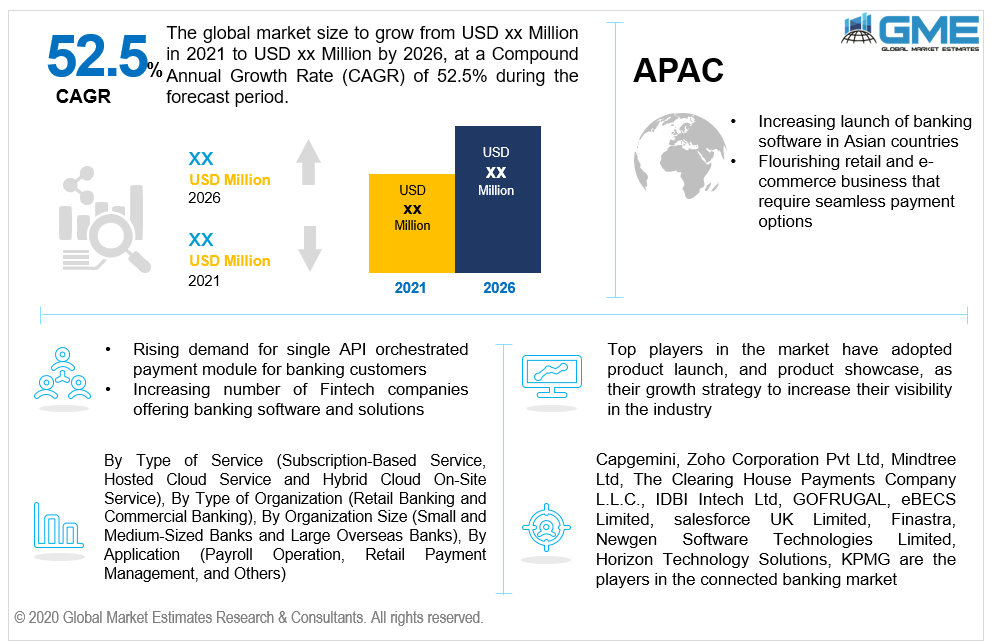

Global Connected Banking Market Size, Trends & Analysis - Forecasts to 2026 By Type of Service (Subscription-Based Service, Hosted Cloud Service and Hybrid Cloud On-Site Service), By Type of Organization (Retail Banking and Commercial Banking), By Organization Size (Small and Medium-Sized Banks and Large Overseas Banks), By Application (Payroll Operation, Retail Payment Management, and Others), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The connected banking market is projected to grow at a CAGR of 52.5% from 2021 to 2026. It is a utility based service/ solution helping retail and commercial customers and banks connected through all the bank related products and services in a seamless manner. Connected banking has been recognized as a boon for merchants, vendors, and business owners who otherwise had a complex structure of payment, collection, transaction, and business dealings. This service offers banking customers an efficient platform for conducting transactions and payments to their merchants and vendors using the Corporate Internet Banking facility of the Bank and automate reconciliation of the customer’s accounting entries which saves the transaction data, time, and cost.

Connected banking enhances business efficiency and hence will foresee a high growth in the market from 2021 to 2026. Transaction through an Omnichannel, for cross border and domestic transactions with a single API will drive the market for connected banking. The rising trend of shifting business focus to customer-centric fundamentals and increasing demand for vendors for effortless payments and collection will also help drive the market. Ease of other banking operations such as easy loan disbursement, account management, and top-notch credit and debit card services are some of the parallel factors propelling the growth of this market. However, a lack of awareness regarding a single API financial support system in growing and developing countries will hamper the demand for this service in the market. Moreover, the high cost associated with the registration fee of connected banking services will pose as a hindering factor for the market to grow rapidly.

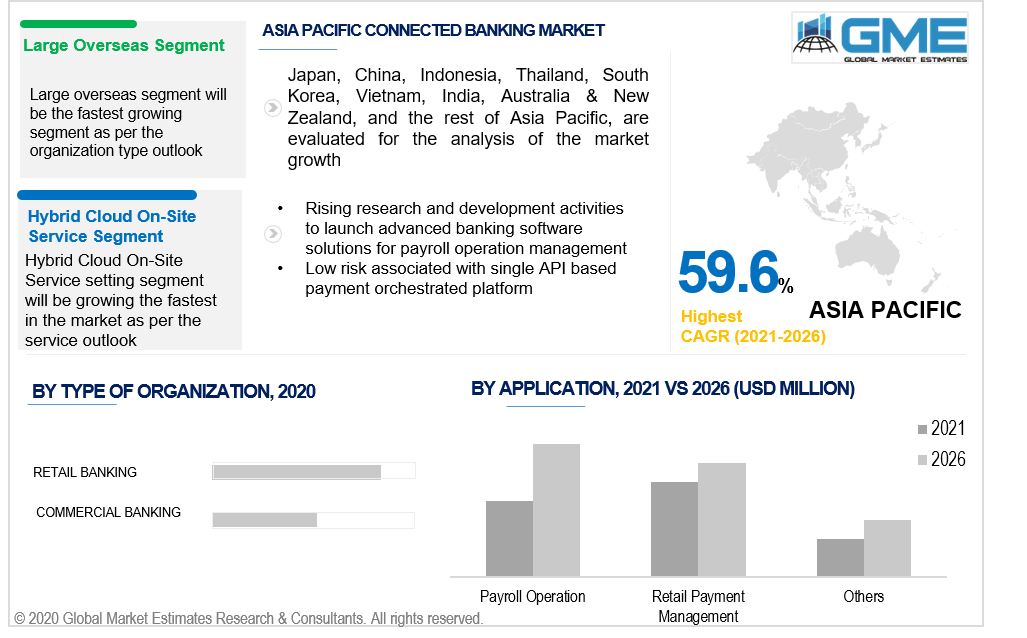

Based on the type of services or type of product offered the market is segmented into subscription based service, hosted cloud service, and hybrid cloud on-site service. The hybrid cloud on-site service will be the fastest growing segment in the market from the 2021 to 2026 forecast period. This is mainly because a hybrid system is a combination of both a private and public cloud service where the software can communicate between each distinct service and offer relentless service to the customers. It has been analyzed that a hybrid cloud strategy offers businesses and customers with higher flexibility rate by shifting the entire workload in the cloud service based on the customer needs and cost fluctuation.

Small and medium-sized banks and large overseas banks are the segmentation based on the size of the organization in the connected banking market. The large overseas banks' segment will be the largest one in terms of revenue sales and market share. This is mainly attributed to increasing awareness regarding the benefits and advantages of connected banking services for banking customers who are a part of complex and large size business organizations and need a single API system to seamlessly execute payment and transaction operations. The however small and mid-sized organization will be the fastest growing segment especially in the developing countries India, China, Japan, Malaysia, Singapore, Saudi Arabia, United Arab Emirates Brazil, Argentina, and others.

Based on the type of bank as per end-user outlook, the market can be split into retail banking and commercial banking. The commercial banking segment will be the largest end-user segment and also will be the fastest growing one owing to a major factor i.e. the increasing importance of connected banking services for commercial and business ecosystems.

By application, the market is segmented into payroll operation, retail payment management, and other applications. The payroll operation segment will be the fastest growing segment in the market owing to advantages such as ease in management of employee data, automatic employee leave, and attendance data. These services can be channelized through a single API cloud-based software making it easier for employers.

As per the geographical analysis, the connected banking market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America). North America (the United States, Canada, and Mexico) will be the market segment with a lion’s share. The increasing awareness regarding advanced banking software and rising product launch strategies by top Fintech companies are helping the North American market grow rapidly. Also, with the increasing and flourishing retail business, the North American market has witnessed a huge demand for a single API, omnichannel-based, orchestrated payment gateway system which should be integrated with banking services and saving accounts. This factor will pose as a market growth driver from 2021 to 2026. On the other hand, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) will be the fastest growing regional market from 2021 to 2026. The major reason for the market to attain the highest CAGR value is the flourishing retail and e-commerce business. Also with the increasing Fintech based software launch strategies in countries like China, Japan, and India, for end-users like developing and upcoming banks (both retail and commercial banks) will support the Asian market growth during the forecast period.

Capgemini, Zoho Corporation Pvt Ltd, Mindtree Ltd, The Clearing House Payments Company L.L.C., IDBI Intech Ltd, GOFRUGAL, eBECS Limited, salesforce UK Limited, Finastra, Newgen Software Technologies Limited, Horizon Technology Solutions, KPMG, Marg ERP Limited, Tata Consulting Services, Profinch Solutions Pvt. Ltd, Plaid, SAP SE, Opus, Unipro Tech Solutions Pvt Ltd, eBECS Limited, Yapily Ltd, MuleSoft LLC, Ingenpro Consulting Services Pvt. Ltd, Solid Financial Technologies, Inc., IDC, Wipfli LLP, Apizee, DXC, Accenture, FIS Global, Diebold Nixdorf, Yodlee, hylobiz, Arrayo, Atos Syntel Inc., and Avaya among others are the players in the connected banking market.

Please note: This is not an exhaustive list of companies profiled in the report.

In September 2020, LendingTree app launched connected bank accounts, which is a new feature added for consolidated money management and loan disbursement. This service is powered by Plaid.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Connected Banking Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Type of Organization Overview

2.1.3 Service Overview

2.1.4 Application Overview

2.1.5 Organization Size Overview

2.1.6 Regional Overview

Chapter 3 Connected Banking Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Advancements in the Fintech Software Products

3.3.1.2 Flourishing Retail and E-Commerce Business

3.3.2 Industry Challenges

3.3.2.1 Lack of Awareness Regarding Orchestrated Payment Transaction System

3.4 Prospective Growth Scenario

3.4.1 Type of Organization Growth Scenario

3.4.2 Service Growth Scenario

3.4.3 Application Growth Scenario

3.4.4 Organization Size Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Organization Size Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Connected Banking Market, By Type of Organization

4.1 Type of Organization Outlook

4.2 Retail Banking

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Commercial Banking

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Connected Banking Market, By Application

5.1 Application Outlook

5.2 Payroll Operations

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Retail Payment Management

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Others

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Connected Banking Market, By Service

6.1 Subscription-Based Service

6.1.1 Market Size, By Region, 2019-2026 (USD Million)

6.2 Hosted Cloud Service

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Hybrid Cloud On-Site Service

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Connected Banking Market, By Organization Size

7.1 Small and Medium-Sized Banks

7.1.1 Market Size, By Region, 2019-2026 (USD Million)

7.2 Large Overseas Banks

7.2.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 8 Connected Banking Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2019-2026 (USD Million)

8.2.2 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.2.3 Market Size, By Service, 2019-2026 (USD Million)

8.2.4 Market Size, By Application, 2019-2026 (USD Million)

8.2.5 Market Size, By Organization Size, 2019-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.2.4.2 Market Size, By Service, 2019-2026 (USD Million)

8.2.4.3 Market Size, By Application, 2019-2026 (USD Million)

Market Size, By Organization Size, 2019-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.2.7.2 Market Size, By Service, 2019-2026 (USD Million)

8.2.7.3 Market Size, By Application, 2019-2026 (USD Million)

8.2.7.4 Market Size, By Organization Size, 2019-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2019-2026 (USD Million)

8.3.2 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.3.3 Market Size, By Service, 2019-2026 (USD Million)

8.3.4 Market Size, By Application, 2019-2026 (USD Million)

8.3.5 Market Size, By Organization Size, 2019-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.3.6.2 Market Size, By Service, 2019-2026 (USD Million)

8.3.6.3 Market Size, By Application, 2019-2026 (USD Million)

8.3.6.4 Market Size, By Organization Size, 2019-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.3.7.2 Market Size, By Service, 2019-2026 (USD Million)

8.3.7.3 Market Size, By Application, 2019-2026 (USD Million)

8.3.7.4 Market Size, By Organization Size, 2019-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.3.8.2 Market Size, By Service, 2019-2026 (USD Million)

8.3.8.3 Market Size, By Application, 2019-2026 (USD Million)

8.3.8.4 Market Size, By Organization Size, 2019-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.3.9.2 Market Size, By Service, 2019-2026 (USD Million)

8.3.9.3 Market Size, By Application, 2019-2026 (USD Million)

8.3.9.4 Market Size, By Organization Size, 2019-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.3.10.2 Market Size, By Service, 2019-2026 (USD Million)

8.3.10.3 Market Size, By Application, 2019-2026 (USD Million)

8.3.10.4 Market Size, By Organization Size, 2019-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.3.11.2 Market Size, By Service, 2019-2026 (USD Million)

8.3.11.3 Market Size, By Application, 2019-2026 (USD Million)

8.3.11.4 Market Size, By Organization Size, 2019-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2019-2026 (USD Million)

8.4.2 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.4.3 Market Size, By Service, 2019-2026 (USD Million)

8.4.4 Market Size, By Application, 2019-2026 (USD Million)

8.4.5 Market Size, By Organization Size, 2019-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.4.6.2 Market Size, By Service, 2019-2026 (USD Million)

8.4.6.3 Market Size, By Application, 2019-2026 (USD Million)

8.4.6.4 Market Size, By Organization Size, 2019-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.4.7.2 Market Size, By Service, 2019-2026 (USD Million)

8.4.7.3 Market Size, By Application, 2019-2026 (USD Million)

8.4.7.4 Market Size, By Organization Size, 2019-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.4.8.2 Market Size, By Service, 2019-2026 (USD Million)

8.4.8.3 Market Size, By Application, 2019-2026 (USD Million)

8.4.8.4 Market Size, By Organization Size, 2019-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.4.9.2 Market size, By Service, 2019-2026 (USD Million)

8.4.9.3 Market Size, By Application, 2019-2026 (USD Million)

8.4.9.4 Market Size, By Organization Size, 2019-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.4.10.2 Market Size, By Service, 2019-2026 (USD Million)

8.4.10.3 Market Size, By Application, 2019-2026 (USD Million)

8.4.10.4 Market Size, By Organization Size, 2019-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2019-2026 (USD Million)

8.5.2 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.5.3 Market Size, By Service, 2019-2026 (USD Million)

8.5.4 Market Size, By Application, 2019-2026 (USD Million)

8.5.5 Market Size, By Organization Size, 2019-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.5.6.2 Market Size, By Service, 2019-2026 (USD Million)

8.5.6.3 Market Size, By Application, 2019-2026 (USD Million)

8.5.6.4 Market Size, By Organization Size, 2019-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.5.7.2 Market Size, By Service, 2019-2026 (USD Million)

8.5.7.3 Market Size, By Application, 2019-2026 (USD Million)

8.5.7.4 Market Size, By Organization Size, 2019-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.5.8.2 Market Size, By Service, 2019-2026 (USD Million)

8.5.8.3 Market Size, By Application, 2019-2026 (USD Million)

8.5.8.4 Market Size, By Organization Size, 2019-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2019-2026 (USD Million)

8.6.2 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.6.3 Market Size, By Service, 2019-2026 (USD Million)

8.6.4 Market Size, By Application, 2019-2026 (USD Million)

8.6.5 Market Size, By Organization Size, 2019-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.6.6.2 Market Size, By Service, 2019-2026 (USD Million)

8.6.6.3 Market Size, By Application, 2019-2026 (USD Million)

8.6.6.4 Market Size, By Organization Size, 2019-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.6.7.2 Market Size, By Service, 2019-2026 (USD Million)

8.6.7.3 Market Size, By Application, 2019-2026 (USD Million)

8.6.7.4 Market Size, By Organization Size, 2019-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Type of Organization, 2019-2026 (USD Million)

8.6.8.2 Market Size, By Service, 2019-2026 (USD Million)

8.6.8.3 Market Size, By Application, 2019-2026 (USD Million)

8.6.8.4 Market Size, By Organization Size, 2019-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Capgemini

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Zoho Corporation Pvt Ltd

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Mindtree Ltd

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 The Clearing House Payments Company L.L.C.

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 IDBI Intech Ltd

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 GOFRUGAL

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Finastra

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 salesforce UK Limited

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Newgen Software Technologies Limited

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Connected Banking Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Connected Banking Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS